Microsoft's board deemed the proposal “unnecessary,” emphasizing the company’s existing processes to manage and diversify its corporate treasury.

The shareholders also pointed to Bitcoin’s significant returns as evidence of its potential. Over the past year, Bitcoin has grown by 131%, far outpacing corporate bond growth, which averaged 126%.

This collaboration will bring WSPN’s transparent, fully-backed stablecoin to Fractal’s high-performance Bitcoin ecosystem, marking a significant step in WUSD’s mission to bridge traditional finance with digital assets.

In this exclusive interview, Widmer shared insights into how this model is reshaping financial accessibility, particularly for those traditionally left out of mainstream banking systems.

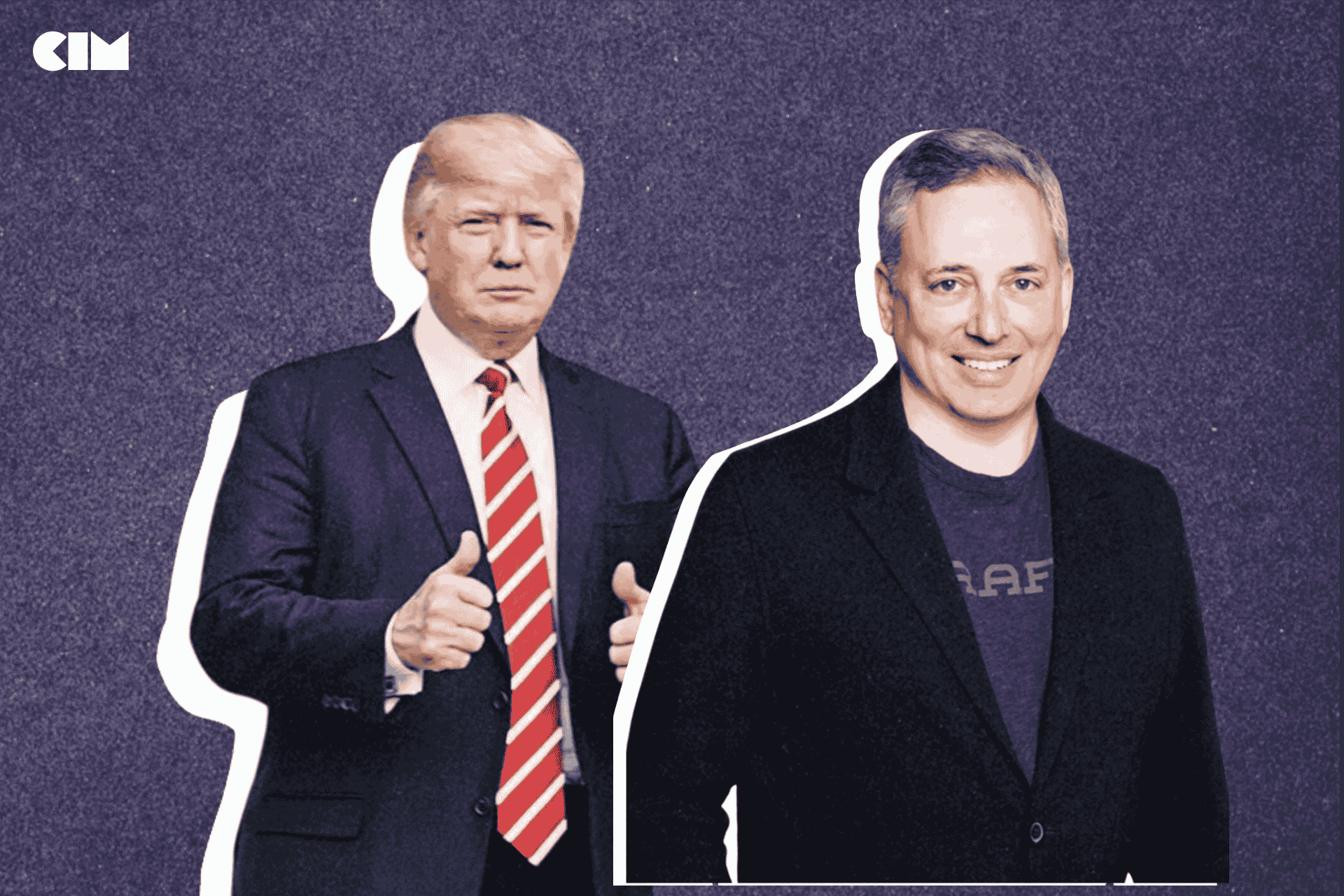

United States President-elect Donald Trump has appointed David Sacks, ex-PayPal operating chief, as lead policy adviser on artificial intelligence (AI) and cryptocurrency. The appointment was announced on December 6 via