- The CFTC, under Acting Chair Caroline Pham, is launching public roundtables to address prediction markets, digital assets, and market structure innovation.

- Amid regulatory shifts, the CFTC aims to engage stakeholders and establish clear rules for evolving financial markets, including crypto and prediction tools.

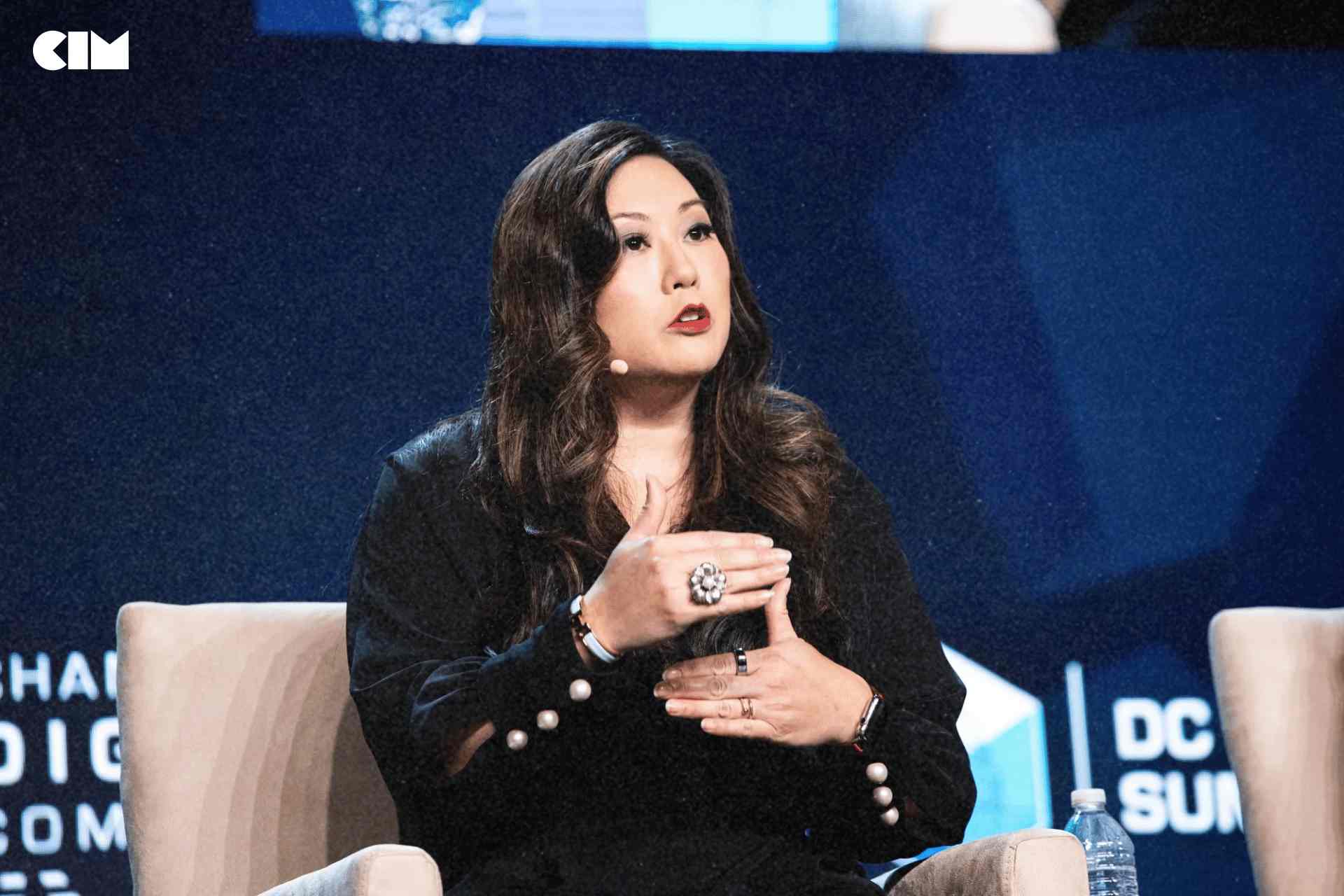

The U.S. Commodity Futures Trading Commission (CFTC) is initiating a series of public roundtable discussions on prediction markets and digital assets, signaling renewed regulatory interest under Acting Chair Caroline Pham. These roundtables will focus on innovation in market structures, conflicts of interest, and the integration of digital assets into prediction markets, Pham announced on Monday.

“The CFTC will get back to basics by hosting staff roundtables that will develop a robust administrative record with studies, data, expert reports, and public input,” said Pham.

“A holistic approach to evolving market trends will help to establish clear rules of the road and safeguards that will promote U.S. economic growth and American competitiveness.”

As part of this effort, the CFTC plans to engage with industry leaders, advocacy groups, and stakeholders over the coming months to gather insights and foster dialogue.

This initiative follows a broader shift in regulatory tone since the recent inauguration of Donald Trump, with some agencies adopting a more open stance toward cryptocurrency. The Securities and Exchange Commission (SEC), a sister agency to the CFTC, launched a new crypto task force last week.

The move comes amid criticism from the crypto industry, which has accused the SEC’s former Chair, Gary Gensler, of adopting a “regulation by enforcement” approach.

Gensler, who stepped down last week, had previously emphasized that most cryptocurrencies should be classified as securities, urging crypto firms to register with the SEC. However, industry leaders argued that existing registration frameworks were ill-suited to the nuances of digital assets. Trump has nominated Paul Atkins, a former regulator with a more crypto-friendly stance, to replace Gensler, pending Senate confirmation.

The CFTC has also faced legal challenges in its oversight of prediction markets. A 2023 dispute with prediction market operator Kalshi centered on whether election contracts could be offered, with the CFTC initially opposing such contracts as “contrary to the public interest.” A court later ruled that the agency exceeded its authority and dismissed its appeal.

Former CFTC Chair Rostin Behnam, who emphasized prediction markets during his tenure, stepped down on January 20. The CFTC is yet to see a permanent chair nomination as discussions around these evolving markets continue.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by Harshajit Sarmah.