Now Reading: Rexas Finance Gains Momentum in Real-World Asset Tokenization

-

01

Rexas Finance Gains Momentum in Real-World Asset Tokenization

Rexas Finance Gains Momentum in Real-World Asset Tokenization

- Rexas Finance raised $16.25 million across seven presale stages, showcasing a strong interest in real-world asset tokenization through blockchain.

- The platform enables fractional ownership of assets like real estate and commodities, reflecting blockchain’s growing role in traditional finance.

Real-world asset (RWA) tokenization firm Rexas Finance (RXS) has reported a $16.25 million raise through its presale stages. The project has now entered its eighth stage, with tokens priced at $0.10—a more than threefold increase from the initial stage.

RWA tokenization is increasingly being viewed as a way to democratize access to high-value assets like real estate, commodities, and art, historically dominated by institutional investors. Rexas Finance allows individuals to own fractional shares of such RWA, potentially reshaping markets that have long faced challenges of high entry costs and low liquidity. Aided by blockchain, investors can now participate in markets that were previously out of reach, from commercial properties to commodities such as gold and oil.

The project’s presale has seen strong momentum, with seven stages selling out ahead of schedule. Forty-two percent of the token supply is allocated for presale, a decision aimed at opening opportunities for retail investors rather than relying on traditional venture capital.

ALSO READ: Polygon Executive Colin Butler Touts RWA Tokenization as Crypto’s Killer App

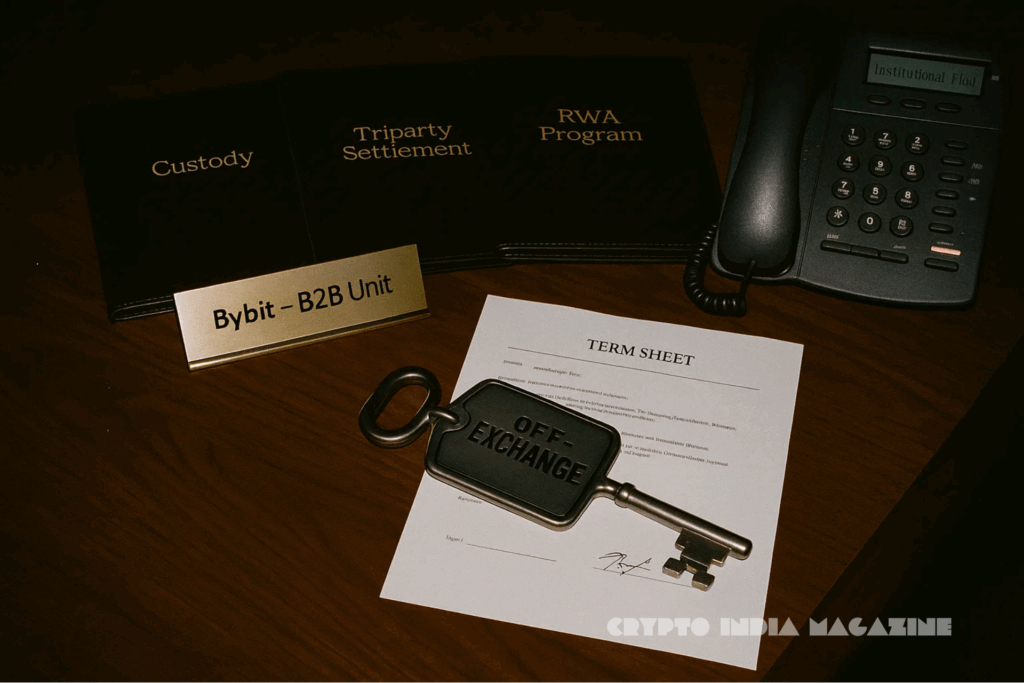

RXS also offers tools like the Rexas Token Builder and QuickMint Bot, designed to simplify the tokenization process for users. Additionally, its Rexas Launchpad serves as a fundraising platform for projects entering the crypto space. The company’s approach aligns with growing calls for innovation in blockchain-driven financial services, though its claims of transforming markets remain to be tested as adoption scales.

The project has undergone a CertiK audit, aimed at ensuring security and reliability for its smart contracts. Listings on platforms such as CoinMarketCap and CoinGecko have further amplified its visibility, connecting it with a broader investor base.

RXS’s ability to maintain its current trajectory will likely depend on the scalability of its platform and its reception upon listing on major exchanges.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by Harshajit Sarmah.