Now Reading: Bitwise Joins ETF Race With Avalanche Filing as Institutions Bet Beyond Bitcoin

-

01

Bitwise Joins ETF Race With Avalanche Filing as Institutions Bet Beyond Bitcoin

Bitwise Joins ETF Race With Avalanche Filing as Institutions Bet Beyond Bitcoin

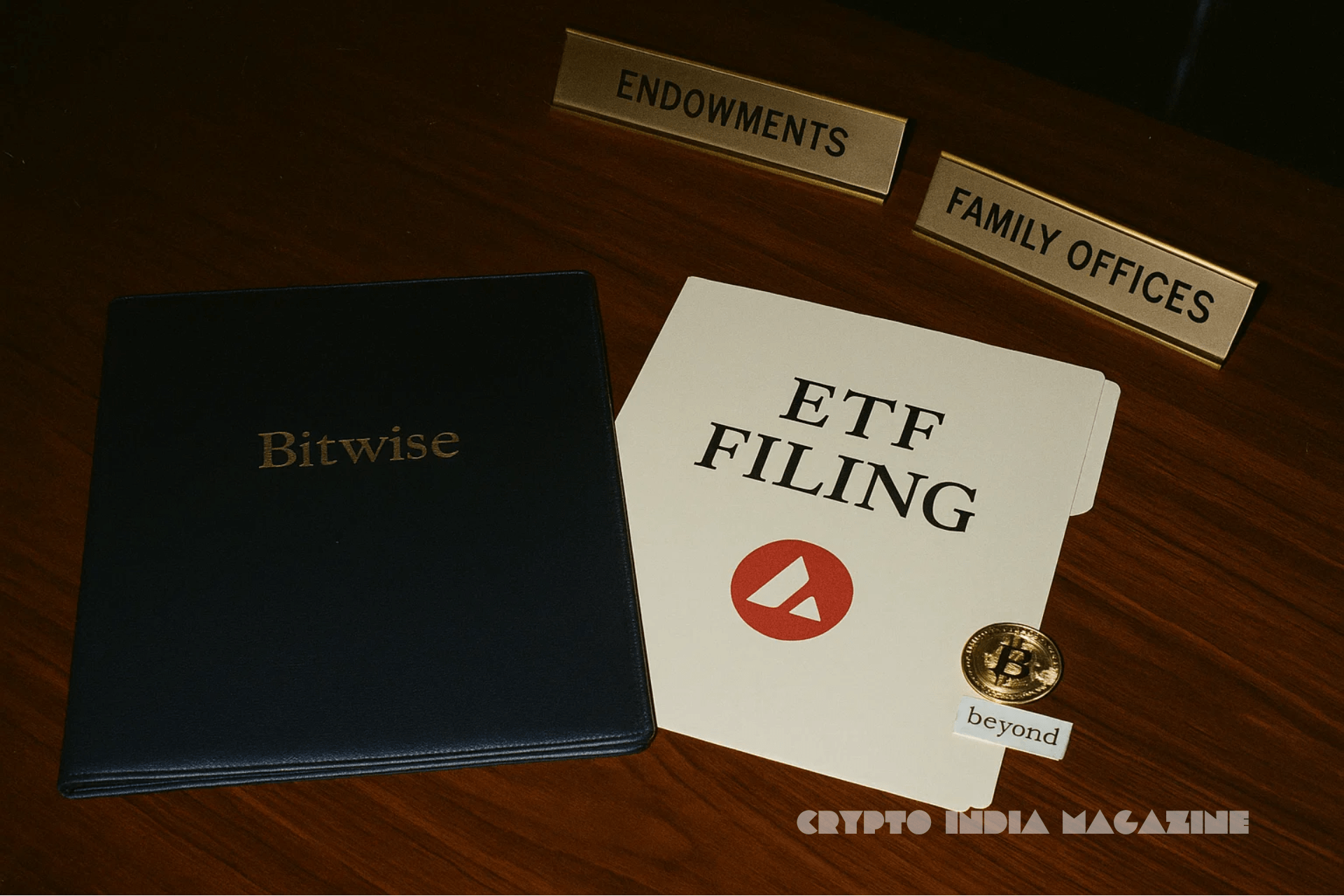

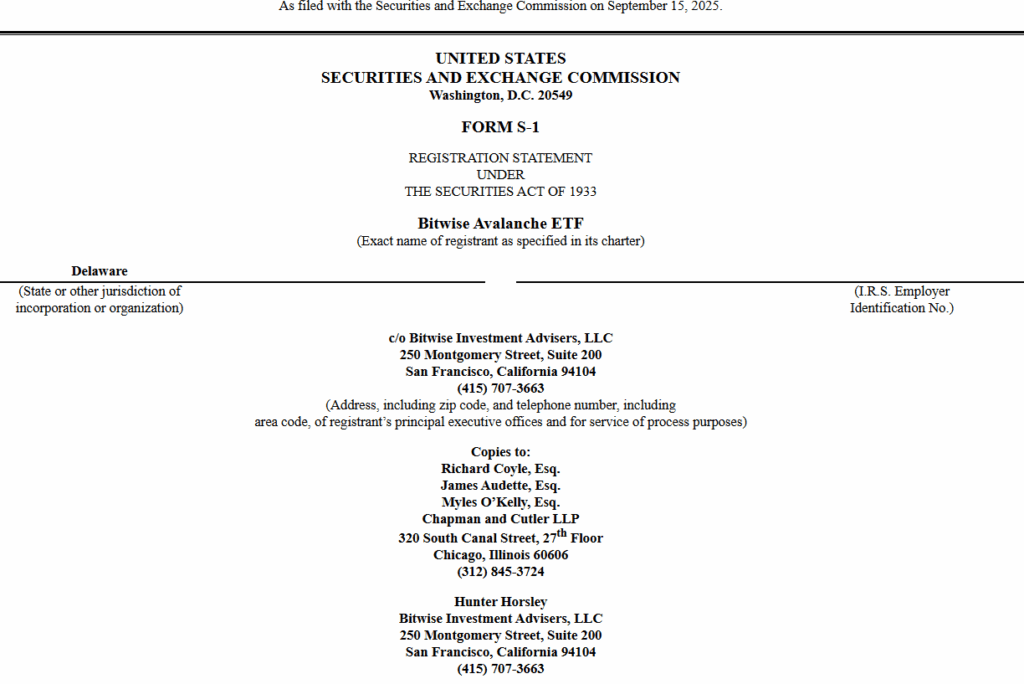

The race to launch a U.S. spot Avalanche (AVAX) exchange-traded fund (ETF) is heating up, with Bitwise Asset Management filing an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC).

The move follows the trust’s registration in Delaware, where it was organized as a statutory trust, and places Bitwise alongside asset managers VanEck and Grayscale in seeking regulatory approval for Avalanche-backed investment products.

The proposed Bitwise Avalanche ETF would provide investors with direct exposure to AVAX by holding the token in custody, rather than relying on derivatives. Coinbase Custody Trust Company has been tapped as custodian, safeguarding the assets in segregated accounts with cold storage protections. The net asset value (NAV) of the ETF will track the CME CF Avalanche–Dollar Reference Rate, published daily by CF Benchmarks.

Shares of the ETF are expected to list on a U.S. exchange under a ticker symbol yet to be disclosed. According to the filing, issuance and redemption will occur in blocks of 10,000 shares, known as baskets, settled either in cash or in Avalanche itself. The structure allows investors to gain direct exposure to AVAX without the complexities of managing wallets or private keys.

Avalanche, a proof-of-stake blockchain known for its scalability, subnet creation, governance, and smart contract functionality, has gained traction among developers and institutions alike. At the time of writing, AVAX trades at $29.83, up 1.29% over the past 24 hours, though still more than 57% below its all-time high.

Institutional Interest Expands Beyond Bitcoin and Ethereum

