Now Reading: Gen Z Overtakes Millennials to Lead India’s Crypto Investment Wave

-

01

Gen Z Overtakes Millennials to Lead India’s Crypto Investment Wave

Gen Z Overtakes Millennials to Lead India’s Crypto Investment Wave

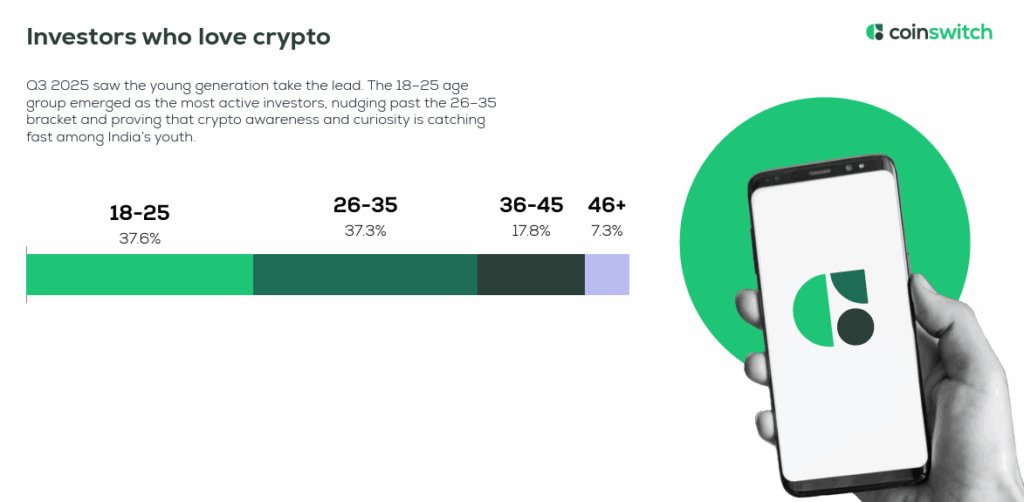

For the first time, Generation Z (Gen Z) has overtaken millennials as the dominant force in India’s crypto market, marking a demographic shift that underscores how digital assets are maturing from a speculative trend into a mainstream investment choice.

According to the CoinSwitch Q3 2025 report, India’s Crypto Portfolio: How India Invests, investors aged 18 to 25 now represent 37.6% of the platform’s 2.5 crore user base, narrowly ahead of millennials (26–35) at 37.3%. Those aged 36–45 account for 17.8%. It is the first time India’s youngest investors have led the pack, signalling the next phase in the country’s fast-evolving crypto story.

Young Investors Drive a New Kind of Wealth

Experts say that Gen Z’s emergence reflects a significant shift in attitudes toward wealth creation. What began as a high-risk experiment is now seen by many in their early 20s as a serious long-term strategy.

“Digital assets are no longer an outsider’s bet,” a CoinSwitch spokesperson noted. “Gen Z investors are combining traditional savings with crypto portfolios, using it to build financial independence earlier in life.”

Improved internet access, regional-language apps, and simpler interfaces have accelerated this shift, drawing millions of first-time users from across India. These trends, CoinSwitch said, point to “financial empowerment beyond the big cities.”

