Now Reading: Avantis Raises $8M Series A Led by Peter Thiel’s Founders Fund

-

01

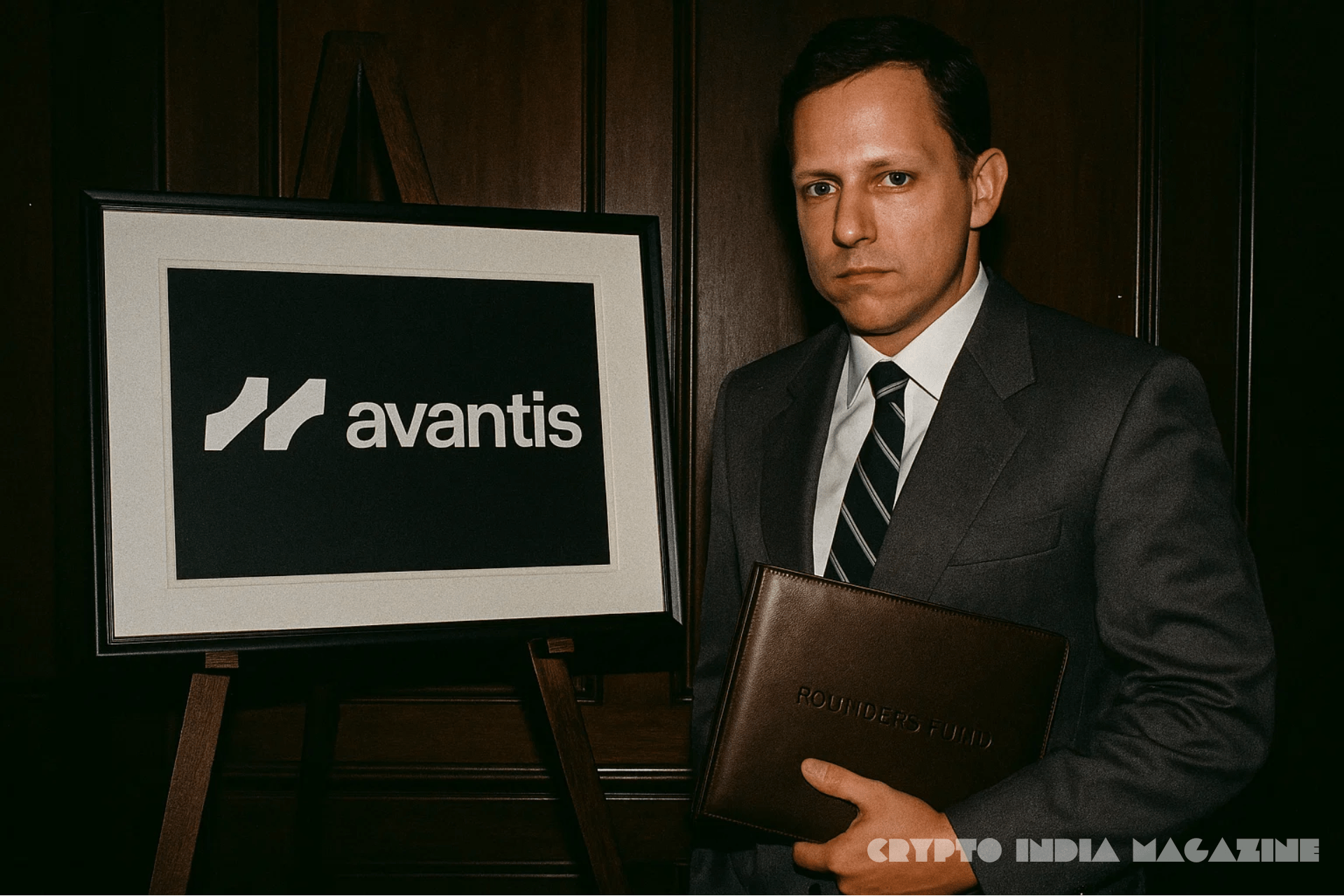

Avantis Raises $8M Series A Led by Peter Thiel’s Founders Fund

Avantis Raises $8M Series A Led by Peter Thiel’s Founders Fund

Avantis, a decentralized exchange built on Coinbase’s Layer 2 Base, has raised $8 million in a Series A round co-led by Peter Thiel’s Founders Fund and crypto-native heavyweight Pantera Capital, doubling down on its mission to bring global financial markets onchain.

Other participants in the round include Symbolic Capital, SALT Fund, and Flowdesk. Although the round closed in mid-2024, Avantis waited until now to announce it publicly to match its platform’s recent growth milestones, according to Harsehaj Singh, CEO of Lumena Labs, the team behind Avantis.

Since its 2023 launch, Avantis has evolved into the largest derivatives trading protocol on Base. It has facilitated over $7.5 billion in cumulative volume and attracted more than 60,000 users. The platform allows leveraged trading not just in crypto but also in real-world assets (RWAs) like forex and commodities.

Next in line are equities, sports betting, and prediction markets — a bold step that could potentially transform the platform into a universal derivatives layer.

“We’re setting clear KPIs to bring every global asset, market, and event onchain,” said Singh. “Our total addressable market is expanding far beyond crypto, to global macro, sports, and beyond.”

To power this ambition, Avantis is building a new technical foundation. It plans to upgrade its automated market maker (AMM) to support a broad range of price feeds, from crude oil to sports odds. It also plans to launch a custom Ethereum Virtual Machine (EVM)-compatible blockchain for fast, gasless transactions. This infrastructure overhaul will roll out as part of Avantis v2 in the coming months. It will bring new features such as 10x capital efficiency, advanced trading options, and cross-margining across multiple asset classes.

The Series A was structured as equity with token warrants. While the valuation remains undisclosed, the round brings Avantis’ total funding to $12 million, including a $4 million seed round raised in 2023.

Pantera’s general partner, Paul Veradittakit, called Avantis a “pioneer of a new class of DeFi infrastructure.” He emphasized the protocol’s ability to offer leverage on everything from interest rate volatility to sports. The exchange currently operates with a 12-member team and plans to stay lean. It plans for strategic hiring focused on AI talent to enhance its trading stack.

As the DeFi space seeks to merge with traditional finance (TradFi) and real-world events, Avantis is positioning itself as a bridge. It does not just list assets, but builds native infrastructure to trade, price, and risk-manage them onchain.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by the Editorial Team.

Interested in advertising with CIM? Talk to us!