Now Reading: Bitcoin Hits Record $109.4K, Surpasses Amazon as Fifth Largest Asset Globally

-

01

Bitcoin Hits Record $109.4K, Surpasses Amazon as Fifth Largest Asset Globally

Bitcoin Hits Record $109.4K, Surpasses Amazon as Fifth Largest Asset Globally

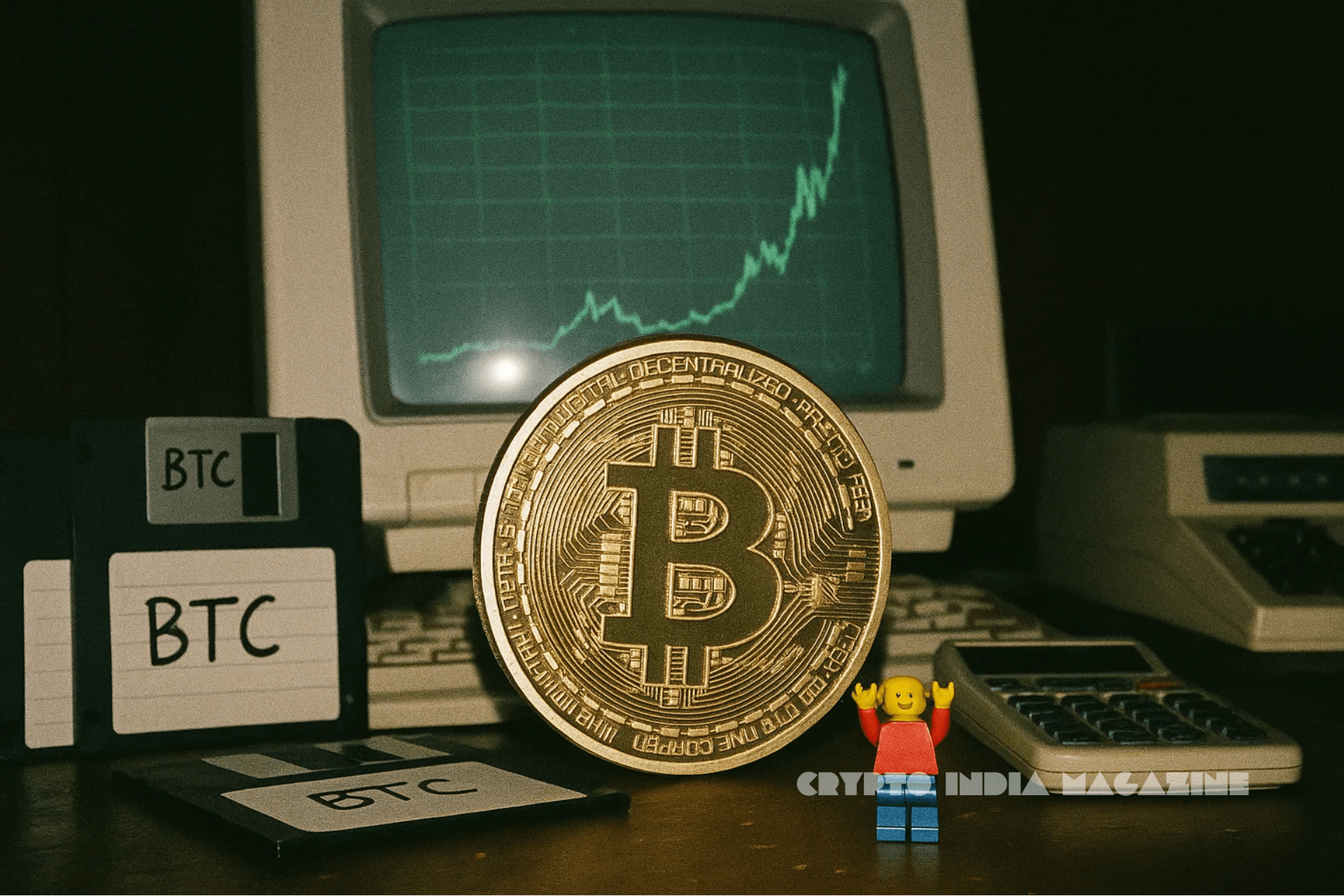

Bitcoin has once again made history. The world’s largest cryptocurrency surged to a new record high of $109,400 on Wednesday, lifting its market capitalization to an unprecedented $2.16 trillion, surpassing Amazon to become the fifth most valuable asset globally.

According to the CoinDesk Bitcoin Index, BTC’s new high came during early U.S. trading hours, briefly pushing past its previous peak set in January around the time of President Donald Trump’s inauguration. Though the price has since consolidated slightly lower to $108,954, the milestone underscores Bitcoin’s growing dominance in the global financial landscape.

Bitcoin’s latest rally has elevated it above Amazon, whose market cap currently stands at $2.15 trillion. Only gold ($22T), Microsoft, NVIDIA, and Apple (ranging between $3.1T–$3.4T) now sit above it in the global asset rankings.

The move is being fueled by strong institutional interest, particularly from spot Bitcoin exchange-traded funds (ETFs). In May alone, Bitcoin ETFs brought in over $3.6 billion in net inflows, according to market data. Notably, BlackRock’s iShares Bitcoin Trust (IBIT) has emerged as the fifth-largest ETF by inflows this year, pulling in roughly $9 billion, according to Bloomberg analyst Eric Balchunas.

The rally has also been supported by strategic treasury buys from firms like Michael Saylor’s Strategy and Twenty One Capital, which have added Bitcoin to their balance sheets amid expectations of long-term appreciation.

“This time, the run is not about hype,” said one analyst. “It’s about structured capital, regulated vehicles, and macro conviction.”

Favorable U.S. Regulation Adds Legitimacy

Adding to the momentum is a string of pro-crypto regulatory developments in the U.S. Earlier this week, the U.S. Senate advanced a bill to regulate stablecoins, signaling broader political support for integrating digital assets into the traditional financial system.

Simultaneously, several U.S. states and countries like Ukraine and the Czech Republic are moving toward building national Bitcoin reserves, further validating BTC’s status as a sovereign-grade store of value.

Bitcoin is now up over 16% year-to-date, while traditional tech giants like Amazon have seen share price pullbacks. Amazon is down about 8% over the same period.

Analysts Say This Rally Looks Different

Unlike previous bull markets driven by speculative mania, this rally appears to be founded on stronger fundamentals, including growing adoption, improved infrastructure, and macroeconomic alignment.

The lack of excessive leverage or retail-driven meme coin frenzies has also contributed to what many believe is a more sustainable uptrend. Stablecoin flows and institutional ETF purchases have replaced hype with long-term positioning.

“The foundation is stronger, the inflows are real, and the narrative has matured,” noted another strategist. “Bitcoin has become a macro asset.”

With Bitcoin’s ascent through major market milestones, its position as a mainstream financial instrument is no longer up for debate—it’s rewriting the rules of asset valuation and investor behavior in real time.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by the Editorial Team.

Interested in advertising with CIM? Talk to us!