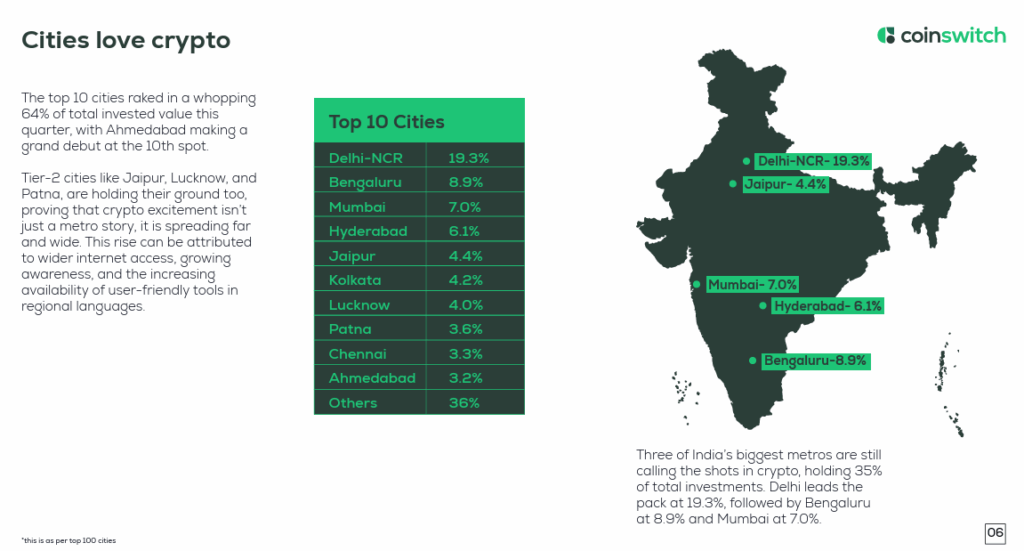

Beyond the Metros

India’s largest metros still dominate in total investment: Delhi leads with 19.3%, followed by Bengaluru (8.9%) and Mumbai (7.0%) of CoinSwitch’s investor base. However, Tier-2 cities such as Jaipur, Lucknow, Patna, and Ahmedabad are quickly rising. Ahmedabad entered the top-10 for the first time this quarter, underscoring the spread of crypto adoption beyond traditional financial hubs.

Each region also shows distinct investment styles:

- Mumbai allocates 37.4% of its holdings to blue-chip coins such as Bitcoin and Ethereum.

- Hyderabad tops large-cap investments (37.3%).

- Patna dominates mid-cap allocations (42%).

- Jaipur leads small-cap portfolios (9.4%).

- Kolkata posted the highest profitability, with 77% of investor portfolios in profit.

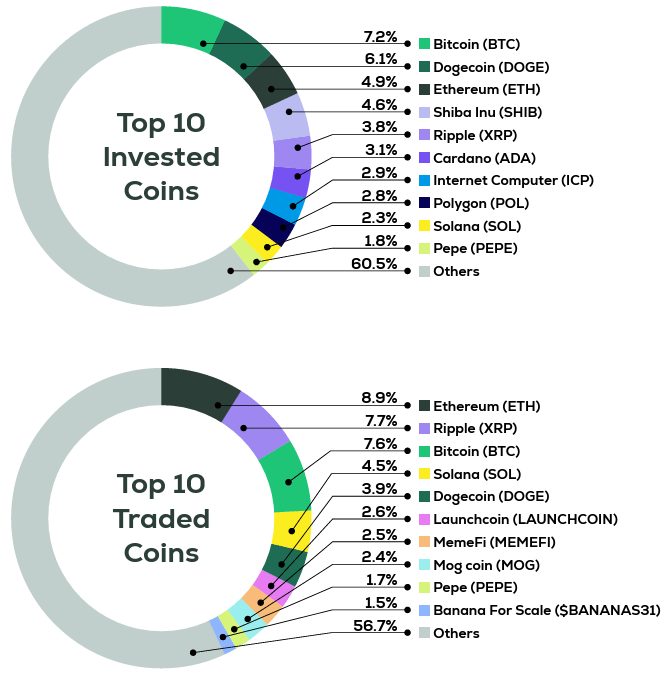

India’s Favourite Coins

Across the country, Bitcoin (BTC) remains the most widely held token, at 7.2%, followed by Dogecoin (DOGE) at 6.1% and Ethereum (ETH) at 4.9%. Other top performers include Ripple (XRP), Cardano (ADA), Solana (SOL), Polygon (POL), and Shiba Inu (SHIB). Community-driven coins like Pepe (PEPE) have also carved out a 1.8% share, proving that meme-based tokens still capture Indian investors’ attention.

Trading behaviour paints a similar picture of maturity: Ethereum led trading volumes (8.9%), while Bitcoin and Ripple each accounted for 7.6%. Activity peaked in July, coinciding with Bitcoin’s record rally and the U.S. approval of the GENIUS Act.

Balaji Srihari, Vice President at CoinSwitch, described the shift as part of a larger institutionalisation of crypto investing in India.

“Our insights reflect one of the largest retail investor bases in the country. The data clearly shows India’s crypto market is entering a more mature phase. Though metros continue to lead, the next phase will be shaped by Tier-2 and Tier-3 cities.”

A Broader Transformation

As Gen Z’s participation deepens, analysts say India’s crypto ecosystem is reaching an inflection point. Where earlier waves of adoption were driven by hype, today’s investors are focusing on utility, blue-chip assets, and long-term gains.

With over 2.5 crore users and a rapidly diversifying geographic base, the market now mirrors India’s broader digital-finance boom, one where youth, access, and ambition converge.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by the Editorial Team.

Interested in advertising with CIM? Talk to us!