Quick Byte:

- Michael Saylor hints at a fresh Bitcoin buy after Strategy (MSTR) acquired over 80,000 BTC in Q1 using $7.69 billion raised, mostly from stock sales.

- Despite anticipating a net loss due to unrealized BTC losses, Saylor remains bullish, calling Bitcoin immune to recent tariff tensions.

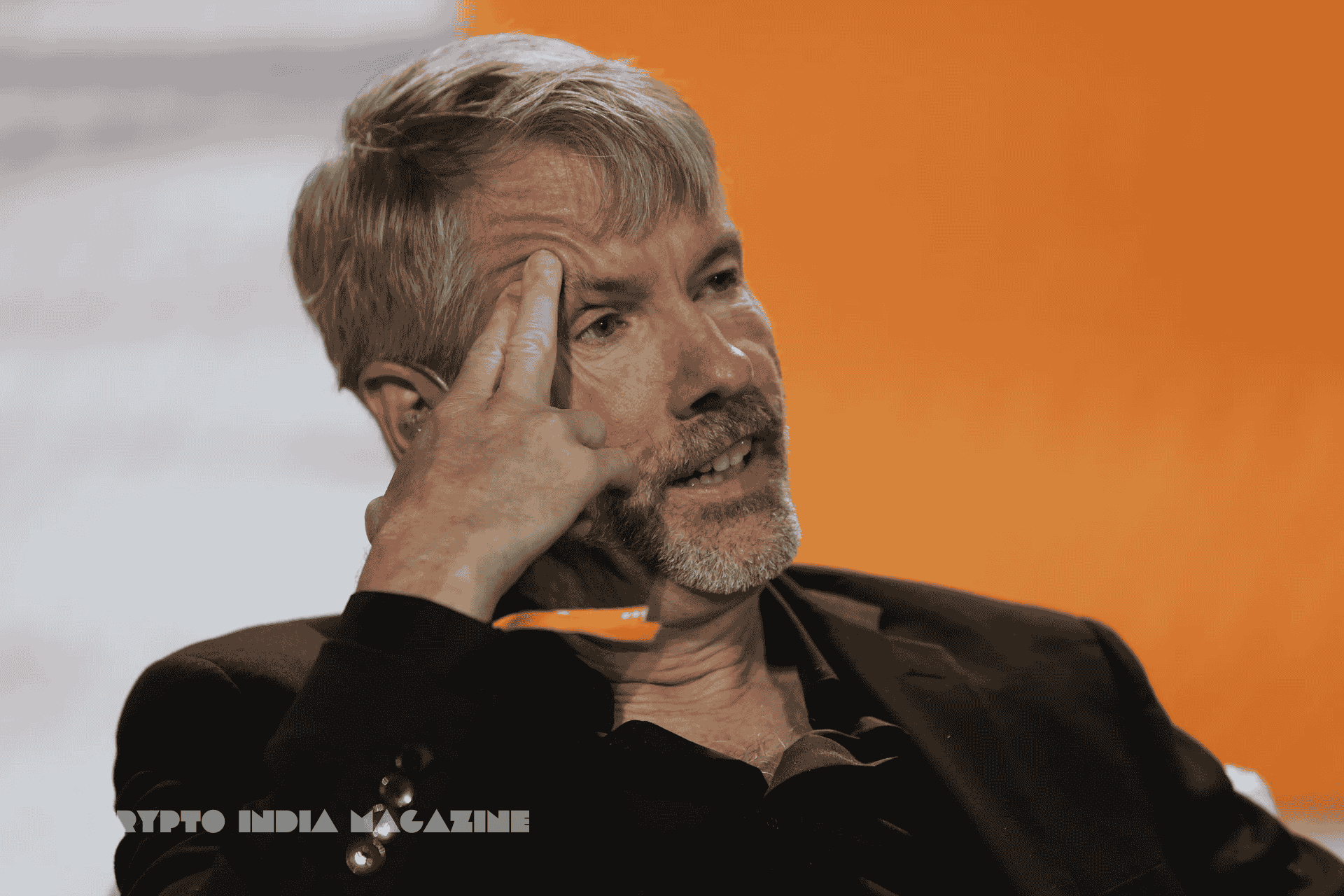

Strategy (previously MicroStrategy), the business intelligence firm led by Bitcoin advocate Michael Saylor, may be gearing up for another major Bitcoin acquisition. The speculation follows a series of strategic BTC purchases by the company this year and Saylor’s cryptic social media activity over the weekend.

Despite reporting expected net losses in Q1 due to unrealized losses on its Bitcoin holdings, the company appears undeterred in its aggressive accumulation strategy.

Since the beginning of 2025, Strategy has added 80,785 BTC to its balance sheet. The buying spree was backed by a massive capital raise of $7.69 billion in the first quarter alone, more than half of which came from common stock sales. Much, if not all, of those funds have been funneled into acquiring more Bitcoin, strengthening the company’s already dominant crypto position.

On Sunday, Saylor shared a screenshot of the company’s BTC holdings tracker on X (formerly Twitter), a move that has historically preceded a purchase announcement. Alongside the post, he wrote, “No tariffs on orange dots,” a tongue-in-cheek reference to Bitcoin’s signature logo and a likely jab at the recent trade tensions sparked by Donald Trump’s reintroduction of tariffs earlier this month.

The implication here is that Strategy’s Bitcoin-buying ambitions remain unaffected by geopolitical headwinds or economic policy shifts.

The company briefly paused its Bitcoin accumulation during the week ending April 6, but its current stash stands at 528,185 BTC, according to Bitcointreasuries.net. Acquired at an average price of $67,458, the holdings are now worth an estimated $44.59 billion, up from the $35.63 billion spent to acquire them. This gives Strategy control over roughly 2.5% of Bitcoin’s total circulating supply, positioning it as the largest corporate holder of the cryptocurrency by a wide margin.

While the expected Q1 losses underline the volatility inherent in holding a large crypto treasury, Strategy appears to be playing the long game. Saylor, who stepped down as CEO in 2022 to focus on the company’s Bitcoin strategy as Executive Chairman, has remained unwavering in his conviction. He has repeatedly framed Bitcoin as a superior store of value in contrast to fiat currencies and traditional assets.

If another purchase is confirmed this week, it would mark yet another chapter in Strategy’s unique corporate strategy—one that has closely linked its market identity and financial outlook to the trajectory of Bitcoin itself.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by the Editorial Team.

🗣️ Interested in advertising with CIM? Talk to us!