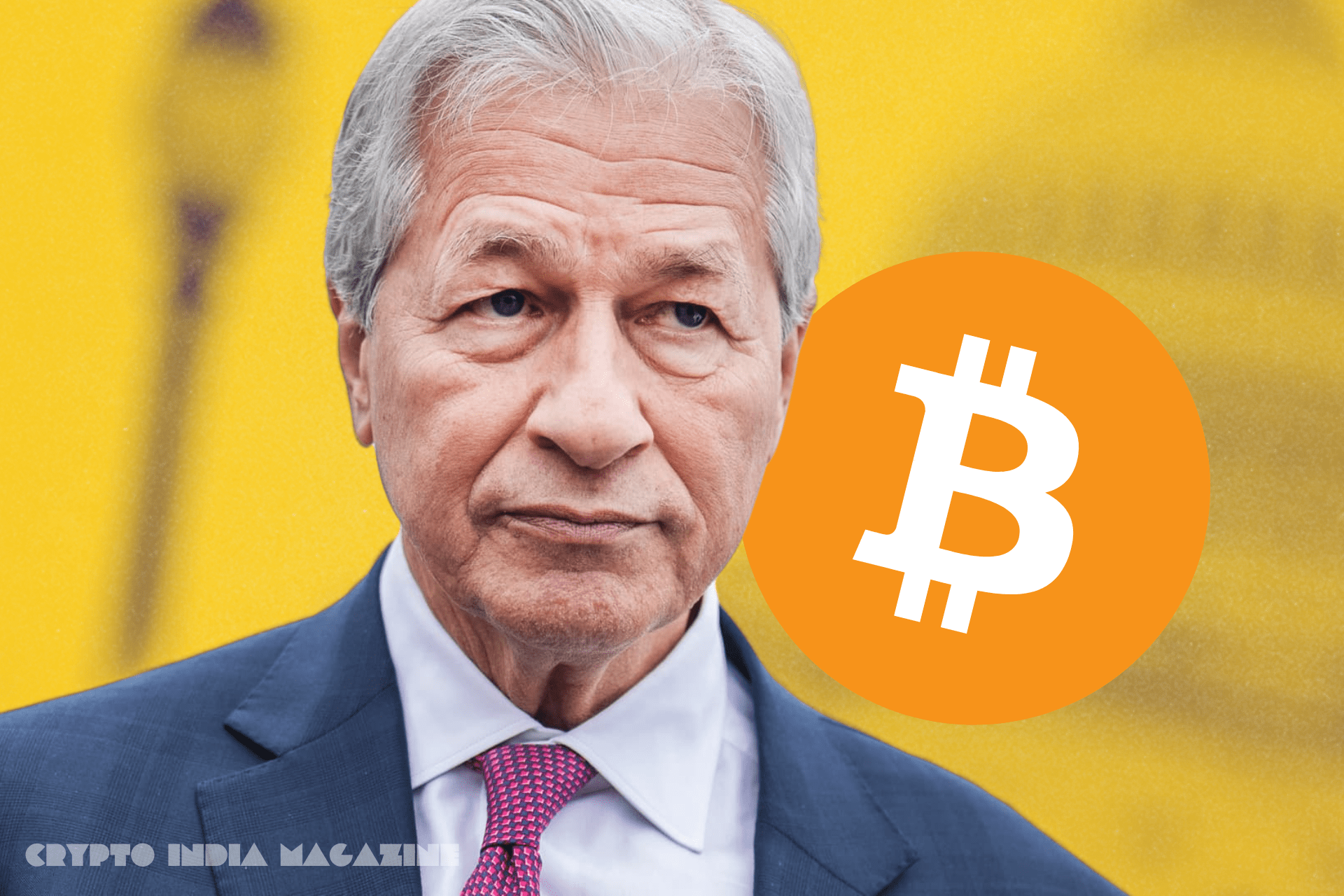

Now Reading: JPMorgan to Open Bitcoin Access to Clients Despite CEO Jamie Dimon’s Ongoing Skepticism

-

01

JPMorgan to Open Bitcoin Access to Clients Despite CEO Jamie Dimon’s Ongoing Skepticism

JPMorgan to Open Bitcoin Access to Clients Despite CEO Jamie Dimon’s Ongoing Skepticism

In a notable pivot, JPMorgan Chase will soon allow its clients to buy Bitcoin, according to CEO Jamie Dimon, who announced during the bank’s annual Investor Day on Monday. While the bank still has no plans to custody the asset, the move signals a shift in how the U.S. financial giant is approaching digital assets.

Dimon, a longtime vocal critic of Bitcoin and cryptocurrencies, maintained his personal reservations during the event. “We are going to allow you to buy it,” he said, before reiterating, “I’m still not a fan,” citing concerns about the cryptocurrency’s use in illicit activities like money laundering and sex trafficking.

Despite Dimon’s personal stance, the announcement reflects growing institutional demand for Bitcoin, especially in the wake of the asset’s growing legitimacy and adoption among asset managers, corporates, and retail investors. JPMorgan’s move also puts it in line with competitors like Goldman Sachs and Fidelity, which have both expanded their crypto offerings in recent years.

Notably, the bank will not provide custody services for Bitcoin, meaning clients can buy the asset through JPMorgan’s channels, but the storage and safekeeping of the coins will likely be handled through third-party custodians.

In a further twist, Dimon also used his remarks to downplay the significance of blockchain technology itself.

“We’ve been talking about blockchain for 12 to 15 years,” he said. “We spend too much on it. It doesn’t matter as much as you all think.”

His comments come despite JPMorgan’s own activity in the space. The bank’s blockchain platform, Kinexys, recently executed its first public blockchain transaction, settling tokenized U.S. Treasury assets on the testnet of Ondo Chain, a move seen by many as a step toward future on-chain settlement systems in traditional finance.

While Dimon’s tone remains cautionary, the bank’s decision underscores the growing inevitability of Bitcoin’s inclusion in traditional finance. With Bitcoin trading above $100,000, many banks and institutions that once distanced themselves from crypto are now seeking ways to offer access without directly exposing themselves to its volatility or legal complexities.

JPMorgan has also been cautiously experimenting with blockchain and tokenized finance in the background, running cross-border payments, developing stablecoin-like systems, and participating in tokenized asset settlements.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by the Editorial Team.

Interested in advertising with CIM? Talk to us!