Now Reading: Ripple Partners with Chainlink to Advance RLUSD Stablecoin in DeFi Ecosystem

-

01

Ripple Partners with Chainlink to Advance RLUSD Stablecoin in DeFi Ecosystem

Ripple Partners with Chainlink to Advance RLUSD Stablecoin in DeFi Ecosystem

- Ripple partners with Chainlink to integrate RLUSD stablecoin into DeFi, enabling use in trading, lending, and cross-border payments.

- RLUSD gains decentralized pricing support from Chainlink Price Feeds, enhancing reliability and transparency for DeFi applications.

Ripple has announced a partnership with data provider Chainlink to enhance the integration of its RLUSD stablecoin with decentralized finance (DeFi) applications.

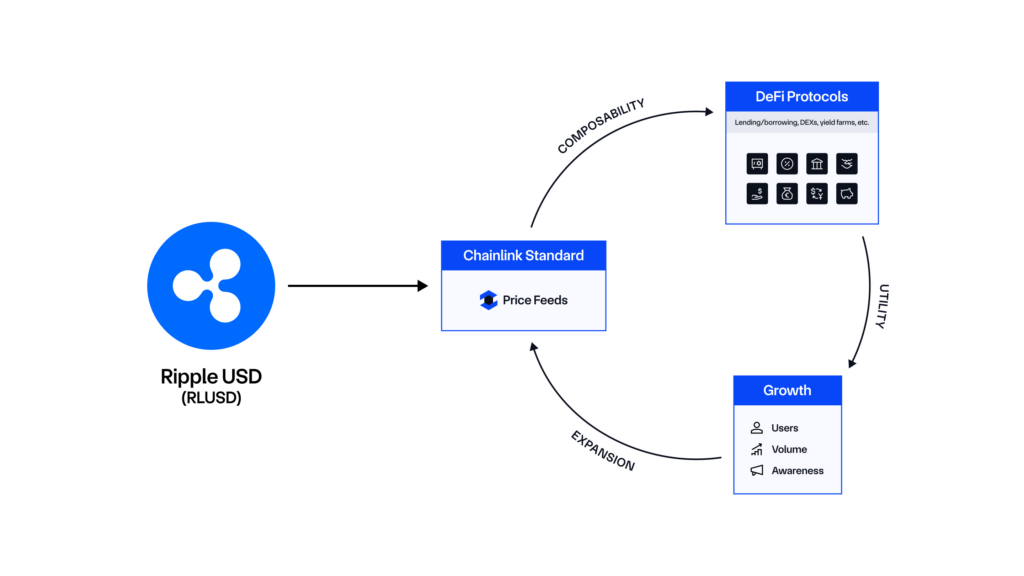

This collaboration leverages Chainlink’s services to enable RLUSD compatibility with DeFi protocols, facilitating activities such as trading and lending.

The feature, which went live on the Ethereum blockchain, marks a significant step in expanding RLUSD’s functionality within the DeFi ecosystem.

Ripple introduced the U.S. dollar-pegged RLUSD stablecoin to the Ethereum and XRP Ledger networks in October. According to CoinGecko data, the token currently has a market capitalization of $72 million.

Ripple aims to accelerate the adoption of RLUSD in DeFi and cross-border payment systems through its integration with Chainlink’s infrastructure. Chainlink Price Feeds, which have supported over $18 trillion in transaction value, provide accurate and decentralized pricing data essential for managing risks in DeFi applications.

Jack McDonald, Ripple’s senior vice president of stablecoin, emphasized the significance of the collaboration.

“By enabling seamless functionality across DeFi, RLUSD is well-positioned to support a growing range of use cases in decentralized financial systems,” he said.

He added that the integration ensures reliable and transparent operations for protocols using RLUSD in various financial activities.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by Harshajit Sarmah.