- BlackRock CEO Larry Fink suggests Bitcoin could reach $700,000 per coin, driven by institutional investments and fears of currency debasement.

- Fink warns of elevated inflation risks, while critics argue true inflation rates may be higher than CPI figures, fueling Bitcoin’s appeal.

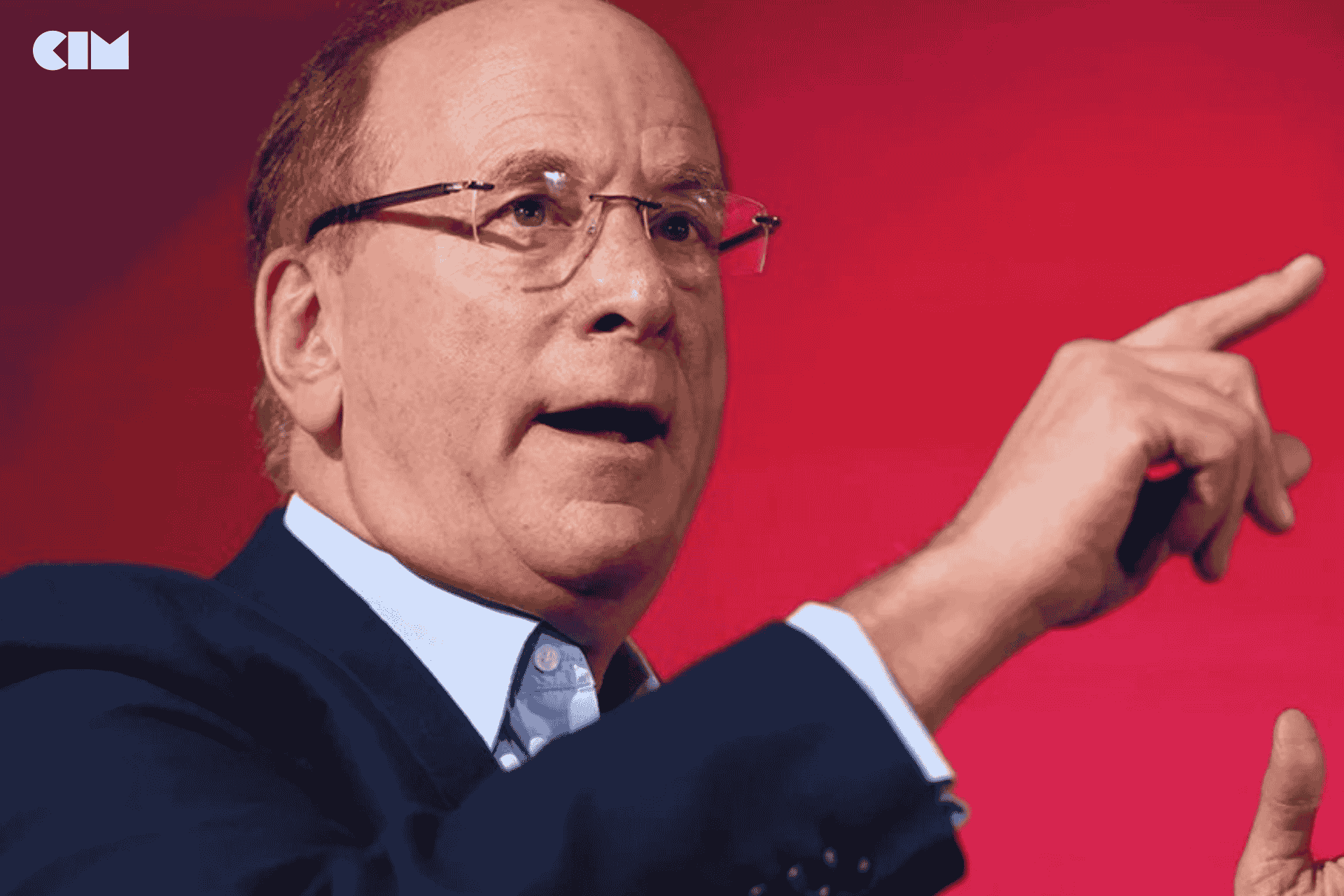

During an interview at the World Economic Forum in Davos, BlackRock CEO Larry Fink recently shared his views on Bitcoin’s role as a potential hedge against economic instability. Fink suggested that Bitcoin could surge to $700,000 per coin, driven by increasing fears of currency debasement and global economic uncertainty.

Fink highlighted how small allocations from institutional investors—ranging between 2% and 5%—could significantly influence Bitcoin’s price.

Speaking to Bloomberg, he remarked:

“If you’re frightened about the debasement of your currency or the economic or political stability of your country, you can have an internationally based instrument called Bitcoin that will overcome those local fears.”

While advocating for Bitcoin’s utility as an investment tool, Fink quickly clarified that he was not promoting the cryptocurrency, maintaining a neutral stance on its adoption.

The BlackRock chief also expressed concerns about inflationary pressures in the year ahead, warning that it might be premature to assume inflation has peaked. His comments come as U.S. Consumer Price Index (CPI) inflation for 2024 was reported at 3.2%, slightly below the 3.3% forecasted by analysts.

However, some critics argue that the CPI, which tracks inflation based on a basket of household goods, does not fully capture the true inflation rate. A shareholder proposal submitted to Meta in January, urging the company to adopt Bitcoin as a reserve asset, claimed that real inflation figures could be nearly double the CPI rate.

The National Center for Public Policy Research, a free-market think tank, echoed similar concerns in a December proposal to Amazon. The group noted that average CPI inflation over the past four years was approximately 4.95%, peaking at 9.1% in June 2022. They argued that corporations need to consider higher inflation benchmarks when managing their assets.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by Harshajit Sarmah.