Now Reading: Hong Kong Proposes Crypto Tax Exemptions for Global Funds

-

01

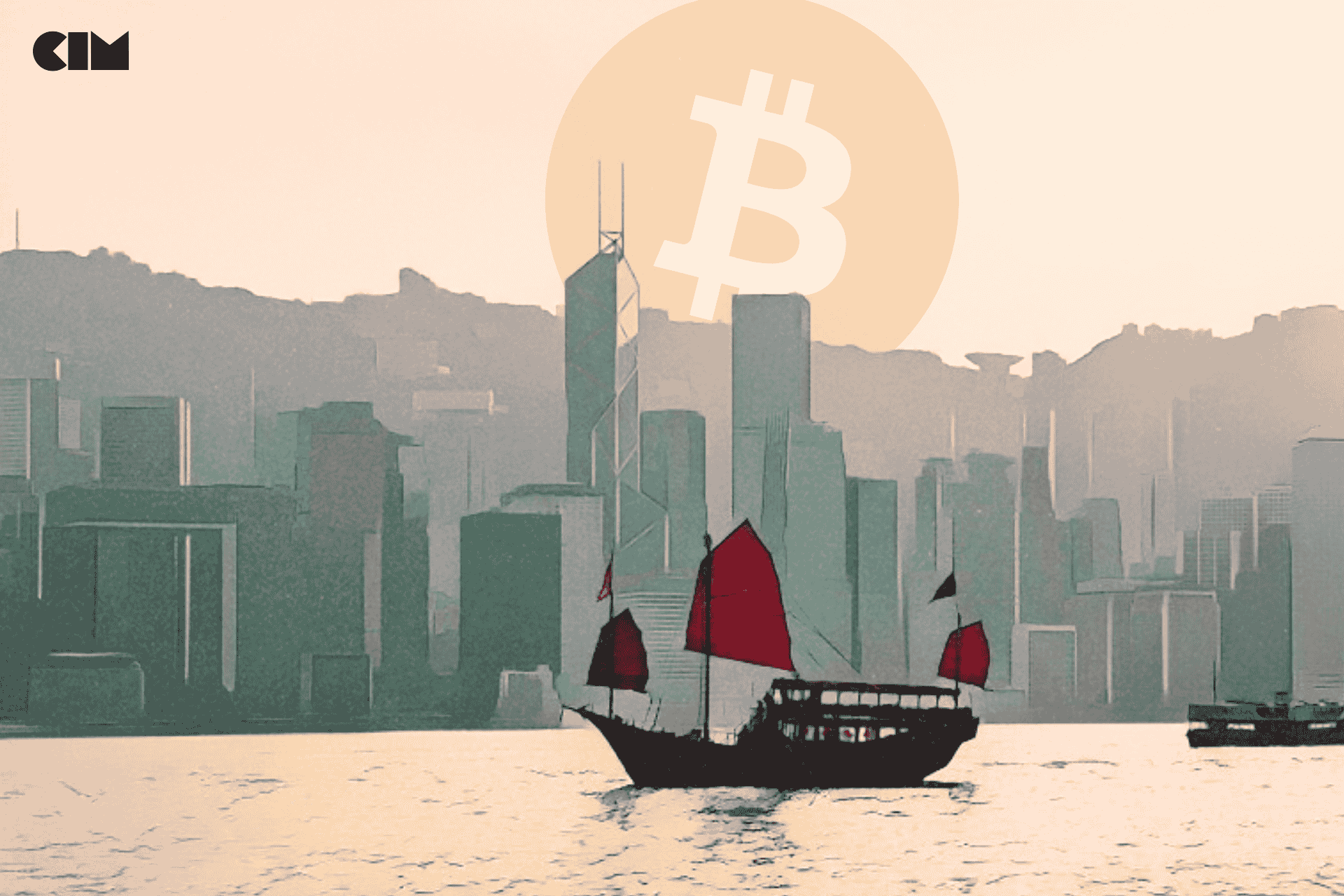

Hong Kong Proposes Crypto Tax Exemptions for Global Funds

Hong Kong Proposes Crypto Tax Exemptions for Global Funds

- Hong Kong proposes tax exemptions for cryptocurrency gains to attract hedge funds, private equity, and family offices.

- The initiative is part of a broader strategy to compete with financial hubs like Singapore and Switzerland.

- ZA Bank launches crypto services as Hong Kong integrates digital assets into traditional banking systems.

Hong Kong has proposed exempting cryptocurrency gains from taxes for hedge funds, private equity, and family investment vehicles, aiming to solidify its status as a global crypto financial hub. The initiative, currently under a six-week public consultation, also includes tax exemptions for investments in private credit, overseas property, and carbon credits.

This move comes as the city faces stiff competition from regional and international financial centers like Singapore and Switzerland. Singapore’s Variable Capital Company (VCC) framework, introduced in 2020, has attracted over 1,000 funds, while Hong Kong’s Open-Ended Fund Company (OFC) structure, launched in October 2023, has established more than 450 funds. These measures are part of Hong Kong’s broader strategy to position itself as a key player in the Asia-Pacific financial landscape.

Market analysts suggest that the proposed tax exemptions could enhance Hong Kong’s appeal as an offshore financial center, encouraging liquidity inflows into the city. By easing taxation on digital and alternative assets, the city aims to attract global investment and bolster its digital economy.

ALSO READ: Russia Approves Draft Amendments for Crypto Taxation Framework, Sets Mining Rules

Crypto analyst Justin d’Anethan recently noted that Hong Kong is “offering tax breaks and speeding up crypto licenses,” signaling its intent to use cryptocurrency as a growth engine.

The tax proposal coincides with other significant developments in the city’s digital finance ecosystem. ZA Bank, Hong Kong’s largest digital bank, has launched a retail crypto trading service, allowing customers to buy and sell Bitcoin and Ether directly through fiat accounts. This new offering, developed in partnership with the crypto exchange HashKey, aligns with regulatory requirements and reflects the city’s efforts to integrate traditional banking with cryptocurrency.

Calvin Ng, alternate chief executive at ZA Bank, emphasized that the initiative addresses the growing demand for crypto services while meeting compliance standards. Such developments are part of Hong Kong’s broader strategy to position itself as a leader in the global crypto market.

If implemented, the tax exemptions could significantly boost Hong Kong’s role as a crypto hub, attracting more international funds and solidifying its position in the competitive financial landscape. The proposal is seen as a crucial step in adapting to the rapidly evolving dynamics of the global crypto industry.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by Harshajit Sarmah.