Now Reading: A New Kind of Digital Money is Taking Over

-

01

A New Kind of Digital Money is Taking Over

A New Kind of Digital Money is Taking Over

Imagine a new type of money for the internet. It’s not like Bitcoin, whose price can swing wildly from one day to the next. Instead, this money is designed to be stable, holding its value just like a regular US dollar. These are called stablecoins, and they are quietly becoming a massive part of the financial world.

They act as a bridge between the new world of digital money and the traditional financial systems we rely on. Recent papers by Vedang Vatsa, including Stablecoins in the Modern Financial System and Stablecoin Growth and Market Dynamics, both indexed in the S&P Global Market Intelligence Research Paper Series, explore the scale of this growth, the potential risks, and the broader impact of stablecoins in today’s financial system.

Just How Big Is This?

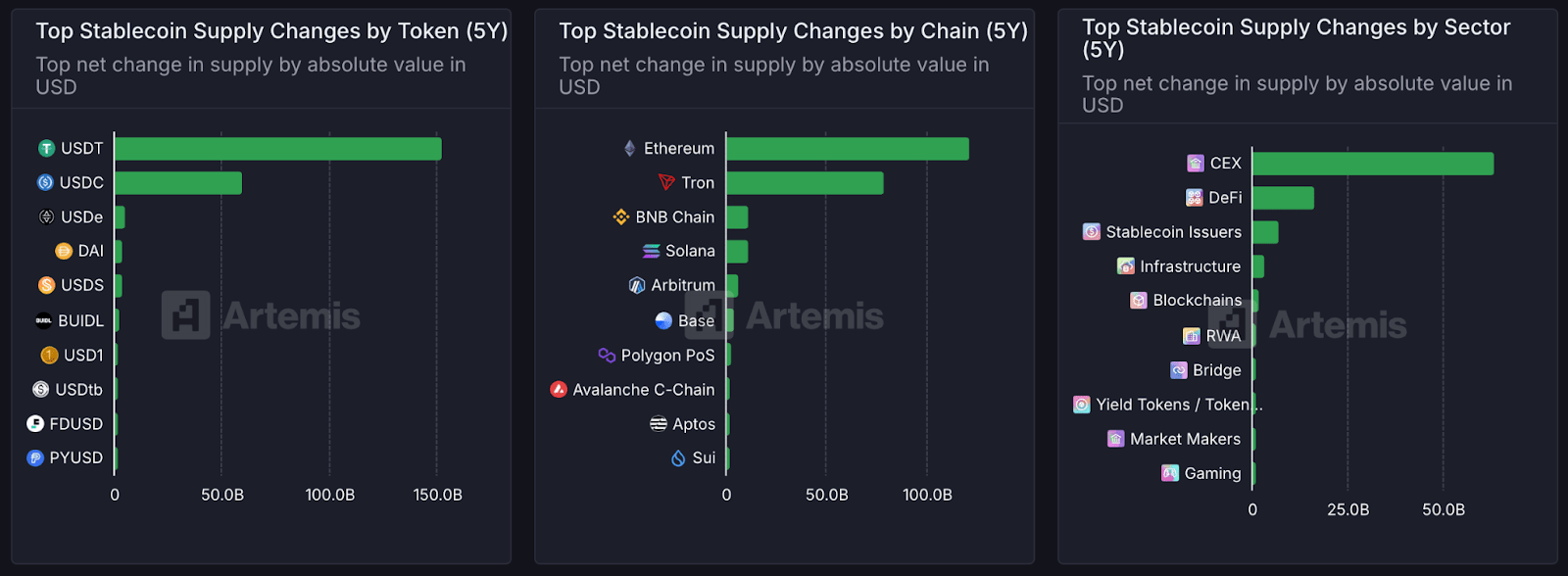

The growth of stablecoins has been stunning. At the start of 2024, the total value of all stablecoins was around $132 billion. By March 2025, it had jumped to over $227 billion.

But here’s the most amazing number: in 2024, people and companies used stablecoins to move a whopping $27.6 trillion. To give you an idea of how big that is, it’s more money than what people spent using their Visa and Mastercard cards combined over the same year. This shows that stablecoins aren’t just a small-time experiment anymore. They are being used to handle huge amounts of money all around the globe. This suggests people really want a form of digital cash that is stable and easy to send online.

