Now Reading: Polymarket Eyes $9B Valuation After CFTC Nod and Election Bet Boom

-

01

Polymarket Eyes $9B Valuation After CFTC Nod and Election Bet Boom

Polymarket Eyes $9B Valuation After CFTC Nod and Election Bet Boom

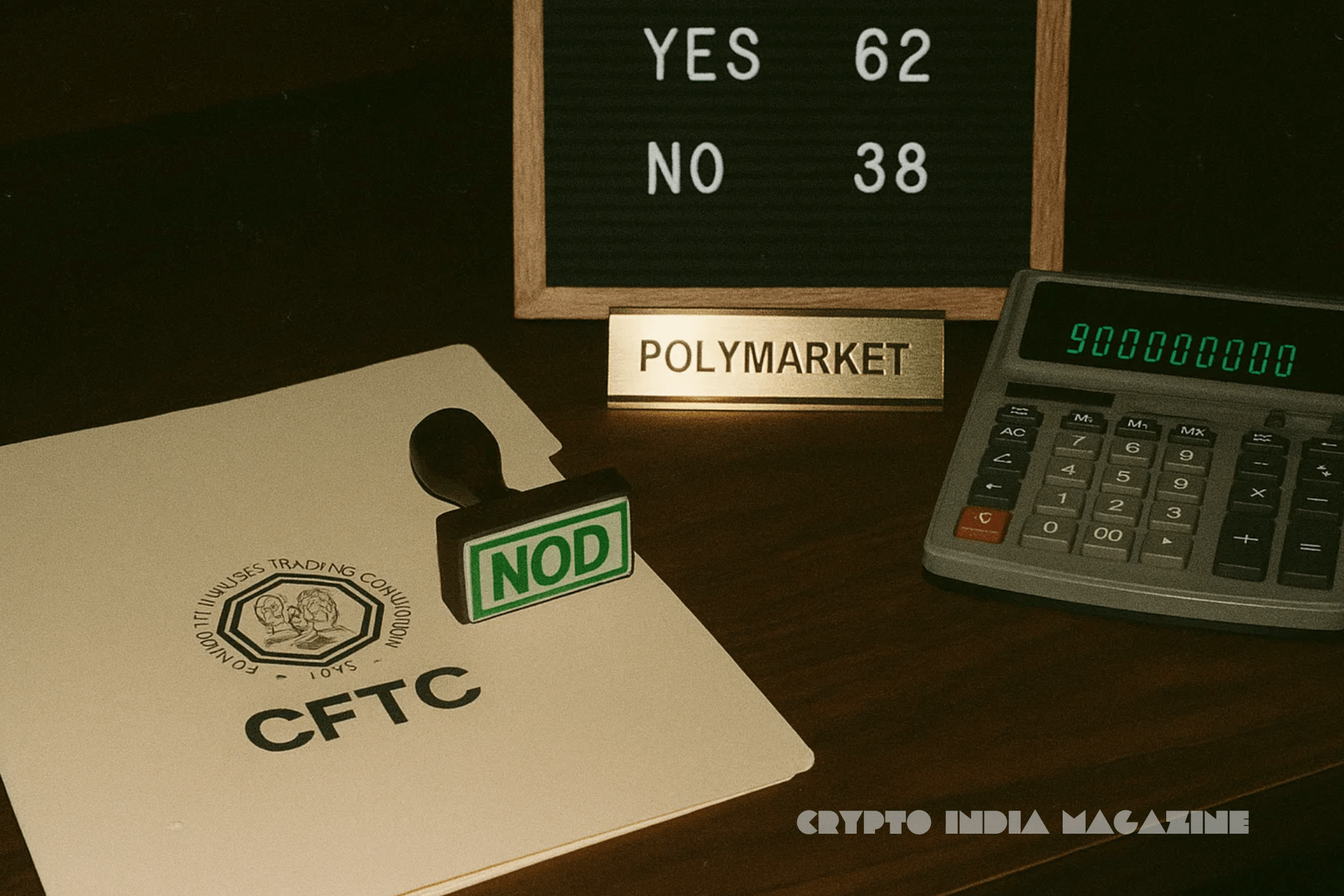

Polymarket is reportedly weighing a valuation as high as $9 billion, according to a report from The Information. The figure represents a dramatic leap from its $1 billion valuation in June, when it raised capital in a round led by Peter Thiel’s Founders Fund.

The surge reflects both a regulatory shift and booming user activity. Earlier this year, the U.S. Commodity Futures Trading Commission (CFTC) gave Polymarket the green light to operate domestically. The decision marked a sharp reversal from 2021, when the agency barred the platform from offering event contracts in the United States.

With that hurdle removed, Polymarket has expanded rapidly. The platform allows users to wager on outcomes ranging from U.S. elections and geopolitical tensions to court rulings and economic data. During the last election cycle alone, it processed more than $8 billion in bets, putting its online traffic ahead of established betting giants like FanDuel, DraftKings, and Betfair.

The renewed regulatory acceptance has sparked a broader investor reappraisal of the prediction markets sector. Polymarket’s main rival, Kalshi, has also seen its valuation climb, jumping from $2 billion earlier this year to $5 billion today. Both companies are now seen as frontrunners in an industry once dismissed as a niche curiosity but increasingly viewed as a mainstream financial instrument.

Polymarket has also courted high-profile political connections. Donald Trump Jr.’s venture capital firm, 1789 Capital, recently invested tens of millions of dollars in the company, with Trump Jr. joining as an advisor. The move signals that prediction markets are gaining traction not just in Silicon Valley but also in politically influential circles.

The valuations highlight investor conviction that prediction markets could redefine how information and expectations are priced. Supporters argue that they provide a transparent and efficient way to gauge public sentiment on political and economic events, functioning as “crowdsourced futures markets.” Critics, however, remain wary. In Washington, some policymakers have raised alarms that prediction markets could amplify misinformation or be exploited to influence electoral outcomes.

Still, momentum is building. The rapid climb in valuations for Polymarket and Kalshi suggests that investors see regulated prediction platforms as poised to scale in ways traditional sportsbooks cannot. Unlike sports betting, event-based contracts touch on politics, economics, and global affairs—areas of deep interest to institutions as well as retail users.

For Polymarket, the question is no longer whether it can attract users (it has already processed billions in wagers) but whether regulators will continue to tolerate and shape the industry’s evolution. With a CFTC license now secured and a valuation that rivals mid-cap fintech firms, the company appears set to push prediction markets into the financial mainstream.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by the Editorial Team.

Interested in advertising with CIM? Talk to us!