Now Reading: The Global Growth and Adoption of Blockchain

-

01

The Global Growth and Adoption of Blockchain

The Global Growth and Adoption of Blockchain

Blockchain developed gradually from early cryptographic research and ideas around distributed trust. Early efforts, such as digital cash prototypes and proposals for online value systems, formed the groundwork. What followed was a slow but steady transition toward practical, programmable systems that could manage value, identity, and agreements in a decentralized way.

As these concepts matured, so did the technology. Around the early 2010s, developers and technologists began building platforms that could host decentralized applications and smart contracts. These ideas shaped blockchain into a shared infrastructure that could serve many sectors. It became more than just a way to transfer money. It was now a foundation for building services that did not rely on a single authority.

Enterprise interest in blockchain began rising soon after. By the middle of the last decade, several open-source frameworks were developed specifically to meet business needs. These platforms allowed organizations to manage data securely and transparently across multiple parties. Sectors such as logistics, healthcare, insurance, and banking started to explore how blockchain could simplify their operations and reduce verification costs.

Large companies started conducting pilots and proof-of-concept programs. Over time, these trials turned into live deployments. Blockchain became part of workflows involving shipment tracking, patient record management, insurance claim automation, and digital identity verification. While the pace of adoption differed across regions and industries, the direction was clear. Blockchain was finding a place in real-world processes.

As organizations became more familiar with the technology, their use cases evolved. Some focused on digitizing existing records. Others explored the tokenization of real-world assets such as land titles, equity, or bonds. These experiments opened the door to programmable ownership and near-instant settlement of transactions. Today, many enterprises view blockchain as a tool for digital transformation, with benefits that go beyond cost savings.

Ecosystem Growth and Developer Participation

The health of a digital ecosystem often depends on its developers. In blockchain, this has proven especially true. A growing number of programmers, architects, and engineers have helped expand the technology’s reach. They design new protocols, maintain codebases, and create applications that users interact with daily.

Developer communities have grown across many networks. While some platforms have a long-standing presence, newer ecosystems have also emerged with different approaches to scalability, sustainability, and user experience. Each network tends to attract a particular kind of developer based on its values and technical design.

Some platforms focus on public infrastructure with open participation, while others cater to enterprise-grade permissioned use. Both approaches have merit. Together, they ensure that blockchain development is not one-dimensional. Instead, it spans a wide spectrum of philosophies and technical styles.

One trend that continues to grow is the use of modular and composable components. Developers are increasingly building tools that can work across chains or plug into other systems. This shift allows teams to focus on specific layers, such as consensus, identity, or storage, without having to recreate everything from scratch.

There is also growing interest in sustainability and efficiency. Developers are now prioritizing networks that require less energy and support greener infrastructure. This shift has been driven by both environmental awareness and practical concerns around operational costs.

Some ecosystems are grounded in academic research, while others prioritize developer speed and performance. This diversity supports experimentation. It also helps projects learn from each other and evolve in ways that benefit the broader community.

Many builders today are not working on just one chain. They are designing tools that bridge across multiple systems. This multi-chain mindset may help reduce fragmentation and bring blockchain closer to being an interoperable foundation for digital services.

A complementary analysis of blockchain growth trends can be found in the Blockchain Ecosystem Evolution study, which explores long-term patterns in public interest, developer activity, and code contributions.

Public Engagement and Institutional Readiness

Public interest in blockchain has not followed a straight line. It has moved in waves. At times, it has surged with excitement and speculation. At other times, attention has faded as users waited for clearer outcomes or more stable products.

Still, one can see a steady baseline of activity. Search behavior, developer documentation, wallet usage, and transaction volumes all suggest that interest remains steady, even if it does not always trend upward. It may be fair to say that blockchain has shifted from novelty to infrastructure.

One sign of ongoing engagement is the rise in self-custody and personal wallet adoption. Users across many regions are exploring how to manage their assets and identities without relying on intermediaries. This can be seen as part of a broader trend toward personal control in digital life.

Transaction activity across major networks continues to be strong. Whether it involves payments, asset transfers, or interactions with decentralized applications, blockchain use is becoming more routine. It is no longer limited to early adopters or niche communities.

At the same time, institutions have been preparing to engage more directly. Financial firms, asset managers, and consultancies are building the tools needed to work with tokenized assets, smart contracts, and on-chain data. Many of these efforts are still early-stage, but the intent is clear. Institutions are no longer observing from the sidelines.

