Now Reading: Trump Announces U.S. Crypto Reserve, Fueling Bitcoin Surge Past $91K

-

01

Trump Announces U.S. Crypto Reserve, Fueling Bitcoin Surge Past $91K

Trump Announces U.S. Crypto Reserve, Fueling Bitcoin Surge Past $91K

Bitcoin (BTC) surged past $91,000 on Sunday following U.S. President Donald Trump’s announcement of a strategic crypto reserve for the United States. Initially, Trump named XRP, Solana (SOL), and Cardano (ADA) as part of the reserve, later clarifying that Bitcoin and Ethereum (ETH) would also be included.

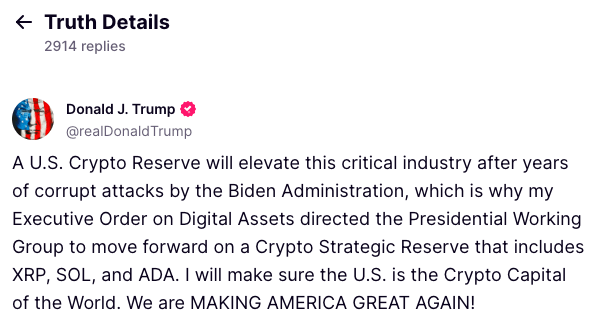

Trump made the announcement on Truth Social, stating,

“A U.S. Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration, which is why my Executive Order on Digital Assets directed the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL, and ADA. I will make sure the U.S. is the Crypto Capital of the World. We are MAKING AMERICA GREAT AGAIN!”

The announcement triggered a significant rally in the crypto market. XRP spiked 32% to approximately $2.80, while ADA and SOL rose over 20%, crossing the $1 and $160 marks, respectively. BTC saw a 6% increase, trading above $91,000, and ETH climbed nearly 10% to $2,400.

The broader CoinDesk 20 Index (CD20) gained 17% in the last 24 hours. The bullish sentiment also extended to crypto-linked stocks, including Coinbase (COIN), MicroStrategy (MSTR), and Bitcoin mining firms like Marathon Digital (MARA) and Riot Platforms (RIOT).

While the inclusion of XRP, SOL, and ADA was met with enthusiasm from their respective communities, the absence of BTC and ETH in the initial announcement sparked reactions from their supporters. However, Trump later reassured that “BTC and ETH, as other valuable cryptocurrencies, will be at the heart of the Reserve.”

The announcement sparked mixed reactions within the crypto industry. Arthur Hayes, co-founder of BitMEX, commented skeptically on the move, saying,

“Nothing new here. Just words. Lmk when they get congressional approval to borrow money and or revalue the gold price higher.”

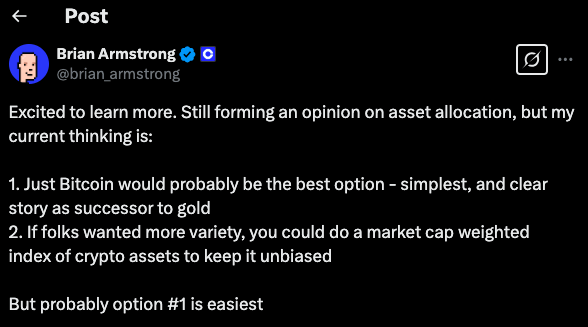

Meanwhile, Coinbase CEO Brian Armstrong expressed interest in learning more about the initiative, stating that he was still forming an opinion on asset allocation. He suggested that Bitcoin alone would likely be the best option due to its simplicity and clear narrative as a successor to gold.

However, he also noted that if broader diversification were desired, a market cap-weighted index of crypto assets could provide a more unbiased approach.

Trump’s strategic reserve plan has been in discussion since his 2024 presidential campaign. In January, after taking office, he signed an executive order directing the Presidential Working Group on Digital Assets to evaluate the establishment of a national digital asset stockpile. While the order did not mandate its creation outright, Trump’s latest statements indicate a push to formalize the initiative. The working group is set to host a summit on March 7 with key industry leaders and policymakers.

The idea of a strategic Bitcoin reserve has also been previously floated in legislative circles. Senator Cynthia Lummis introduced a bill advocating for the U.S. Treasury to acquire one million Bitcoins over five years. While state-level proposals for crypto reserves have surfaced, most have struggled to gain traction.

Trump’s embrace of a national crypto reserve marks a significant policy shift and could impact regulatory discussions in Washington. The move comes amid ongoing legal battles, including Ripple’s lawsuit with the U.S. Securities and Exchange Commission (SEC) over whether XRP constitutes an unregistered security. Additionally, Trump’s administration has received contributions from crypto industry players, including Fairshake, a super PAC backed by Ripple, and donations toward his 2025 inaugural fund.

David Sacks, the White House’s crypto and AI czar, has also drawn attention due to his connections to Solana. As a limited partner at Multicoin Capital, an investor in Solana’s ecosystem, Sacks previously disclosed that he was “hodling” SOL. Following Trump’s announcement, he noted on X (formerly Twitter) that the move aligned with Trump’s earlier executive order.

As the U.S. moves toward formalizing a crypto reserve, the implications for market regulation, institutional adoption, and international competitiveness remain to be seen. The upcoming March 7 summit is expected to shed further light on the administration’s plans and the role of digital assets in U.S. economic strategy.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by Harshajit Sarmah.