Now Reading: Singapore Beats the U.S. to Become the World’s Most Crypto-Friendly Country

-

01

Singapore Beats the U.S. to Become the World’s Most Crypto-Friendly Country

Singapore Beats the U.S. to Become the World’s Most Crypto-Friendly Country

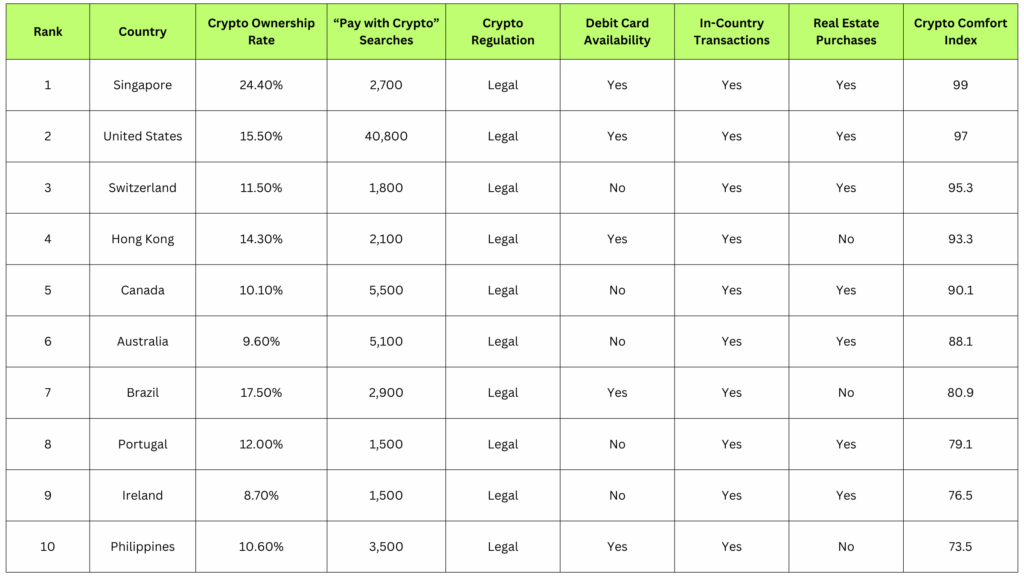

Singapore has emerged as the most comfortable country in the world for everyday cryptocurrency use, according to new research by decentralized exchange ApeX Protocol. The study assessed global adoption trends and practical usability, producing a “Crypto Comfort Index” that ranked countries on a scale of 0–100.

The city-state scored 99.0, leading the pack with 24.4% of its population owning digital coins, a strong exchange presence, and the ability to use crypto across all major channels—from debit cards and local transactions to property purchases. With 81 exchanges operating domestically, Singapore checked every usability box, setting a global benchmark for crypto-friendly living.

The United States followed closely with a score of 97.0, bolstered by its expansive infrastructure. Americans have access to more than 31,700 crypto ATMs—the largest network worldwide—and 166 exchanges. Despite a lower ownership rate than Singapore (15.5%), the U.S. recorded the highest search interest for crypto payments, with over 40,000 monthly queries. Like Singapore, the country allows the use of debit cards, in-country transactions, and real estate purchases in cryptocurrency.

Switzerland ranked third with 95.3, establishing itself as the most crypto-friendly nation in Europe. The Alpine country has a dense network of 1,130 ATMs and 32 exchanges despite a population of just under nine million. While crypto debit cards are not widely available, Swiss residents can use digital assets for everyday purchases and even real estate deals, further solidifying the country’s reputation as a hub for blockchain innovation.

Other top performers included Hong Kong (93.3), Canada (90.1), and Australia (88.1). Hong Kong combines strong ownership rates (14.3%) with the availability of debit cards and local transactions, although real estate purchases remain off the table. Canada, home to the world’s second-largest crypto ATM network (over 3,000), offers favorable regulations and property deals in digital currencies. Australia, meanwhile, boasts more than 1,000 ATMs and 31 exchanges, supporting both local payments and real estate transactions.

Brazil stood out as the only Latin American country in the top 10, ranking seventh with 80.9. With 17.5% of its population owning crypto—the second-highest adoption rate globally—Brazil also offers debit cards and in-country transactions, though property deals in digital assets are not yet available.

Portugal (79.1), Ireland (76.5), and the Philippines (73.5) rounded out the list. Portugal and Ireland allow both local transactions and real estate purchases with crypto, but lack debit card availability. In contrast, the Philippines provides debit card options and everyday spending opportunities, but not property transactions.

How the Index Was Built

The ApeX Protocol study evaluated seven indicators: cryptocurrency ownership rates, ATMs per capita, local exchanges, “pay with crypto” searches, debit card availability, in-country transaction options, and real estate usability. Ownership rates and ATMs were weighted most heavily (25% each), reflecting their importance for mainstream adoption, while exchanges carried a 15% weight. Debit cards, in-country transactions, and property purchases each contributed 10%, and search interest accounted for 5%.

Numeric indicators were adjusted to population size and normalized to a 0–100 scale. Binary usability measures (such as whether debit cards or real estate purchases were possible) were scored as yes (100), no (0), or neutral (50) where data was unavailable.

“Young people are driving crypto adoption while governments struggle to keep pace,” an ApeX Protocol spokesperson said. “Countries that move quickly now can establish themselves as digital financial hubs for decades to come.”

Globally, nearly 7% of the population owns cryptocurrency, the study noted. However, the ability to spend crypto in everyday life remains fragmented. While adoption is spreading, usability infrastructure varies widely, highlighting a divide between ownership and practical use.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by the Editorial Team.

Interested in advertising with CIM? Talk to us!