Now Reading: What Gen Z and Millennials Can Learn From the Bitcoin Pizza Day

-

01

What Gen Z and Millennials Can Learn From the Bitcoin Pizza Day

What Gen Z and Millennials Can Learn From the Bitcoin Pizza Day

Today, investing has become an integral part of personal finance. With a growing number of salaried individuals actively setting aside a portion of their income for wealth creation, assets like stocks, mutual funds, real estate, and crypto have taken centre stage.

Among these, one particular story in the crypto world that offers a valuable lesson in innovation, timing, and long-term thinking is that of the “Bitcoin Pizza Day”. This iconic moment from crypto history serves as a powerful case study in early adoption, long-term vision, and the significant impact of emerging technologies.

Understanding the Significance of Bitcoin Pizza Day

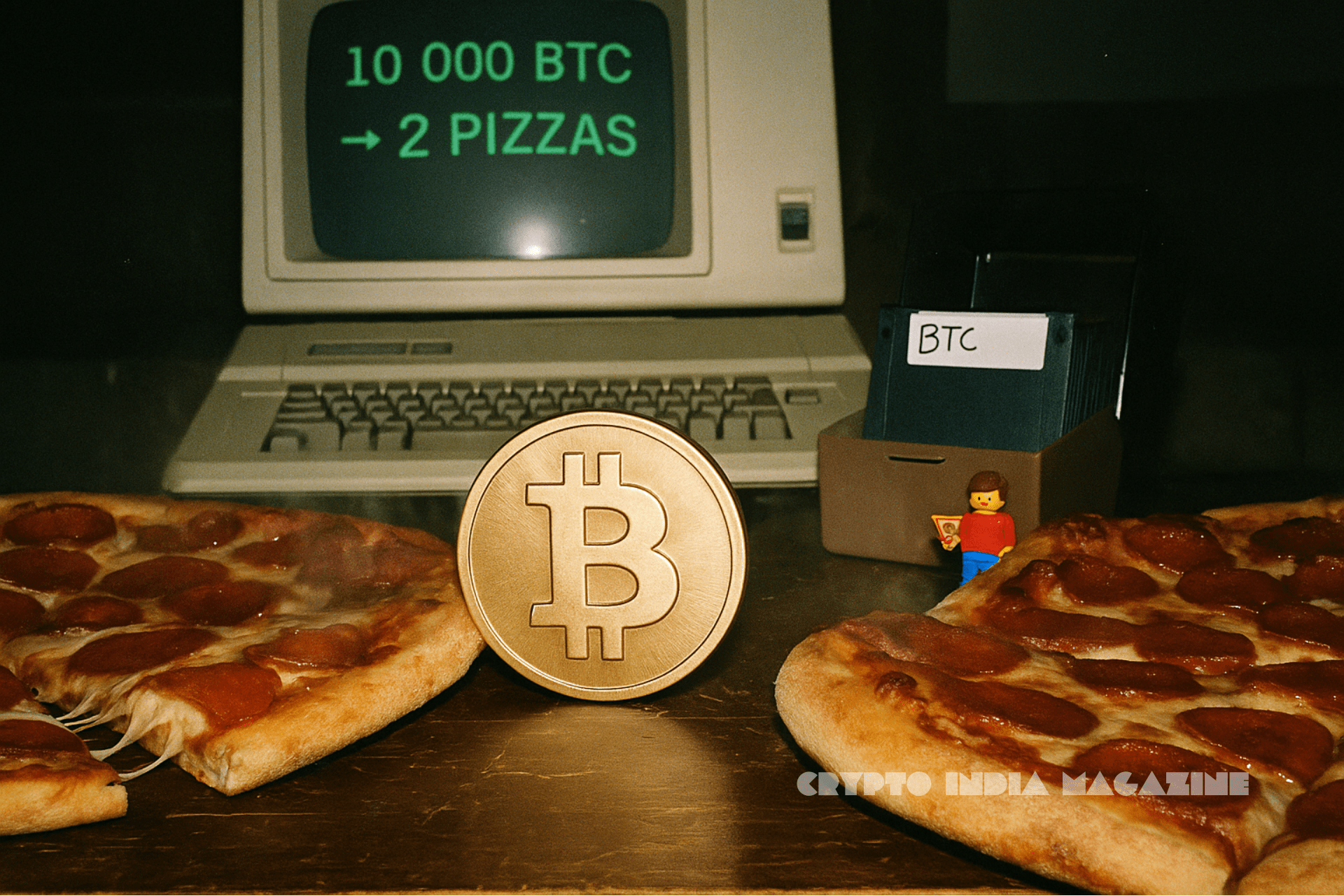

On May 22, 2010, a Florida-based programmer named Laszlo Hanyecz made history by purchasing two Papa John’s pizzas in exchange for 10,000 Bitcoins. At that time, the transaction was worth just $41. Fast forward to today, those 10,000 Bitcoins would be valued at over $1 billion, making it the most expensive meal ever bought.

This transaction marked the first real-world use of Bitcoin as a medium of exchange, proving that digital assets could hold and transfer value. That moment laid the foundation for the growth of Bitcoin from a niche experiment to a trillion-dollar asset class.

As a tribute to that first transaction, every year, the crypto community celebrates Bitcoin Pizza Day, reminding us not just of how far Bitcoin has come but also of the importance of vision, conviction, and being early in recognizing potential.

What Today’s Investors Can Learn From the Bitcoin Pizza Day

1. Early Adoption

One of the biggest takeaways from the Bitcoin Pizza story is the advantage of getting in early. Like any emerging asset class, early adopters often benefit from lower entry points and outsized long-term returns, provided the asset proves its value. For Millennials and Gen Z, this means paying attention to early-stage innovations, understanding their potential, and being willing to take calculated risks.

