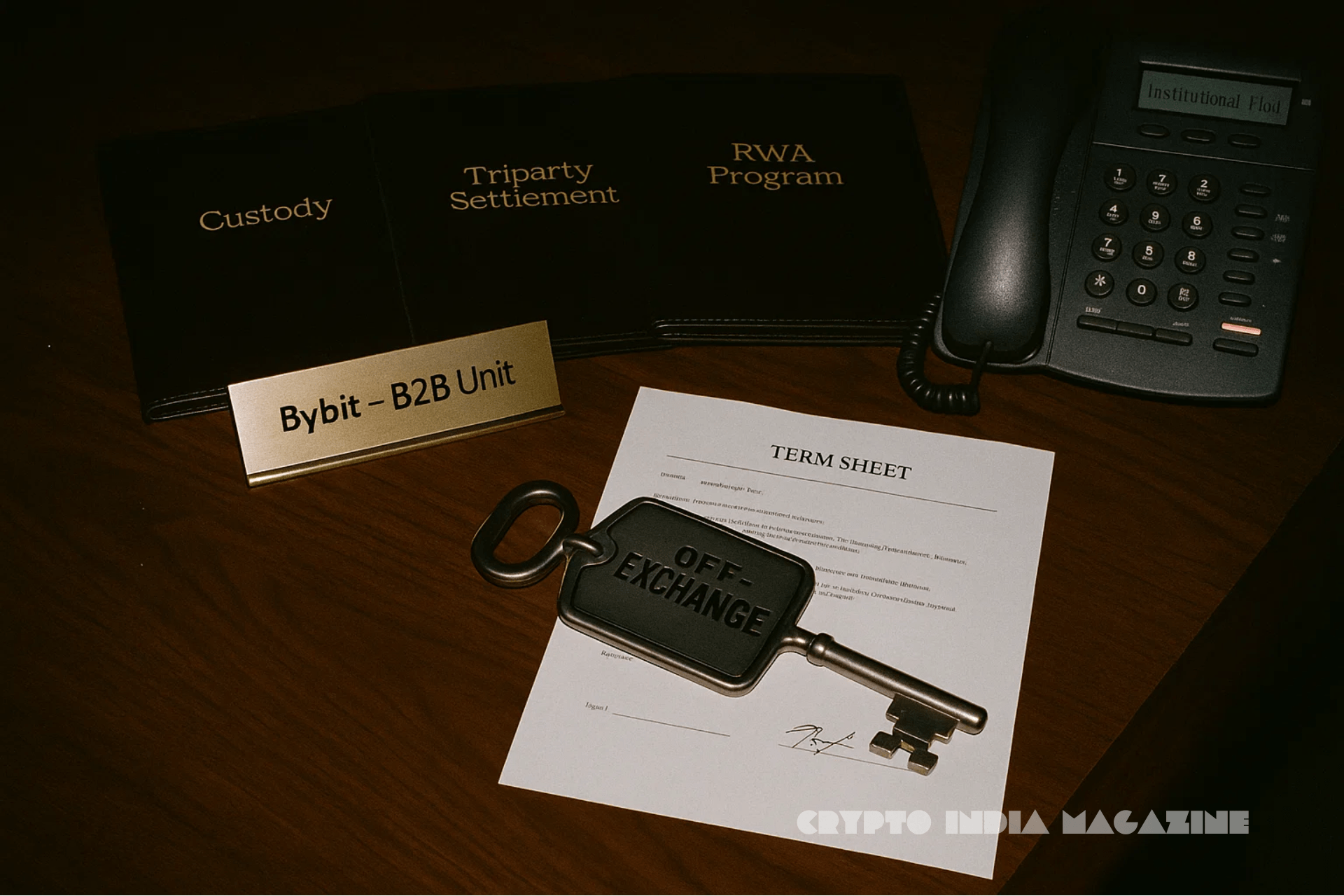

Now Reading: Bybit Opens Institutional B2B Unit With Custody, Triparty Settlement, and RWA Collateral

-

01

Bybit Opens Institutional B2B Unit With Custody, Triparty Settlement, and RWA Collateral

Bybit Opens Institutional B2B Unit With Custody, Triparty Settlement, and RWA Collateral

Bybit has formally launched a Business-to-Business Unit (BBU), marking a strategic pivot beyond retail trading and into the infrastructure-heavy needs of institutional and enterprise clients.

The new unit consolidates Bybit’s existing institutional teams under one roof. It will be led by Yoyee Wang, a former portfolio manager at the Royal Bank of Canada who most recently headed Bybit’s global treasury.

The BBU will provide services often demanded by large funds, including off-exchange custody, triparty settlement frameworks, and tokenized real-world asset (RWA) collateral programs. These features are designed to reduce counterparty risk, improve capital efficiency, and expand the tools available to professional traders.

Bybit said the move responds to two major barriers institutions face in digital assets: custody risk and idle capital inefficiency. Off-exchange custody and triparty settlement will allow clients to hold funds with trusted custodians while still receiving trading credit, reducing the systemic risks highlighted by past exchange failures.

Meanwhile, the RWA collateral program will let clients pledge tokenized traditional assets as collateral for trading, reducing the need to keep large amounts of idle capital on exchanges.

“Institutions are looking for trusted partners who understand both the rigor of traditional finance and the innovation of crypto,” Yoyee Wang, Head of BBU at Bybit, said “At Bybit, we are building a complete business loop that integrates custody, liquidity, and yield — giving our clients not just market access, but a strategic edge in this new era.”

Bybit’s BBU will also extend beyond crypto-native institutions. Its Digital Treasury Asset (DTA) solutions target traditional corporations seeking secure and compliant ways to allocate part of their treasury into digital assets. The offering includes security protocols, compliance guidance, and yield optimization tailored for corporate risk officers.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by the Editorial Team.

Interested in advertising with CIM? Talk to us!