Strategy, formerly known as MicroStrategy, has announced plans to raise up to $500 million through a new offering to expand its Bitcoin holdings, as per reports. The company introduced a perpetual preferred stock, Strife, priced at $100 per share with a fixed 10% dividend, available exclusively to institutional investors. Unlike Strategy’s earlier Strike offering, which had an 8% dividend, Strife’s payouts will only be made in cash.

The move comes as Strategy continues to aggressively accumulate Bitcoin. On Monday, the firm disclosed the purchase of approximately $10.7 million worth of Bitcoin, bringing its total holdings to an estimated $41.4 billion. Although the latest acquisition represents only a fractional increase of 0.026%, it signals the company’s ongoing commitment to its Bitcoin strategy.

Analysts have indicated that despite challenging market conditions, there is no sign that Strategy will slow down its Bitcoin purchases.

Strategy has previously raised billions through stock sales and zero-interest convertible bonds. The introduction of Strife, offering a higher dividend rate than Strike, suggests the company is adapting its financing strategy to attract more institutional interest.

However, the launch of the new offering coincided with a decline in Strategy’s stock price. Shares fell 6.5% in early trading on Tuesday to around $275, according to Yahoo Finance, and are down 5.5% year-to-date. Despite this, the stock has still doubled in value over the past six months.

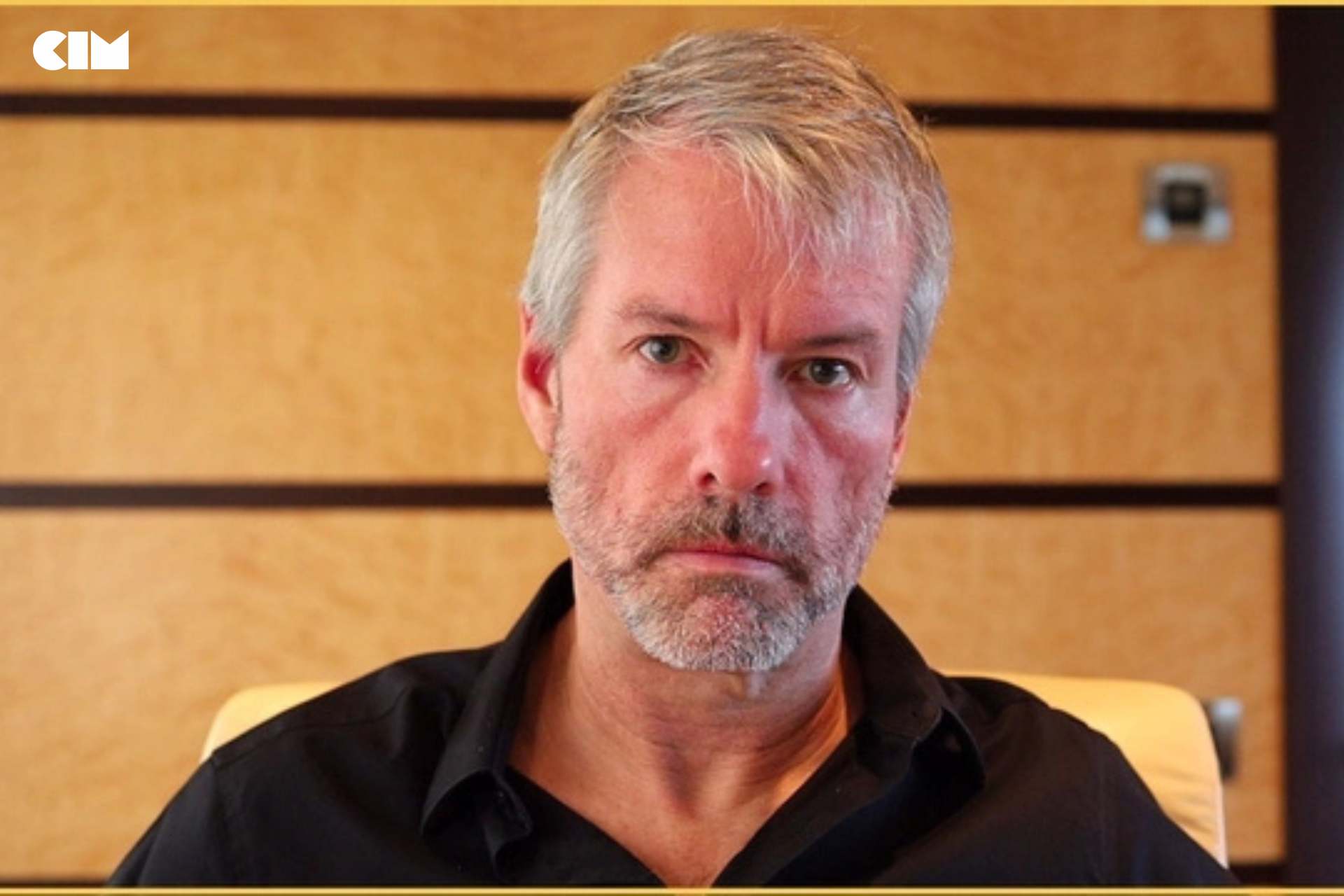

Speaking at Future Proof Citywide in Miami, Strategy’s co-founder and Executive Chairman Michael Saylor addressed Bitcoin’s recent price movements. He attributed the downturn to shifting rate cut expectations, economic concerns, and tariffs, placing Bitcoin in what he described as a “macro, risk-off zone.” However, he remained optimistic about the asset’s future performance.

“When that flips, I think Bitcoin will rip forward with a vengeance,” he said.

Strategy’s ongoing Bitcoin accumulation and financing maneuvers come amid a volatile market backdrop. As the firm continues its ambitious approach, the success of its latest funding initiative will likely be a key factor in determining its ability to sustain further purchases of the cryptocurrency.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by the Editorial Team.