Before investing, it’s important to evaluate an asset based on its utility, scalability, and real-world applications. Bitcoin, in its early days, was seen by many as experimental. But those who saw its potential and acted on it reaped the benefits.

2. Systematic Investment Strategy

Not everyone can identify the next big thing or invest in large quantities from the start. But what works across time is systematic investing. If an investor had started a monthly SIP (Systematic Investment Plan) of $50 in Bitcoin starting May 22, 2010, they could have accumulated close to 4,500 Bitcoins over time, worth approximately $375 million today with a total investment of just $8,900. This example shows that discipline and consistency, not just timing, can lead to substantial wealth creation.

3. Understanding the Supply and Demand

The main reason that Laszlo was able to trade the 10,000 Bitcoins is because there was demand. As the demand grew over time, the value kept increasing. What the current generation of investors should keep in mind while investing is that if your investment has real-world demand, it is bound to create value over the long term.

Conclusion

Bitcoin Pizza Day is far more than a quirky milestone in crypto’s origin story, it’s a powerful reminder of what it means to believe in an idea before the world catches on. It represents the courage to back innovation, the importance of timing, and the exponential value that can emerge from early conviction.

For today’s generation of investors, especially Millennials and Gen Z, the takeaway is clear: building long-term wealth isn’t just about what you invest in, but when you choose to act—and how consistently you stay the course.

The story of those two pizzas bought for 10,000 Bitcoins speaks to the rewards of foresight, discipline, and patience. Whether it’s crypto or any emerging asset class, successful investing requires more than just trend-chasing. It calls for curiosity, research, and the confidence to invest in what you believe has real-world potential.

Editorial Note: This is a guest post authored by Mr Alankar Saxena, Co-founder and Chief Product Officer of Mudrex. The views and opinions expressed are solely those of the author and do not necessarily represent those of Crypto India Magazine or its editorial team. The content is provided for informational purposes only and should not be taken as financial advice. Please do your own research before investing.