Now Reading: India’s Supreme Court Questions Government Over Crypto Policy Delays: “Why No Clear Cut Regulation?”

-

01

India’s Supreme Court Questions Government Over Crypto Policy Delays: “Why No Clear Cut Regulation?”

India’s Supreme Court Questions Government Over Crypto Policy Delays: “Why No Clear Cut Regulation?”

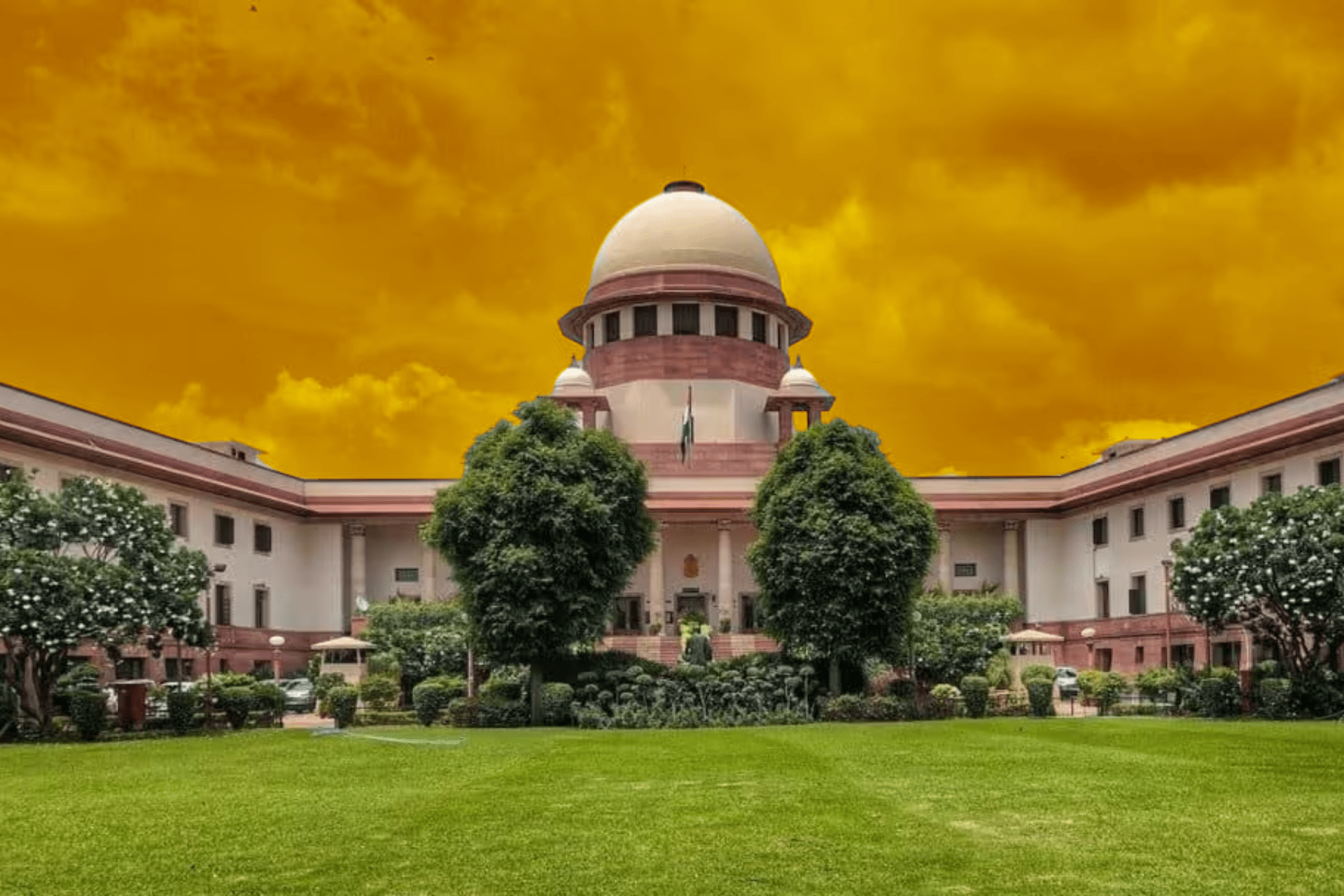

India’s Supreme Court has sharply criticized the central government for its failure to establish a clear and comprehensive policy on cryptocurrency regulation, raising fresh concerns over the country’s lack of legal clarity in one of the world’s fastest-growing crypto markets.

During a hearing on Monday, Justices Surya Kant and N Kotiswar Singh questioned why the Centre had not yet implemented a regulatory framework, stating that unregulated crypto trading was giving rise to a “parallel under-market” capable of threatening the broader economy.

“Why does the Centre not come out with a clear-cut policy on regulating cryptocurrency?” the justices asked, as reported by The Economic Times. “By regulating cryptocurrency, you can keep an eye on the trade.”

Justice Kant went a step further, likening Bitcoin trading to Hawala, the informal and illegal system of transferring money that bypasses official banking channels.

“It is an illicit trade more or less like a Hawala business,” Kant said.

Hawala transactions are considered illegal in India due to their opaque and unregulated nature.

The remarks came during a bail hearing for Shailesh Babulal Bhatt, a Gujarat resident accused of crypto-related fraud. Bhatt is alleged to have operated as one of Gujarat’s biggest BTC trade aggregators, luring investors with promises of high returns. Additional Solicitor General Aishwarya Bhati, representing the government, stated that Bhatt had victimized others through fraudulent schemes.

However, the court said it could not determine whether Bhatt was a perpetrator or a victim, pointing to the legal vacuum around crypto regulation that continues to complicate enforcement and prosecution.

Policy in Limbo

India’s lack of a clear crypto policy has long been a sticking point for the country’s rapidly growing digital asset sector. The government had previously promised to release a discussion paper on its regulatory stance by September 2024, but no such document has been published.

A senior official told reporters earlier this year that the delay stemmed from the need to reassess India’s approach in light of more crypto-friendly developments in the U.S., particularly under the administration of President Donald Trump, who returned to office in January 2025.

India’s cautious stance has created an environment of uncertainty for Web3 startups, investors, and users, who are unsure about the legal standing of trading, holding, or launching crypto-related products. While some regulatory discussions have taken place through the G20 and other global platforms, the absence of domestic clarity continues to hinder industry progress.

The Supreme Court’s intervention marks a turning point in the public conversation around digital asset governance in India. As other countries move to establish crypto as part of their financial infrastructure, India’s indecision risks leaving it behind.

With growing crypto adoption across the country and increased involvement in cross-border Web3 ecosystems, the pressure is now mounting on the Indian government to deliver a robust, transparent, and enforceable crypto regulatory regime.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by the Editorial Team.

Interested in advertising with CIM? Talk to us!