Now Reading: Madras High Court Rules Crypto Is ‘Property’, Grants Relief in WazirX Case

-

01

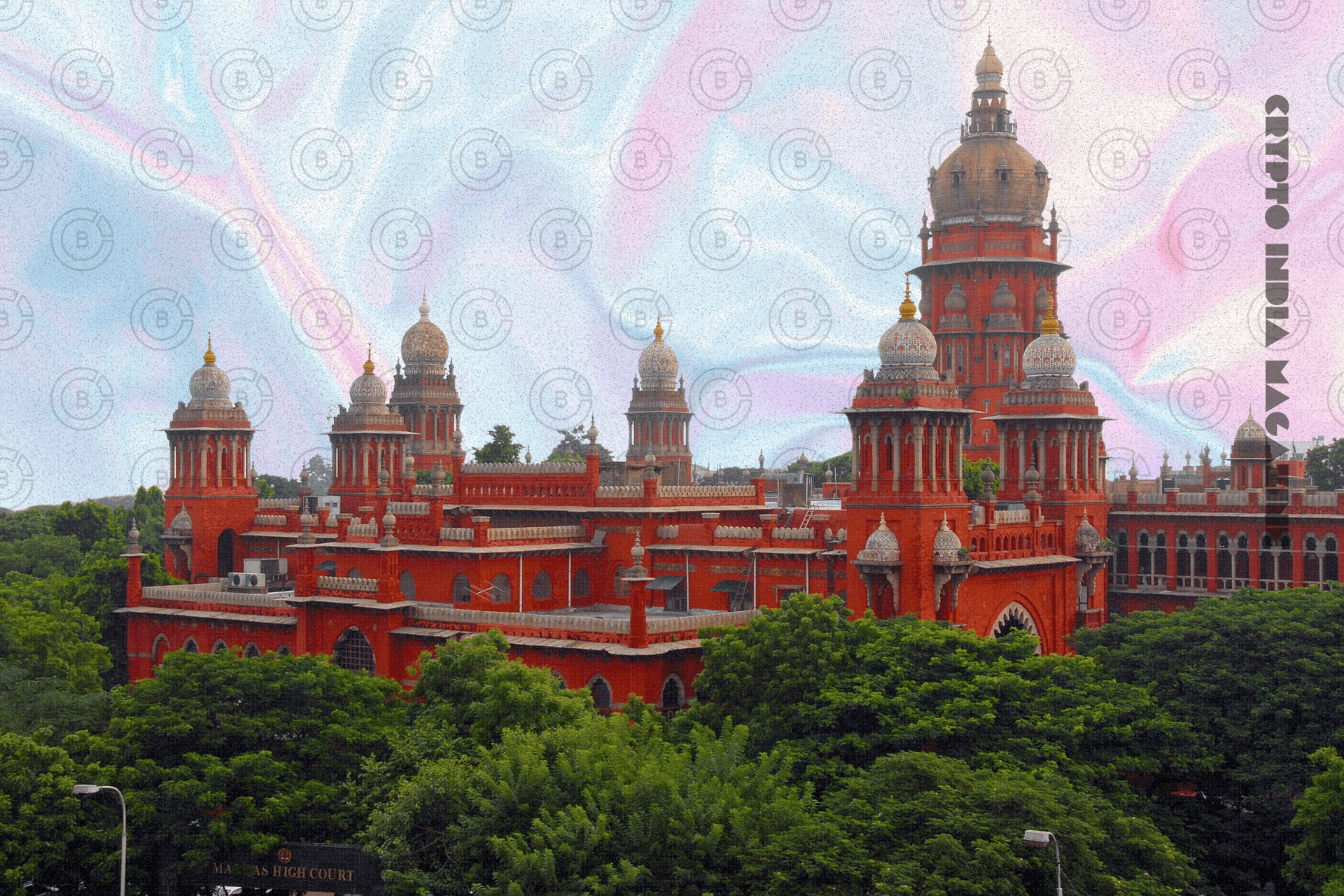

Madras High Court Rules Crypto Is ‘Property’, Grants Relief in WazirX Case

Madras High Court Rules Crypto Is ‘Property’, Grants Relief in WazirX Case

- The Madras High Court held that cryptocurrencies are intangible property that can be owned, possessed, and held in trust.

- In Rhutikumari v Zanmai Labs (2025), the court ordered a ₹956,000 bank guarantee for a depositor whose XRP was frozen after a WazirX cyberattack.

- The ruling strengthens the Indian courts’ ability to protect local investors, even when platforms are offshore, and signals the need for clearer regulatory frameworks.

In a ruling with potentially wide-reaching consequences for Indian crypto holders, a single-judge bench of the Madras High Court has declared that cryptocurrencies qualify as property under Indian law and granted interim relief to an investor whose holdings on the WazirX platform were frozen after a 2024 cyberattack.

The decision in Rhutikumari v Zanmai Labs & Ors (2025), delivered by Justice N. Anand Venkatesh, held that crypto assets are intangible property, not legal tender, but assets that can be “possessed, enjoyed and held in trust.” The court relied on established Indian precedents that adopt an expansive view of “property” and noted similarities with international rulings such as Ruscoe v Cryptopia Ltd (New Zealand, 2020).

The dispute arose after the petitioner purchased about 3,532 XRP on WazirX in January 2024 (reported investment: roughly ₹198,516). After the exchange disclosed a cyber breach in July 2024 and froze depositor accounts, the petitioner’s access to her XRP was blocked. The platform’s Singapore-based owner initiated liquidation and a scheme of arrangement in Singapore; the Singapore court later adopted a resolution scheme dated 13 October 2025, proposing pro-rata payments to investors.

Rejecting the exchange’s contention that the matter belonged exclusively to arbitration in Singapore, the Madras High Court held the petition maintainable in India and intervened to protect the Indian investor’s interest while cross-border proceedings continue. The court directed the respondent to furnish a bank guarantee of about ₹956,000 in favour of the applicant, renewed pending the outcome of the arbitration.

Justice Venkatesh observed that cryptocurrencies fall within the Income-tax Act’s definition of “virtual digital asset” (Section 2(47A)) and therefore merit legal recognition beyond mere speculation. The judgment emphasised the practical realities of crypto ownership — tokens may exist only as data on a ledger, but they carry exchangeable economic value and enforceable ownership rights.

Legal practitioners say the judgment is significant for two reasons. First, it strengthens Indian investors’ ability to seek local judicial relief even when the custodian or platform is offshore and arbitration clauses point abroad. Second, the property finding could affect how courts treat freezing orders, attachment, trust claims, and insolvency-related remedies involving digital assets.

Observers cautioned, however, that the ruling does not resolve larger regulatory questions. Cryptocurrency’s legal classification for taxation, securities regulation, and consumer protection remains governed by a patchwork of statutes and evolving policy. The court itself called for a balanced policy framework that “encourages innovation in the digital economy while protecting consumers and ensuring financial stability.”

For now, the Madras High Court’s order provides immediate practical relief to one depositor and establishes a judicial touchstone: Indian courts can recognise and protect crypto holdings as property — a development likely to inform future litigation, exchange practices, and investor strategies as India’s legal and regulatory framework around digital assets continues to take shape.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by the Editorial Team.

Interested in advertising with CIM? Talk to us!