Now Reading: Arthur Hayes Sees Bitcoin at $200K as Global Central Banks Quietly Loosen Policy

-

01

Arthur Hayes Sees Bitcoin at $200K as Global Central Banks Quietly Loosen Policy

Arthur Hayes Sees Bitcoin at $200K as Global Central Banks Quietly Loosen Policy

- Arthur Hayes argues that global liquidity conditions, rather than short-term price action, will drive Bitcoin’s next major move.

- He describes the Federal Reserve’s Reserve Management Purchases program as “QE in disguise,” saying it quietly expands the money supply.

- Hayes expects Bitcoin to trade sideways near current levels before reclaiming $124,000 and moving toward $200,000 in 2026.

- He also points to Japan’s continued loose monetary stance as a factor that could push investors toward risk assets like Bitcoin.

- Despite transferring a portion of his Ethereum holdings, Hayes says he remains positioned for altcoin opportunities as liquidity improves.

Arthur Hayes, co-founder of BitMEX and chief investment officer of Maelstrom Fund, is once again shaping crypto market debate with a series of macro-driven arguments spanning global central bank policy, Bitcoin price forecasts, and shifting investor behavior across altcoins and Ethereum.

In recent commentary, Hayes has tied Bitcoin’s long-term upside to what he sees as deliberate monetary accommodation by major central banks, including both the U.S. Federal Reserve and the Bank of Japan.

Japan’s Rates and Bitcoin’s Long Tail

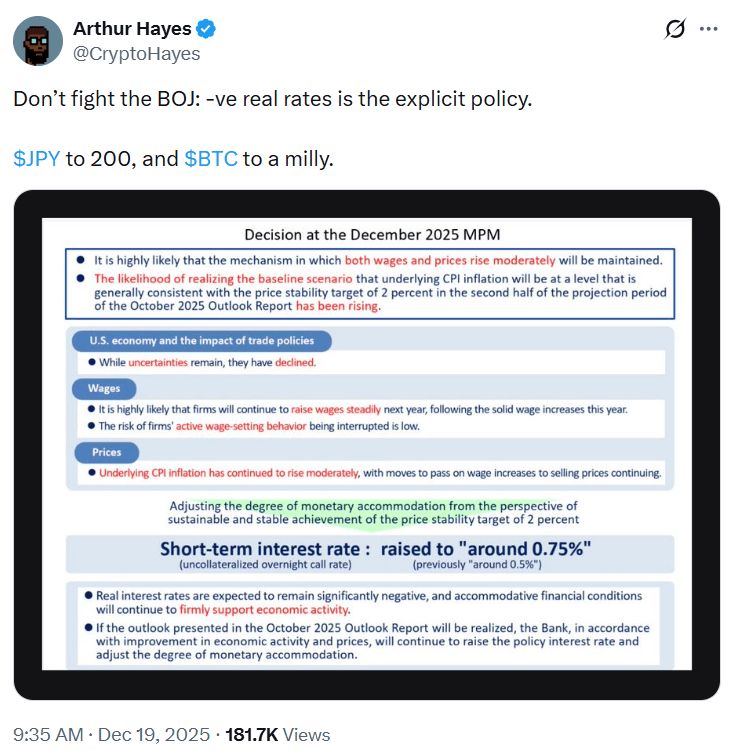

Following the Bank of Japan’s decision to raise interest rates by 25 basis points to 0.75% (a level not seen since 1995), Hayes warned investors against misreading the move as meaningful tightening.

Writing on X, he argued that Japan remains structurally committed to loose monetary policy despite inflationary pressures.

He suggested that persistently low rates could weaken the yen further and push capital toward risk assets such as Bitcoin, adding that the Japanese currency could fall as far as 200 yen per dollar from around 156 at the time.

In that context, Hayes said Bitcoin could ultimately reach $1 million.

At the time of his comments, Bitcoin was trading near $87,000, while retail sentiment remained extremely bearish, according to Stocktwits data.

The Fed’s RMP and a Liquidity Thesis

Hayes’ near- to mid-term Bitcoin outlook centers on the Federal Reserve’s recently introduced Reserve Management Purchases (RMP) program. In his December essay titled Love Language, Hayes described RMP as “QE in disguise,” arguing that the program expands liquidity through indirect channels even if it avoids the optics of traditional quantitative easing.

“RMP is a new acronym that entered my Love Language dictionary on December 10th, the day of the most recent Fed meeting,” Hayes wrote. “Immediately, I recognized it, understood its meaning, and treasured it like my long-lost love, quantitative easing (QE).”

Hayes contends that under RMP, the Fed purchases short-term Treasury bills from money market funds, which then recycle capital back into government financing or repo markets, effectively supporting deficits while expanding the balance sheet.

While he expects Bitcoin to trade sideways between $80,000 and $100,000 in the near term, Hayes believes recognition of RMP’s true impact could drive BTC back above $124,000 before accelerating toward $200,000 in early 2026. He has described March 2026 as a potential peak in expectations, followed by a pullback that still leaves Bitcoin “well above $124,000.”

Altcoins, Fear, and Rotation

Beyond Bitcoin, Hayes has also pushed back against claims that altcoin season is over. In an interview on the Kyle Chassé podcast, he argued that capital rotation never stopped; investors simply failed to hold the assets that performed.

“This is a new season. New things pump,” Hayes said. “So either you adjust and have a framework around how you’re going to appreciate what is new, or you’re always looking in the past.”

He pointed to Hyperliquid as “the best story of the cycle,” despite its sharp correction from an all-time high near $60. Hayes emphasized that fear, rather than lack of opportunity, has kept many investors sidelined, even as CoinMarketCap’s Altcoin Season Index remains firmly in “Bitcoin season” territory.

Ethereum Transfer Sparks Questions

Market attention also turned to Ethereum after blockchain data showed Hayes transferring 508.647 ETH, worth roughly $1.5 million, to a Galaxy Digital address on December 19. The move coincided with a broader $300 billion drawdown in crypto market capitalization over seven days, prompting speculation about potential selling pressure.

However, Hayes’ broader positioning suggests otherwise. On the same day as the transfer, he said Maelstrom Fund was “busy loading up on high-quality shitcoins,” a phrase he has used to describe select altcoins. His disclosed portfolio still holds significant Ethereum exposure, including staked ETH positions via Ether.fi.

Market analysts broadly interpreted the transfer as portfolio rebalancing rather than capitulation, noting that the transaction represented only a small portion of Hayes’ total Ethereum holdings.

A Macro-Driven Framework

Across his commentary, Hayes has remained consistent in framing crypto markets through the lens of global liquidity, monetary policy, and institutional behavior. Whether discussing Japan’s currency pressures, the Fed’s balance sheet mechanics, or capital rotation into altcoins, his thesis rests on the idea that sustained money creation favors scarce and risk assets over fiat.

While many of his projections remain controversial and far from consensus, Hayes continues to argue that policy-driven liquidity, rather than sentiment cycles alone, will define the next phase of crypto markets.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by the Editorial Team.

Interested in advertising with CIM? Talk to us!