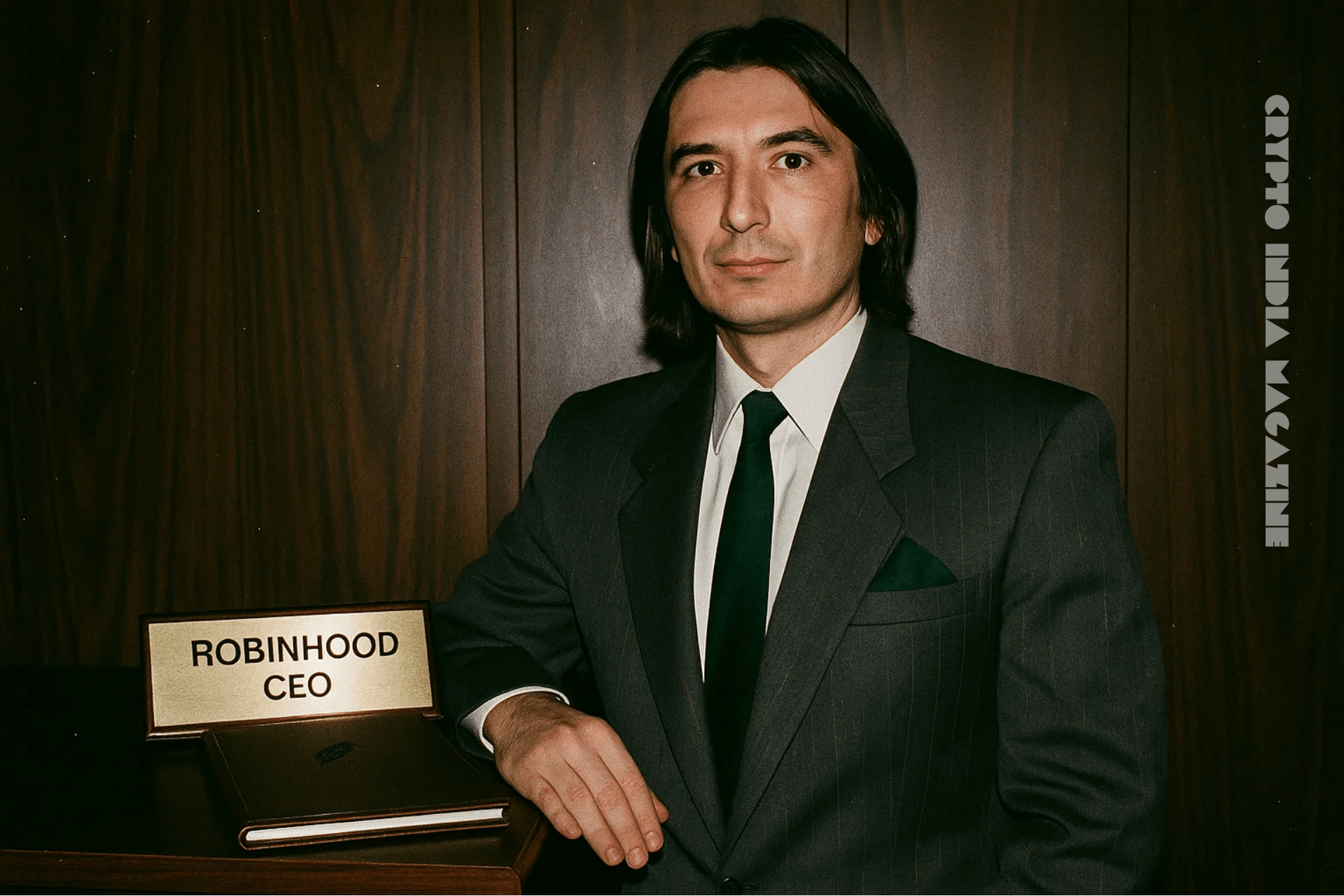

Now Reading: “Tokenization Is Going to Eat the Entire Financial System”: Says Robinhood CEO Vlad Tenev

-

01

“Tokenization Is Going to Eat the Entire Financial System”: Says Robinhood CEO Vlad Tenev

“Tokenization Is Going to Eat the Entire Financial System”: Says Robinhood CEO Vlad Tenev

Robinhood CEO Vlad Tenev has declared tokenization the most disruptive force in global finance, calling it a “freight train” that will eventually absorb traditional markets and merge them with crypto.

Speaking at the Token2049 conference in Singapore, Tenev said that in the future, “everything will be on-chain in some form, and the distinction [between crypto and traditional finance] will disappear.”

Robinhood has already made its move, launching tokenized stocks in Europe, including shares of high-profile private companies such as OpenAI. The goal, Tenev explained, is to enable 24/7 global trading of equities and other assets without the constraints of traditional market hours.

“In the same way that stablecoins have become the default way to get digital access to dollars, tokenized stocks will become the default way for people outside the U.S. to get exposure to American equities,” he said.

Europe was chosen as the launchpad for stock tokens due to its more progressive regulatory stance.

Robinhood’s long-term vision is to tokenize real estate next, opening up another multi-trillion-dollar asset class to on-chain trading. Tenev likened the mechanics of tokenizing property to tokenizing private company shares: assets are placed into a legal structure, and tokens are issued against them.

U.S. Regulatory Lag

While praising some steps taken by U.S. regulators, Tenev warned that the country risks falling behind Europe and Asia in digital asset innovation. He compared the regulatory inertia to America’s lack of high-speed trains:

“The biggest challenge in the U.S. is that the financial system basically works. It’s why we don’t have bullet trains — medium-speed trains get you there well enough. So the incremental effort to move to fully tokenized will just take longer.”

That gap, he argued, leaves global investors underserved. “There’s no urgency to change things,” Tenev said, suggesting that only regulatory adaptation—not technical capability—is holding tokenization back in the U.S.

Legal Gray Zones

Robinhood’s launch of tokenized private shares has not been without controversy.

OpenAI called the move to tokenize its stock “unauthorized,” while crypto lawyers described it as walking a legal tightrope. Tenev dismissed these criticisms as symptoms of regulatory lag, insisting that the barriers are primarily legal rather than technological.

Still, he framed tokenized real estate as the next logical leap in Robinhood’s strategy, potentially transforming property into a tradable, liquid asset accessible worldwide.

“Eating the Financial System”

Tenev closed with a sweeping prediction: tokenization will not just complement traditional finance but subsume it entirely.

“Eventually, it’s going to eat the entire financial system,” he told the Token2049 audience.

For Robinhood, the bet is clear: by pushing tokenized assets into the mainstream now, it aims to secure a first-mover advantage in a world where the boundaries between finance and crypto are no longer distinct.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by the Editorial Team.

Interested in advertising with CIM? Talk to us!