A Market Run by Giants

While this world is growing, it’s not very balanced. The research shows that it’s almost completely controlled by just two companies. The first is Tether, with its coin called USDT, and the second is Circle, with its coin called USDC. Together, they make up about 90% of the entire stablecoin market.

Having just two players in charge can be risky. If either USDT or USDC ran into a serious problem, it could cause trouble across the entire digital finance world because so many people and services depend on them.

Interestingly, the research shows that even though these two are the biggest, they aren’t used in exactly the same way. While Tether’s USDT is the largest, it seems to be used more for holding value or for trading on exchanges. The reports point out that other coins, like USDC and another one called DAI, are moved around more often for their size. This could mean they are more popular for things like making actual payments or for use in the growing area of Decentralized Finance, or DeFi.

How Do They Keep Their Value?

So, how does a digital coin stay worth exactly one dollar? There are a few different methods, and each has its own pros and cons.

- Backed by Real Money: This is the most common and simple way. For every digital dollar coin that exists, the company holds one real dollar in a bank account. Think of it like a coat check ticket; you know you can always trade your ticket back for your actual coat. USDT and USDC work this way. Their stability depends on us trusting that the company really has the money it says it does.

- Backed by Other Digital Coins: This is a more decentralized way. Instead of a company holding dollars, the stablecoin is backed by other digital currencies, like Ethereum, locked up using computer code. To be safe, they are always “over-collateralized.” This is like pawning a $200 watch to get a $100 loan. You have to lock up something worth more than the coin you get, just in case the value of the backing asset drops. The coin DAI is the most famous example of this.

- Backed by Things like Gold: Some stablecoins are linked to the price of real-world things, like gold or oil. This is less common but offers a different kind of stability.

- Algorithmic (No Backing): This is the riskiest type. These coins aren’t backed by anything at all. They use a clever computer program that tries to keep the price at one dollar by controlling the supply. This approach is very experimental, and the failure of a famous algorithmic stablecoin called TerraUSD was a warning story that showed how these can collapse and cause people to lose a lot of money.

What Are People Actually Using Them For?

Stablecoins are becoming useful for solving real-world problems. Their use goes far beyond just trading digital currencies.

One of the biggest uses is for sending money to other countries. If you’ve ever sent money to family overseas, you know it can take days and cost a lot in fees. With stablecoins, you can send money across the world in minutes for a very low cost. One report suggests it could cut costs by 80% or more.

They are also a huge help for people in countries where the local money is unstable. If your country’s currency is losing value to inflation, you can hold your savings in a stablecoin pegged to the US dollar to protect your money. This helps people who might not have access to a regular bank account get some financial stability.

Companies are also starting to use them to pay employees in other countries or to pay their suppliers more efficiently.

What Will Governments Do?

Because stablecoins have become so big, governments are now paying close attention and trying to create rules for them. This is a big challenge as they want to protect people and the financial system without killing off a useful new technology.

The European Union has already created a full set of rules called MiCA. This gives companies a clear guide on what they need to do to operate legally in Europe. The United States, on the other hand, is still figuring it out. Different government groups are involved, and it’s a bit more confusing for now. The rules that governments create will be very important for the future of stablecoins. They could make the market safer, but might also make it harder for smaller companies to compete.

Looking ahead, stablecoins appear positioned to play an increasingly important role in global finance. Their growth trajectory suggests they could become standard infrastructure for digital payments, particularly in cross-border transactions and emerging markets. The integration of stablecoins with traditional financial institutions could accelerate this adoption.

Central bank digital currencies (CBDCs) represent both competition and complementary development for stablecoins. While CBDCs could provide government-backed alternatives to private stablecoins, they might also validate the broader concept of digital currencies and expand overall market acceptance.

The technology underlying stablecoins continues to evolve, with new approaches to maintaining stability, improving scalability, and enhancing user experience. These developments could address current limitations and open new use cases.

Editorial Note: This is a guest post authored by Vedang Vatsa, who is a leading analyst in the Web3 space. His research on stablecoins is indexed in the S&P Global Market Intelligence Researcher Paper Series and ranked among the top papers on SSRN. A former KPMG consultant, he advises on go-to-market strategy for Web3 projects and leads one of the largest Web3 career communities.

Want to write for Crypto India Magazine? Mail us at editorial@cryptoindiamagazine.com