Now Reading: Bitcoin ETFs See Record $937.9 Million Outflow Amid Market Uncertainty

-

01

Bitcoin ETFs See Record $937.9 Million Outflow Amid Market Uncertainty

Bitcoin ETFs See Record $937.9 Million Outflow Amid Market Uncertainty

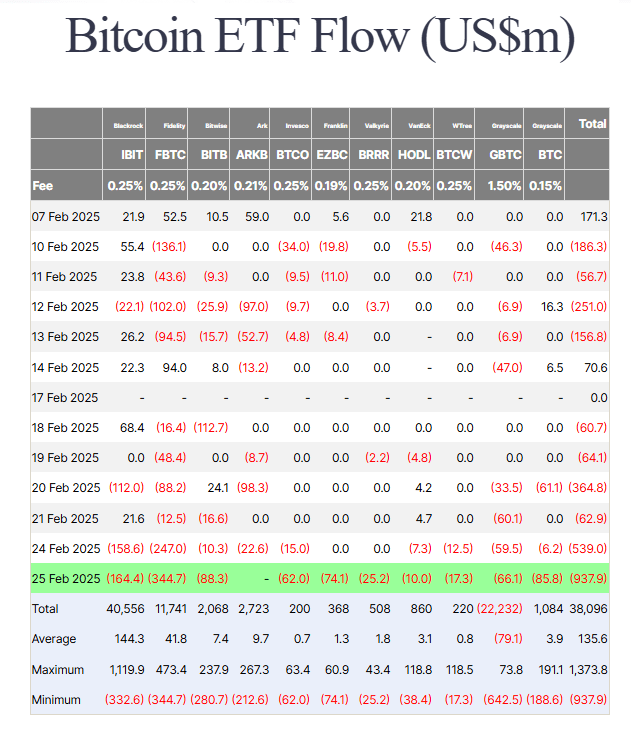

The U.S. Bitcoin spot exchange-traded funds (ETFs) experienced a record net outflow of $937.9 million on February 25, marking the largest single-day withdrawal since their launch in January 2024. The previous record was set on December 19, 2024, when investors pulled $680 million from these funds, according to data from Farside Investors.

The recent selloff follows a trend of increasing outflows from Bitcoin ETFs, with February 24 seeing a net outflow of $539 million—the second-largest this year after the $580 million outflow on January 8. The decline in ETF holdings coincided with Bitcoin’s price dropping below the psychological threshold of $90,000, raising concerns about growing risk aversion among institutional investors.

Among the affected ETFs, Fidelity’s FBTC recorded the largest outflow, with investors withdrawing $344 million. BlackRock’s IBIT followed with $164 million in outflows, while Grayscale’s GBTC saw a net outflow of $66 million.

Ethereum ETFs were also impacted, with a net outflow of $78 million on February 24, the third-largest on record, followed by another $50 million outflow on February 25. The broader crypto market’s downturn has led to speculation regarding the factors driving these significant capital movements.

Market Reactions and Possible Causes

Analysts suggest that the large-scale ETF selloff may be linked to the unwinding of basis trades, a strategy commonly used by hedge funds to exploit price differences between spot and futures markets.

Arthur Hayes, co-founder of BitMEX, suggested on February 25 that hedge funds could be closing their positions in response to narrowing yields.

“Many Bitcoin holders are hedge funds who are long ETFs and short CME futures to capture higher yields than short-term U.S. Treasuries. If the basis falls as the price of Bitcoin falls, these funds will sell their Bitcoin and buy back their CME futures. These funds are making profits, and as the basis approaches U.S. Treasury yields, they will close their positions while the U.S. market is open to lock in profits,” Hayes explained.

Basis trading is an arbitrage strategy that involves taking advantage of price differences between spot and futures markets for the same asset. In the crypto sector, this trade has been widely used by institutional investors seeking stable returns.

Beyond trading strategies, macroeconomic conditions may also be influencing capital outflows from Bitcoin and Ethereum ETFs. The Federal Reserve’s delay in lowering interest rates is seen as a key factor, as higher rates generally reduce investors’ appetite for riskier assets such as cryptocurrencies. The combination of basis trade unwinding and macroeconomic uncertainty has contributed to the volatility in the crypto market.

With Bitcoin’s price now fluctuating below key psychological levels and institutional selloffs continuing, market participants will be closely watching upcoming economic developments and fund flow patterns to gauge the next phase of the crypto market’s trajectory.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by Harshajit Sarmah.