Bitwise’s filing underscores a broader trend of institutional managers expanding beyond Bitcoin and Ethereum to capture exposure to alternative blockchains. VanEck and Grayscale have already taken similar steps, signaling rising demand for diversified crypto investment products.

VanEck filed an S-1 for its own Avalanche ETF in March 2025, while Nasdaq submitted a proposed rule change in April to allow its listing. The SEC has yet to issue a final decision. Grayscale, meanwhile, filed on August 22, 2025, to convert its existing Grayscale Avalanche Trust into a spot AVAX ETF. The proposal also names Coinbase Custody as custodian, with BNY Mellon serving as administrator.

Although the SEC extended its review period to July 15, 2025, no decision was published by that deadline. The filings remain active, highlighting how major players are continuing to push for regulatory clarity and approval.

Broader Implications

If approved, Avalanche ETFs would join a growing roster of regulated crypto funds in the U.S. market, potentially broadening institutional participation in the AVAX ecosystem. For investors, ETFs offer an easier, regulated entry point compared to direct token purchases, streamlining exposure while retaining price correlation.

Still, risks remain. Avalanche’s volatility is evident in its steep drop from all-time highs, and any ETF would pass those risks to investors. Yet, with Bitcoin and Ethereum ETFs already well-established, the push for Avalanche suggests managers believe institutional appetite extends to a wider range of digital assets.

The SEC’s eventual decision will signal whether the agency is ready to move beyond the top two cryptocurrencies in approving spot ETFs. For now, the filings reflect growing confidence that Avalanche, once considered a second-tier blockchain, has matured into an asset with institutional demand strong enough to challenge traditional gatekeepers.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by the Editorial Team.

Interested in advertising with CIM? Talk to us!