Cryptocurrency trading is surging in India, with increasing participation from smaller cities, despite regulatory uncertainties and steep taxes. Many young Indians are turning to crypto markets as an alternative source of income, driving trading volumes on major exchanges to new heights.

Ashish Nagose, a flower shop owner from Nagpur, is among the many Indians learning to trade cryptocurrencies. He previously dabbled in stock options but shifted to crypto as regulatory changes made equity derivatives trading more restrictive. Nagose sees digital assets as a potential safety net for his family business during slow periods.

“I want to run my family shop, and hope that trading can provide a steady income when business slows down, like in the month after Diwali,” Nagose said, seated at his storefront surrounded by fresh flowers.

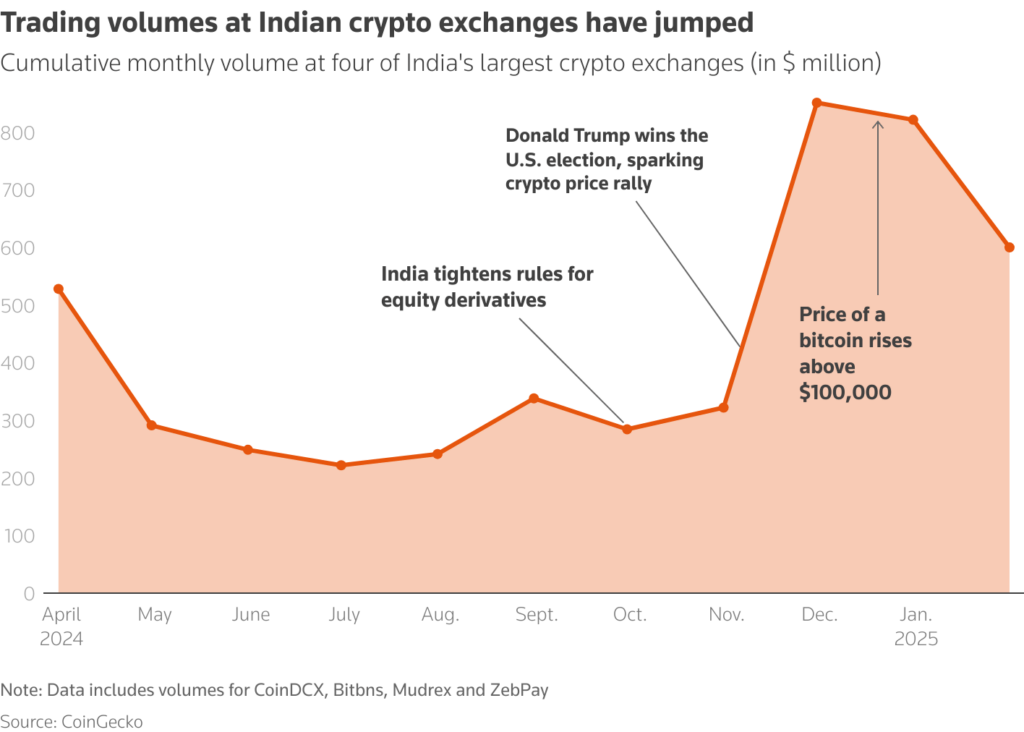

His story is not unique. The latest data from crypto aggregator CoinGecko shows a sharp rise in cumulative trading volumes of Bitcoin, ethereum, Dogecoin, and other digital assets on India’s four largest exchanges. Volumes more than doubled quarter-on-quarter, reaching $1.9 billion in the October – December period of 2024.

India’s booming economy has not translated into widespread job opportunities, with wage growth lagging behind economic expansion. With nearly two-thirds of the country’s 1.4 billion population under the age of 35, many are exploring alternative ways to generate income. Crypto trading has emerged as one such avenue, attracting retail investors from beyond major financial hubs.

According to CoinSwitch, a leading Indian crypto platform, seven of the top ten cities driving crypto trading in 2024 were smaller urban centers like Jaipur, Lucknow, and Pune. This mirrors trends in traditional stock market participation, which has also seen increasing interest from non-metro cities.

“Growth is now being driven by non-metro cities. That’s true for the stock world and it’s true for crypto,” said Balaji Srihari, vice president at CoinSwitch, which has over 20 million users.

Despite the enthusiasm, crypto trading in India faces regulatory uncertainty. The Indian government has neither banned crypto nor established a formal regulatory framework. Instead, it has imposed a 30% tax on trading gains, one of the highest crypto tax rates globally.

While India’s market regulator has signaled a willingness to oversee crypto trading, the government has yet to take a definitive stance. Meanwhile, the Reserve Bank of India (RBI) continues to issue warnings about the risks posed by digital assets.

“Widespread usage of crypto assets and stablecoins has consequences for macroeconomic and financial stability,” the RBI stated in its December 2024 Financial Stability Report.

In cities like Nagpur, the demand for crypto education is growing. At Thoughts Magic Trading Academy, young traders gather daily to sharpen their skills. Yash Jaiswal, an equity options trader, has trained approximately 1,500 students over the past two years. Many attendees see crypto trading as a potential career path amid uncertain job prospects.

Sagar Neware, a 25-year-old mechanical engineer, spends his nights trading crypto after working at a local transport office during the day. He hopes his earnings will allow him to restart his father’s defunct plastic packaging business.

“My father had to shut down his plastic packaging business a few years back, so my first dream is to restart it with the money I can earn from trading,” he said.

India’s crypto market is projected to grow from $2.5 billion in 2023 to over $15 billion by 2035, at a compound annual growth rate of 18.5%, according to consulting firm Grant Thornton Bharat. However, traders and investors remain in limbo, awaiting clear regulations that could determine the future of digital assets in the country.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by Harshajit Sarmah.