Now Reading: Binance Founder CZ Shares 3 Essential Risk Questions Every Crypto Investor Should Ask

-

01

Binance Founder CZ Shares 3 Essential Risk Questions Every Crypto Investor Should Ask

Binance Founder CZ Shares 3 Essential Risk Questions Every Crypto Investor Should Ask

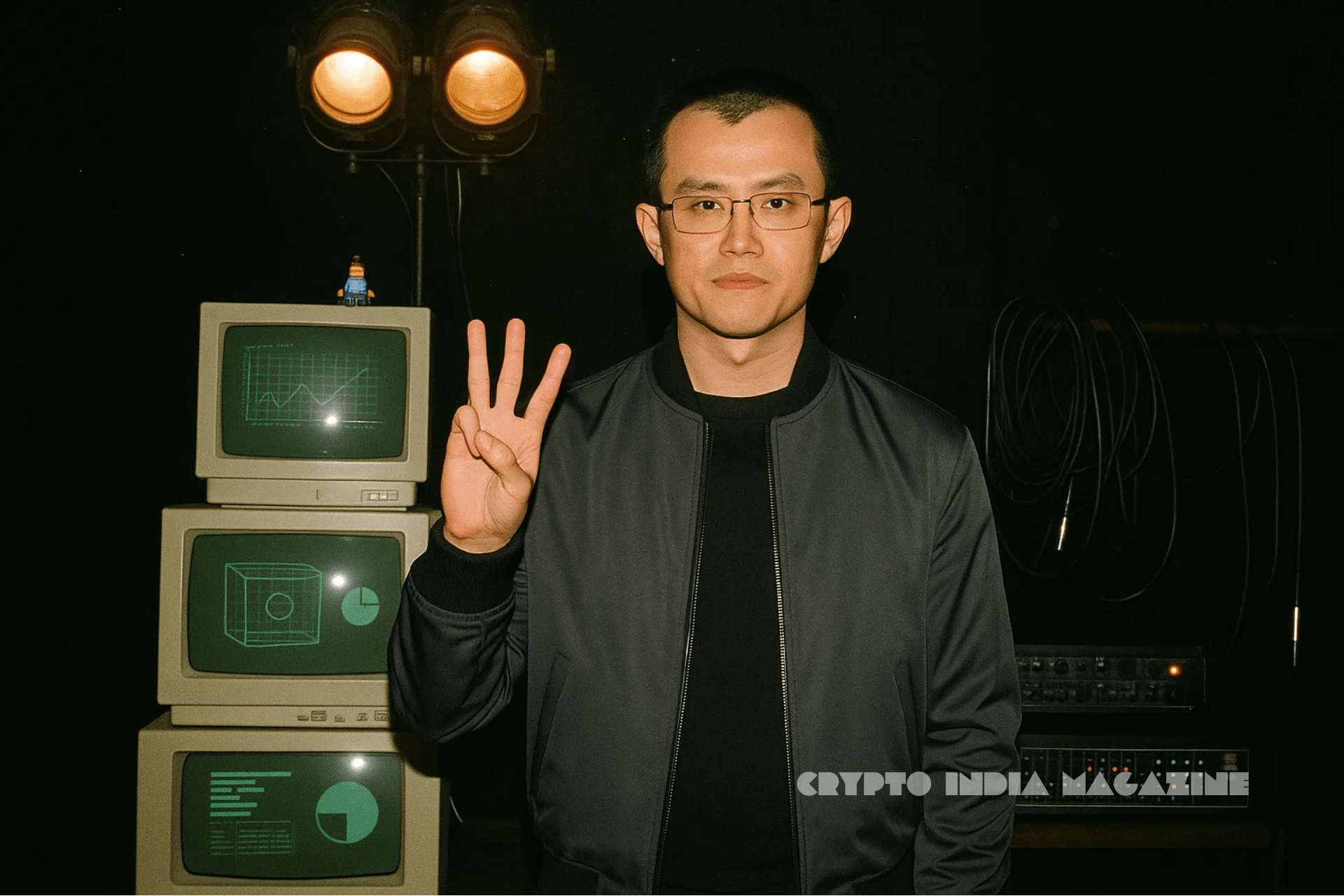

Changpeng Zhao (CZ), the founder and former CEO of Binance, has issued a simple yet powerful risk management framework that he believes every crypto investor should apply before entering the market.

In a post shared on X (formerly Twitter) on Monday, CZ laid out three key questions that investors should ask themselves to better navigate the volatility and uncertainty often associated with digital assets.

- What is the worst-case scenario?

“If it goes to zero, can you survive? Can you maintain your lifestyle?” CZ asked, emphasizing the importance of financial resilience in case of a total loss. - How many times can you afford to try?

Investors should know their financial runway, especially in a market where losses can be sudden and steep. - Do you understand what you’re doing?

CZ advises those unfamiliar with the assets or technology to “read and learn first” before committing capital. According to him, education is a necessary prerequisite to risk-taking in crypto.

A Timely Message Amid Bullish Market Sentiment

CZ’s comments come at a time of renewed optimism in crypto markets.

The recent launch of U.S.-approved Bitcoin ETFs and increasing participation from traditionally conservative financial institutions have led to greater retail and institutional access to digital assets.

Despite stepping down as CEO of Binance in late 2023 amid regulatory challenges, CZ remains an influential figure in the Web3 ecosystem. His recent activities include mentoring startup founders, investing in decentralized infrastructure, and helping develop educational tools to onboard the next wave of crypto users.

He has also made bold predictions about the future of Bitcoin, stating earlier this year that BTC could reach between $500,000 and $1 million during the current market cycle, though he did not commit to a specific timeframe.

Realism Over Hype

While CZ remains bullish on the future of decentralized finance and real-world asset tokenization, he’s also quick to point out the speculative nature of certain corners of the market, particularly meme coins and low-utility tokens.

His focus on risk literacy and due diligence stands in contrast to the high-risk, hype-driven investing that characterized previous bull markets. The new message is clear: manage your downside, know your limits, and don’t invest blindly.

As crypto continues to evolve into a more mainstream financial asset class, CZ’s risk framework may offer a timely reminder for both new and seasoned investors navigating the complexities of the space.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by the Editorial Team.

Interested in advertising with CIM? Talk to us!