Now Reading: Splinterlands Launches $500K Recovery Fund to Aid Players of Failed Crypto Games

-

01

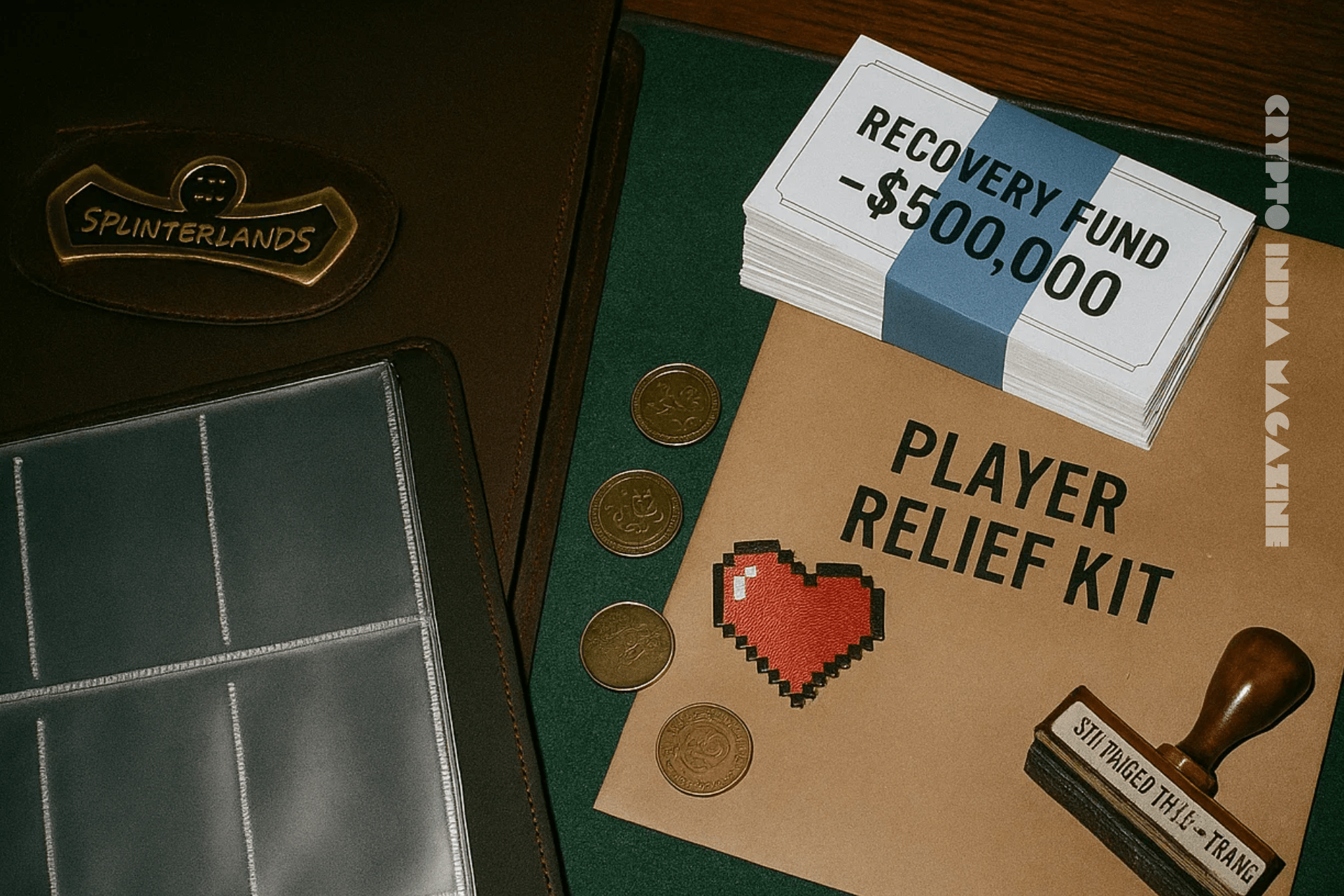

Splinterlands Launches $500K Recovery Fund to Aid Players of Failed Crypto Games

Splinterlands Launches $500K Recovery Fund to Aid Players of Failed Crypto Games

The crypto gaming sector has faced a wave of shutdowns in 2025, leaving thousands of players with worthless tokens and in-game assets. Now, Splinterlands, a long-running blockchain trading card game, is stepping in with a $500,000 recovery initiative designed to give displaced gamers a new home.

The Crypto Gaming Recovery Fund, unveiled this week, will allocate half a million dollars’ worth of tokens and assets over seven years. Eligible players from shuttered titles such as Pirate Nation, Tokyo Beast, and The Walking Dead: Empires can apply by creating a Splinterlands account, purchasing a $10 item that doubles as in-game credits, and submitting proof of their holdings in the defunct games.

In return, participants can gradually unlock Splinterlands assets as long as they remain active through small monthly challenges, such as completing five battles. The design, according to Splinterlands COO Dave McCoy, aims to reward ongoing engagement rather than one-off claims.

“We are just the first, but hopefully we have many other people join us,” he told Decrypt, noting that the fund is structured to last seven years to mirror Splinterlands’ own lifespan in the industry.

The fund is governed by a decentralized autonomous organization (DAO) that decides which games are eligible. In the first year alone, it will distribute over 2 million SPS tokens (worth about $16,000) and 5,000 Rebellion packs. By the seventh year, this will scale up to 10 million SPS (around $82,000) and 25,000 packs, divided among active players from each collapsed game.

An Industry in Retreat

The move comes during what many observers are calling a “crypto gaming purge.” Once hailed as blockchain’s breakout use case, the sector has seen high-profile closures throughout 2025. Deadrop, Ember Sword, Nyan Heroes, Realms of Alurya, Symbiogenesis, Raini: The Lords of Light, MetalCore, Blast Royale, and OpenSeason are just some of the projects that have shuttered in recent months, leaving players stranded.

The reasons vary, unsustainable costs, lack of funding, or fading user bases, but the outcome is the same: stranded communities holding assets without utility.

“When a project gets rugged, it’s a horrible feeling,” said Blaze, Splinterlands’ pseudonymous sales and marketing lead. “We just put our foot down and said: Hey, enough is enough. Somebody has got to step up here and help these people who are getting crippled.”

The sense of collapse has even extended to prominent studios. Ember Sword, once touted as a metaverse game after drawing more than $200 million in NFT land pledges, shut down in May after funding dried up. Solana-based Nyan Heroes, a mech shooter that once boasted over 250,000 wishlists, also closed after failing to secure capital, leaving its NYAN token nearly worthless. Even licensed titles like Gala Games’ The Walking Dead: Empires and Square Enix’s Symbiogenesis have gone offline.

Building Bridges, Not Silos

Splinterlands, which first launched as Steem Monsters in 2018 and later rebranded, sees the fund as a way to bring fractured communities together while proving longevity in a turbulent sector. The game’s SPS governance token has plummeted from its 2021 peak of $1.07 to under a cent, yet the team remains confident.

“The point we’re trying to make is we’re going to be around seven more years, as well,” McCoy said.

For now, the recovery fund is open to only three shuttered games, but Splinterlands has invited other developers to contribute assets and expand the safety net.

“This isn’t about Splinterlands,” McCoy added. “This is about the whole industry.”

Whether others join remains to be seen, but the initiative underscores a reality: as crypto gaming contracts, the projects that endure are under pressure to prove not just their own viability, but their commitment to rebuilding trust in the wider ecosystem.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by the Editorial Team.

Interested in advertising with CIM? Talk to us!