Now Reading: India’s CBI Busts Cross-Border Cybercrime Ring, Seizes $327K in Crypto and Sophisticated Spoofing Tools

-

01

India’s CBI Busts Cross-Border Cybercrime Ring, Seizes $327K in Crypto and Sophisticated Spoofing Tools

India’s CBI Busts Cross-Border Cybercrime Ring, Seizes $327K in Crypto and Sophisticated Spoofing Tools

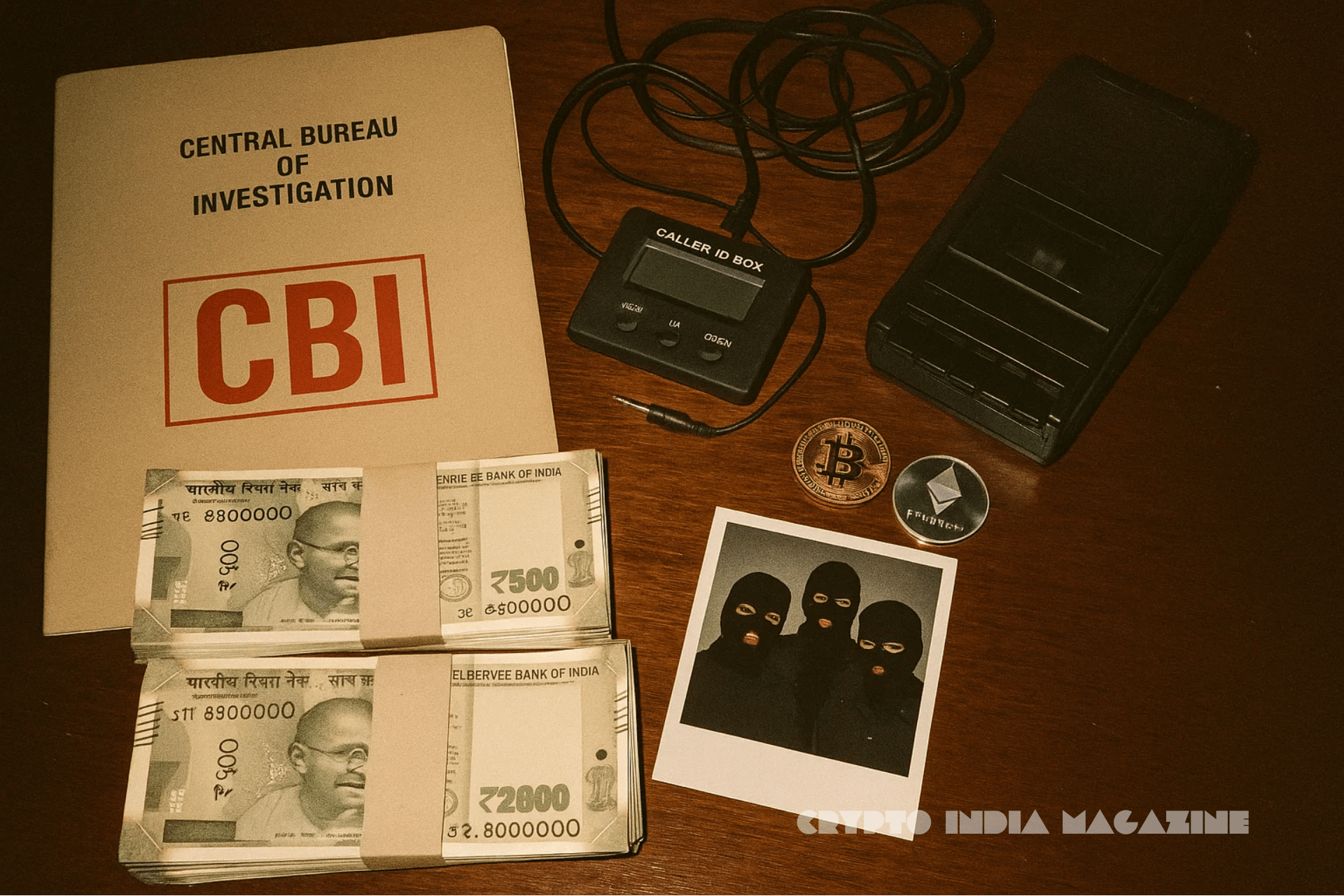

India’s Central Bureau of Investigation (CBI) has arrested a New Delhi resident and seized over $327,000 (₹2.8 crore) worth of cryptocurrency in a crackdown on a transnational cybercrime ring accused of targeting U.S. and Canadian citizens.

The accused, identified as Rahul Arora, was apprehended during coordinated raids across three locations in India. In addition to the crypto seizure, authorities recovered approximately $26,400 (₹22 lakh) in unaccounted cash, as well as advanced caller ID spoofing tools, lead generation software, and voice recordings used in social engineering scams.

In its official release, the CBI said the operation exposed a network that capitalized on jurisdictional loopholes to defraud foreign nationals by impersonating government officials and technical support agents.

“Acting on actionable intelligence, CBI conducted these searches and uncovered incriminating evidence busting the operation of a group engaged in transnational cyber fraud,” the agency said.

The case highlights how India-based cybercrime syndicates are adapting their tactics—leveraging digital tools and global anonymity—to exploit gaps in cross-border enforcement. According to officials, the bust forms part of Chakra-V, a multi-agency initiative involving Interpol, the FBI, and Indian agencies like the I4C (Indian Cyber Crime Coordination Centre). The initiative focuses on digital forensics, VDA (Virtual Digital Asset) seizures, and dark web monitoring.

Importantly, the use of cryptocurrency in this case was for fund storage, not as a medium to carry out the scam. Web3 legal expert Subha Chugh urged the public and policymakers not to conflate this bust with a “crypto scam.”

“Just because the alleged criminal parked funds in cryptocurrency doesn’t mean the scam involved cryptocurrency or was possible through cryptocurrency,” she said. “If the perpetrator had purchased land, would we be calling it a real estate scam?”

Chugh also emphasized the need for law enforcement to become better equipped to manage virtual assets.

“Authorities should be well-versed in how to handle digital assets and actively collaborate with industry specialists,” she added.

CBI, for its part, claimed to have developed in-house capabilities for handling and seizing digital assets.

“We have put in place systems for the management of such assets in accordance with legal provisions,” the agency said.

This isn’t the first high-profile crypto-linked operation CBI has taken on. In February, the agency conducted raids across 60 locations in connection with the $800 million (₹6,600 crore) GainBitcoin Ponzi scheme, seizing an additional $2.9 million (₹23.94 crore) worth of cryptocurrency assets.

While the investigation into Arora’s case continues, the bust signals India’s increasing role in international cybercrime enforcement and its growing ability to deal with crypto assets, not just as a financial tool, but as evidence and an asset class subject to seizure and legal management.