This interest is reflected in changing policy discussions. Governments are starting to consider how to regulate blockchain in ways that support innovation while reducing risk. Digital asset frameworks, pilot programs for central bank digital currencies, and public-sector uses of blockchain for identity or records management have all gained momentum.

In some regions, blockchain is being used to simplify procurement, land ownership registration, or subsidy distribution. These applications may not attract as much media attention as speculative markets, but they can offer lasting improvements in efficiency and transparency.

Decentralized finance continues to grow, offering users the ability to lend, borrow, trade, and earn yield through blockchain protocols. While not without risks, this sector has introduced new models of economic coordination. It has also forced traditional finance to examine how it can adapt.

Tokenization has become a central theme. Real-world assets can now be represented digitally in a way that is both programmable and transferable. This makes it easier to split ownership, automate compliance, and settle trades quickly. In the long run, it may reshape how markets operate.

From Concept to Infrastructure

After more than a decade of experimentation and refinement, blockchain has become part of the fabric of digital infrastructure. It is no longer just a technical curiosity or a theoretical model. It is being used to store data, verify claims, transfer value, and coordinate activity.

The road has not been smooth. Many early projects did not survive. Others had to pivot or rebuild their systems after scaling challenges or regulatory issues. Nonetheless, the field has shown resilience. The ideas behind decentralization, transparency, and programmable logic continue to inspire new solutions.

Much of the current focus is on integration. Teams are building systems that fit into existing legal, financial, and operational environments. Instead of trying to replace institutions, many blockchain projects now aim to enhance or complement them. This approach may be more practical and sustainable in the long run.

As blockchain matures, the nature of innovation has changed. It is less about launching entirely new networks and more about improving tools, expanding usability, and increasing reliability. Quiet improvements in infrastructure may matter more than headline-grabbing announcements.

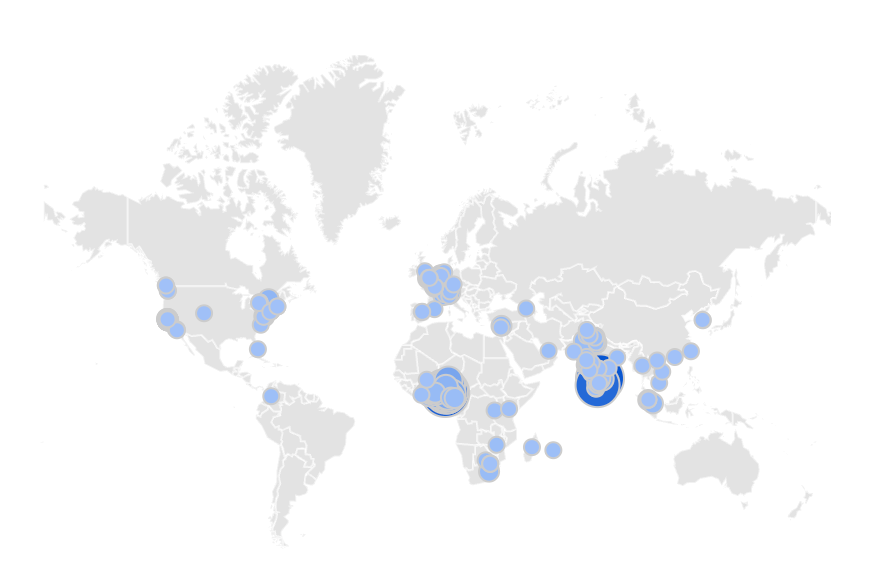

The global developer base continues to evolve. Communities from different countries contribute to this progress, bringing in new ideas and perspectives. This international collaboration supports the view that blockchain is not tied to any single geography or ideology. It can serve a wide range of users and use cases.

Editorial Note: This is a guest post authored by Vedang Vatsa, who is a leading analyst in the Web3 space. His research on stablecoins is indexed in the S&P Global Market Intelligence Researcher Paper Series and ranked among the top papers on SSRN. A former KPMG consultant, he advises on go-to-market strategy for Web3 projects and leads one of the largest Web3 career communities.

We haven’t edited the article. We have only added internal links solely for SEO purposes. These links are editorial decisions and are not associated with the author.

Want to write for Crypto India Magazine? Mail us at editorial@cryptoindiamagazine.com