Now Reading: Bitcoin Hits $116K, but Gold’s Record Rally Poses a Serious Test

-

01

Bitcoin Hits $116K, but Gold’s Record Rally Poses a Serious Test

Bitcoin Hits $116K, but Gold’s Record Rally Poses a Serious Test

Bitcoin’s latest rally has reignited hopes for a year-end surge, but analysts warn its biggest test may come not from regulators or altcoins—but from gold.

The world’s largest cryptocurrency briefly swelled above $116,000 this week, marking a 19-day high amid renewed optimism over U.S. monetary policy. Cooler-than-expected producer inflation data fueled expectations of a Federal Reserve rate cut on September 17, while inflows into U.S. spot Bitcoin ETFs hit an eight-week high of $757 million. In total, U.S. ETFs have already accumulated $1.39 billion worth of Bitcoin in September.

Julio Moreno, head of research at CryptoQuant, told Decrypt that the decline in selling pressure has created “a perfect setup” for Bitcoin to rise further. Sean Dawson, head of research at Derive, added that the Fed looks “set to turn the money printer on, especially in light of weak jobs growth.” Futures markets are pricing in a 92.7% chance of a 25-basis-point cut, according to CME’s FedWatch tool.

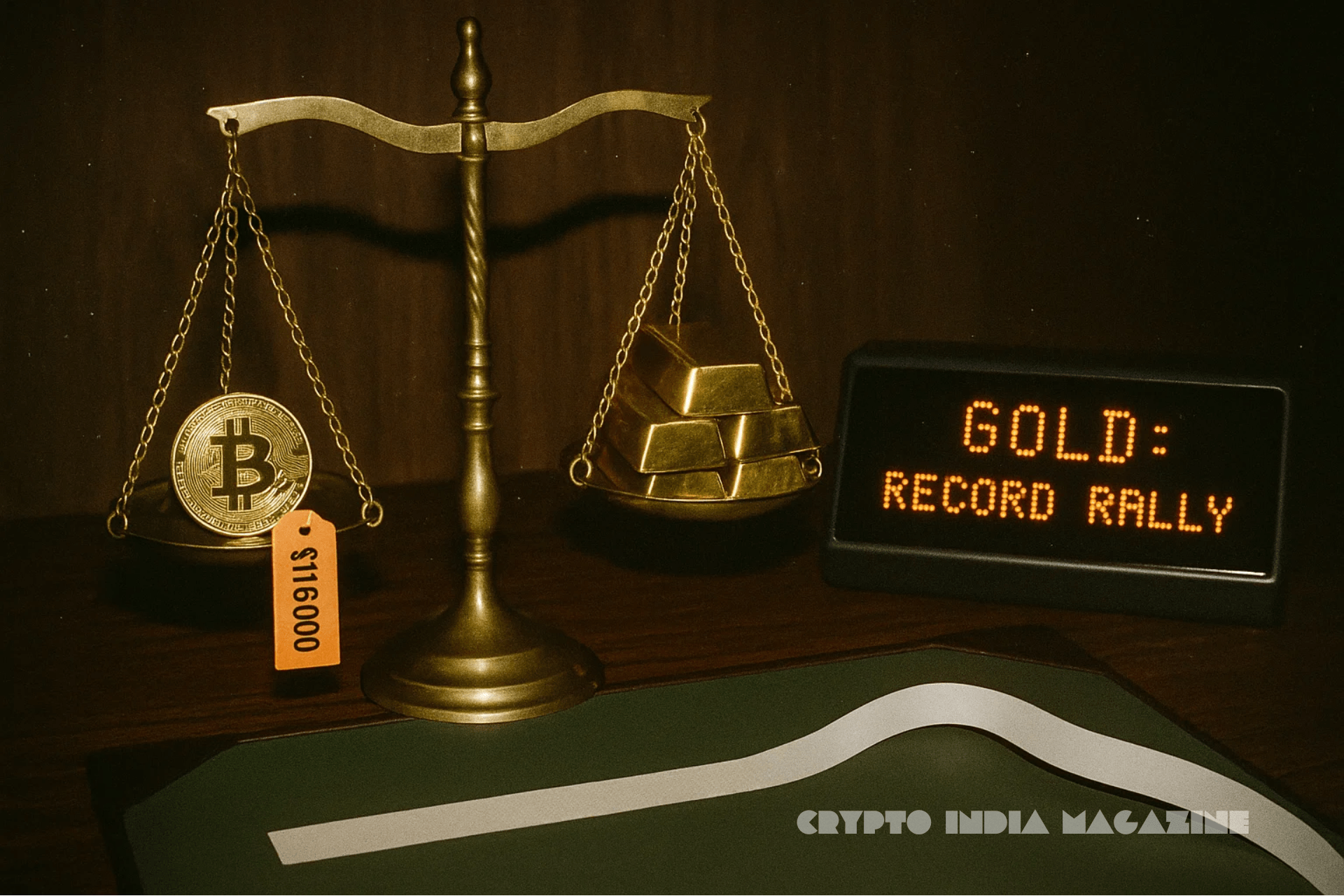

Yet while Bitcoin bulls cheer macro tailwinds, gold has quietly stolen the spotlight. The precious metal just surged to an inflation-adjusted record of $3,683 per ounce, surpassing a high last seen in 1980. Its 8% rise in September alone underscores gold’s enduring role as a safe haven amid uncertainty over global debt and monetary policy.

Bitcoin, by comparison, is still 8% below its $124,000 peak set last month. Analysts at Singapore-based QCP Capital say the relationship between gold and Bitcoin could be pivotal in shaping the final quarter of 2025. At present, the ratio sits at 0.032.

“We’re watching whether the gold-to-Bitcoin ratio approaches 0.041, a level that has historically coincided with periods where gold rallies while Bitcoin stabilizes,” the firm noted.

Prediction markets suggest gold may outshine Bitcoin through year-end. On Myriad, a decentralized forecasting platform, sentiment shifted sharply after gold’s breakout: 63% of participants now believe gold will outperform Bitcoin, up from 54% earlier in the week.

The divergence between the two assets highlights a fundamental question: is Bitcoin ready to challenge gold’s dominance as a hedge against inflation, or is it still a high-beta companion asset?

Institutional flows offer a mixed picture. Bitcoin ETFs are recording record inflows, reflecting growing legitimacy in traditional finance, but gold’s rally underscores that risk-averse investors still prefer the older asset when global uncertainty spikes.

For Bitcoin, the narrative hinges on usability and speculation. ETF inflows and expectations of looser U.S. monetary policy have provided immediate momentum, while Ethereum futures briefly overtook Bitcoin in volume this week, suggesting speculative traders are hedging bets across digital assets. For gold, the story is simpler: a tried-and-tested hedge gaining traction as inflation jitters linger.

Galaxy Digital CEO Michael Novogratz remains bullish, forecasting another surge for Bitcoin by year-end as the Fed begins its cutting cycle. But the competition with gold may temper enthusiasm. If the precious metal continues setting records while Bitcoin consolidates, investors may begin to question whether digital gold can truly outshine its physical counterpart in times of macro stress.

The coming weeks may provide clarity. With the Fed decision looming, and cross-asset ratios like gold-to-Bitcoin and BTC-to-ETH serving as key barometers, markets are entering a phase where sentiment could swing rapidly.

For now, Bitcoin sits at $115,680—buoyed by optimism but shadowed by gold’s historic rally. Whether it can match or surpass its rival will shape not just the rest of 2025, but the broader debate over which asset best protects against inflation in an era of fragile global growth.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by the Editorial Team.

Interested in advertising with CIM? Talk to us!