Now Reading: Slash Raises $41M to Reinvent Vertical Banking for Crypto, Ads, and More

-

01

Slash Raises $41M to Reinvent Vertical Banking for Crypto, Ads, and More

Slash Raises $41M to Reinvent Vertical Banking for Crypto, Ads, and More

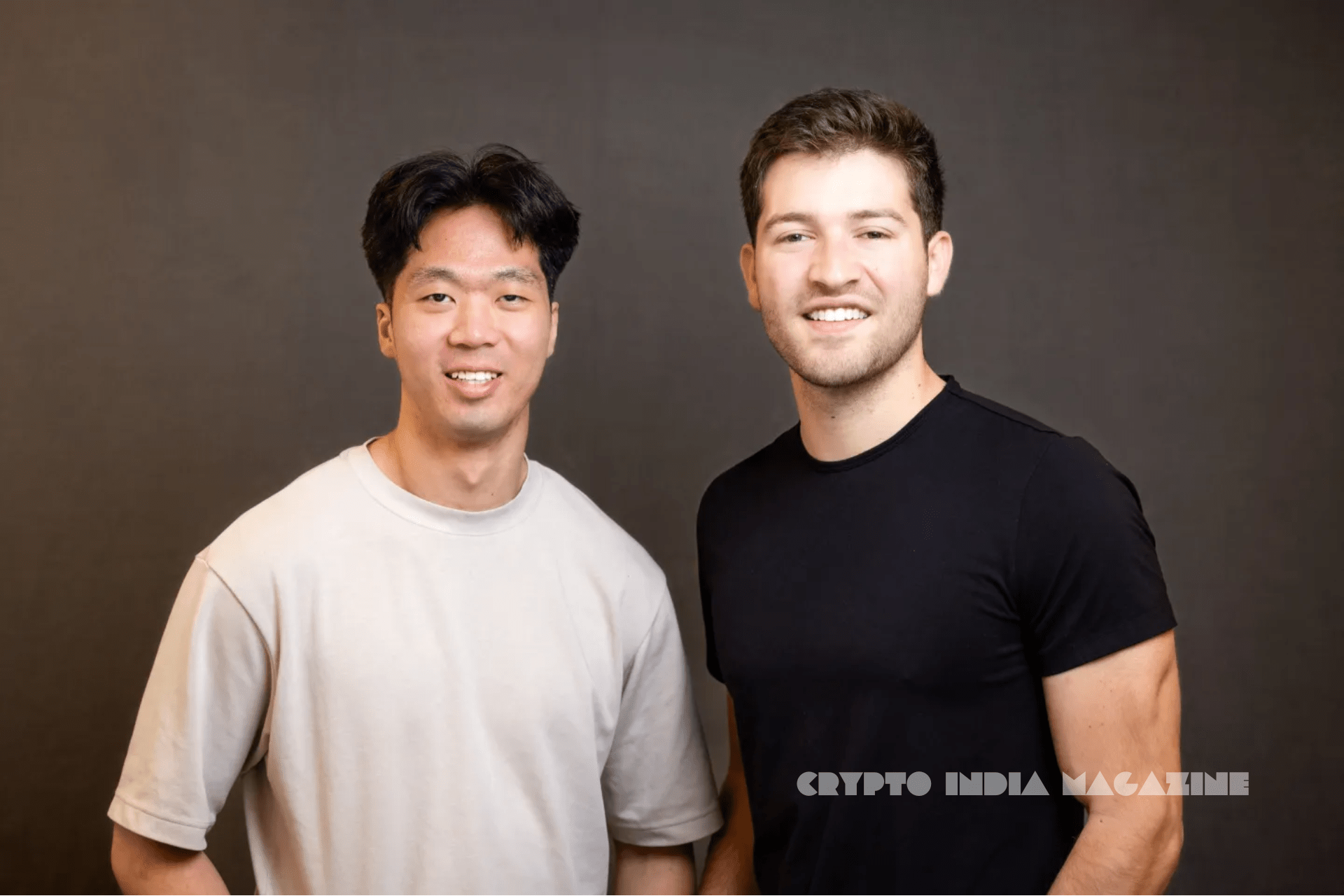

Two Gen Z college dropouts just pulled off one of fintech’s boldest pivots — and it’s paying off in millions.

Victor Cardenas and Kevin Bai, cofounders of the neo-bank Slash, have raised $41 million in a Series B round led by Goodwater Capital, valuing the startup at $370 million. It’s a major milestone for a company that began with a niche focus — banking services for sneaker resellers — only to watch its core market collapse overnight.

That collapse, oddly enough, was sparked by Kanye West. After the rapper’s antisemitic rants prompted Adidas to cut ties and cratered the resale market for Yeezys, Slash’s revenue plunged by 80%. “We had raised $19 million and hired all these people, but the market that was the bedrock of our company evaporated,” Cardenas told Fortune.

The duo quickly regrouped, turning Slash into a “vertical bank” — offering customized financial workflows for specific industries. Their revamped strategy now targets performance marketing firms, crypto-native businesses, and even HVAC operators. The company currently processes around $300 million a month on its cards.

Unlike broader players like Brex and Mercury, Slash’s vertical model allows it to deeply integrate with sector-specific needs, like letting performance marketers create distinct sub-accounts or enabling crypto firms to swap between fiat and tokens. With traditional banks backing away from crypto, Slash’s approach is striking a chord.

Slash also benefits from its partnership with Column, a tech-forward chartered bank launched by a Plaid cofounder. The startup now employs 35 people and plans to scale into e-commerce, online travel, and real estate.

“If we continue solving these niche, vertical, specific financial workflows,” said Cardenas, “then we can sneakily become one of the largest commercial credit card issuers in the country.”

As late-stage fintechs like Chime and Circle prepare to go public, Slash’s $41M raise signals that vertical banking — especially with crypto at its core — may be one of the sector’s most resilient plays.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by the Editorial Team.

Interested in advertising with CIM? Talk to us!