Now Reading: SEC Seeks to Bar FTX, Alameda Executives From Public Company Roles for Up to 10 Years

-

01

SEC Seeks to Bar FTX, Alameda Executives From Public Company Roles for Up to 10 Years

SEC Seeks to Bar FTX, Alameda Executives From Public Company Roles for Up to 10 Years

- The SEC seeks to bar three former FTX and Alameda executives from senior corporate roles for up to 10 years.

- The executives cooperated with prosecutors and testified against Sam Bankman-Fried at his criminal trial.

- The settlements aim to limit their future involvement in public markets without requiring admissions of guilt.

The U.S. Securities and Exchange Commission (SEC) has proposed settlement agreements that would bar three former executives of the collapsed crypto exchange FTX and its sister trading firm, Alameda Research, from holding senior roles at publicly traded companies for up to a decade.

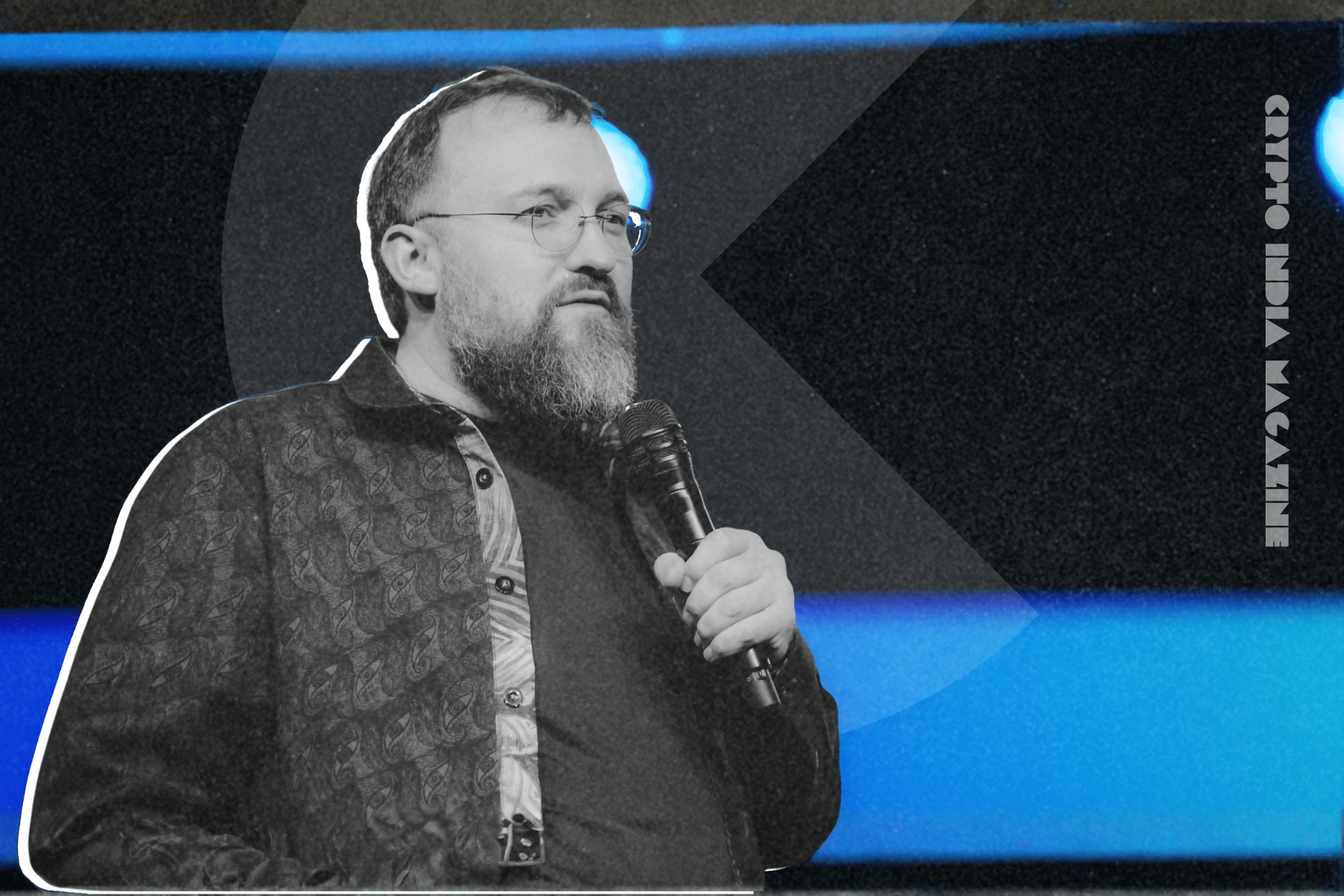

The proposed consent judgments, filed in the U.S. District Court for the Southern District of New York, pertain to former Alameda Research CEO Caroline Ellison, former FTX Chief Technology Officer Gary Wang, and former FTX Head of Engineering Nishad Singh.

Without admitting or denying the SEC’s allegations, all three agreed to injunctions preventing future violations of securities laws, limits on securities trading activity, and multi-year bans on serving as officers or directors of public companies.

Ellison, who was released from prison this week after serving 11 months, accepted a 10-year prohibition on holding executive or board roles at publicly listed firms. She had previously faced a potential sentence of more than a century after pleading guilty to wire fraud, securities fraud, and money laundering charges tied to the collapse of FTX.

Wang and Singh agreed to similar restrictions, including eight-year officer and director bans. Both avoided prison sentences last year, receiving time served and three years of supervised release after cooperating extensively with prosecutors.

At their sentencing hearings, U.S. District Judge Lewis Kaplan praised their cooperation, telling them, “You did the right thing.”

The three executives played a central role in the government’s case against FTX founder and former CEO Sam Bankman-Fried, whose exchange imploded in November 2022. Their testimony detailed how customer funds were misused to cover Alameda’s trading losses and finance political donations, venture investments, and luxury real estate purchases.

Bankman-Fried was sentenced to 25 years in prison in 2024 after a jury found him guilty of stealing at least $8 billion in customer funds. He is currently appealing his conviction and continues to maintain his innocence.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by the Editorial Team.

Interested in advertising with CIM? Talk to us!