Now Reading: Trump-Backed DeFi Project World Liberty Financial Raises $9M in Token Sale as Election Odds Fuel Bitcoin Surge

-

01

Trump-Backed DeFi Project World Liberty Financial Raises $9M in Token Sale as Election Odds Fuel Bitcoin Surge

Trump-Backed DeFi Project World Liberty Financial Raises $9M in Token Sale as Election Odds Fuel Bitcoin Surge

- World Liberty Financial, a DeFi protocol backed by Donald Trump, raised $9.15 million in its public token sale, with 610 million WLFI tokens sold.

- Trump, serving as “chief crypto advocate,” touted crypto as the future, while the project has garnered mixed reactions within the crypto community.

- Trump’s rising odds in the 2024 presidential race have been linked to a 15% rise in Bitcoin’s value, as noted by analysts.

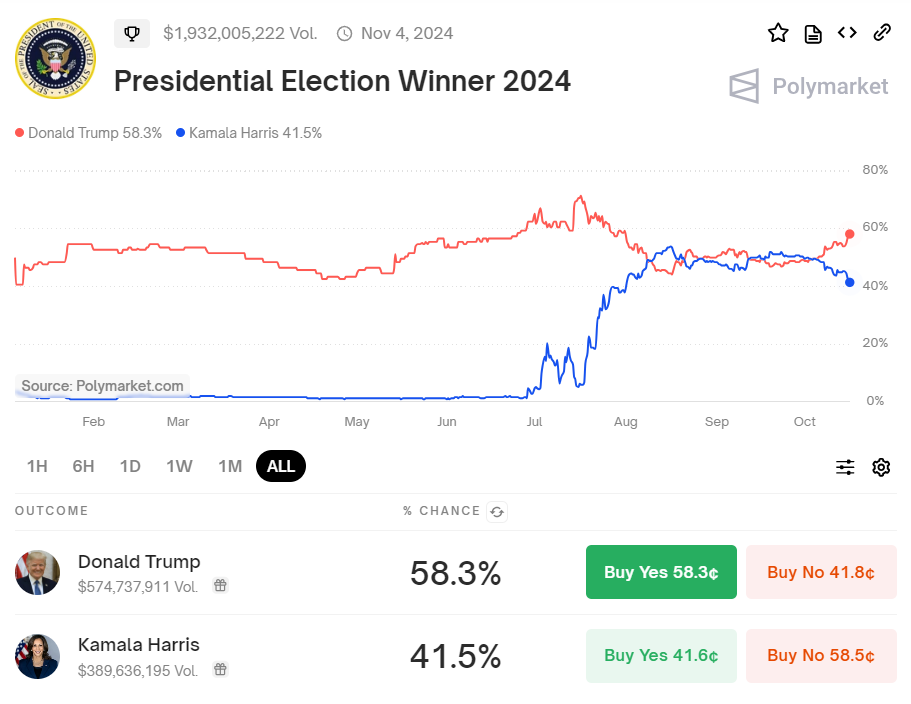

- Decentralized prediction markets show Trump leading against Kamala Harris, though national polls still favor Harris.

World Liberty Financial, a decentralized finance (DeFi) protocol backed by former U.S. President Donald Trump, went live with its highly anticipated public token sale on Tuesday. Despite some website downtimes in the morning, the project saw significant early momentum, selling about 610 million WLFI tokens by 7:25 p.m. ET. With each token priced at $0.015, the sales total reached approximately $9.15 million, including a $5 million surge in the first hour alone.

The WLFI token sale aims to raise $300 million by selling 20% of the token supply, valuing the project at $1.5 billion. According to the project’s roadmap, WLFI will serve as a governance token, enabling holders to vote on platform development decisions. However, tokens will remain non-transferable for the first year, meaning holders will not be able to trade them until 2025. Co-founder Zak Folkman stated that over 100,000 individuals had signed up for the whitelist ahead of the token sale, which went live between 8 and 9 a.m. ET.

World Liberty Financial is co-founded by real estate developers Steve and Zach Witkoff, alongside Folkman and Chase Herro. The project has garnered attention largely due to Trump’s role as “chief crypto advocate” and the involvement of his three sons, Donald Jr., Eric, and Barron, who have been labeled “Web3 ambassadors” for the initiative.

In a post on social media platform X, formerly Twitter, Trump commented on the token sale’s launch, stating, “Crypto is the future. Let’s embrace this incredible technology and lead the world in digital economy.”

Despite the fanfare, reactions to the project have been divided. While some crypto enthusiasts see the involvement of such high-profile figures as a potential boost for the sector, others remain skeptical about the project’s long-term impact on the industry.

Meanwhile, the price of Bitcoin has risen by 15% in October, partly attributed to Trump’s increasing election odds. Analysts at Bernstein noted that Bitcoin’s recent strength is tied to its correlation with Trump’s improving chances in the 2024 U.S. presidential race, highlighting that while both major political parties show support for digital assets, the market is currently leaning toward Trump.

Furthermore, Trump’s rising odds in the 2024 U.S. presidential election have also coincided with the 15% rise in Bitcoin’s value this month. According to the decentralized prediction market Polymarket, Trump currently holds a 58.3% (at the time of writing) chance of winning, with Democratic opponent Kamala Harris trailing at 41.5% (at the time of writing).

Trump’s lead on Polymarket has grown since the beginning of October, while national polling averages still show Harris ahead with 48.5% to Trump’s 46.1%, according to FiveThirtyEight.

Analysts at Bernstein noted that Bitcoin’s recent strength is tied to Trump’s improving election odds, as he is perceived to be more supportive of cryptocurrencies than Harris. Although some suggest Polymarket could be biased toward Trump, Bernstein analysts argue that users are more likely to bet real money on probabilities rather than reflecting personal bias.

Meanwhile, Harris has proposed a regulatory framework aimed at protecting Black men who invest in cryptocurrencies, though she has remained largely quiet on broader crypto issues.