- Microsoft shareholders rejected a proposal to adopt Bitcoin on its balance sheets, citing concerns over volatility and unnecessary financial risks.

- The board emphasized its existing treasury management processes, deeming Bitcoin investments unsuitable for ensuring liquidity and operational funding.

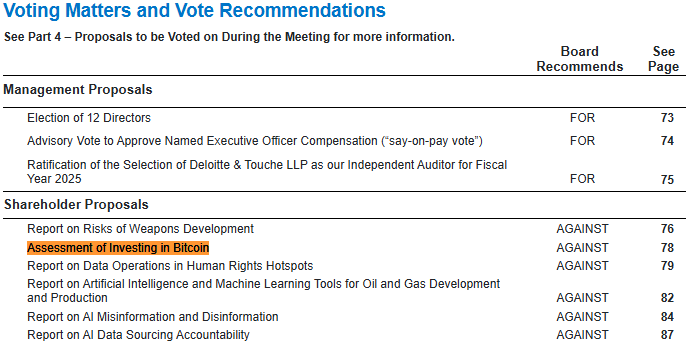

Microsoft shareholders voted against a resolution to incorporate Bitcoin into the company’s balance sheets during the annual meeting on Dec. 10. The proposal, submitted by the National Center for Public Policy Research (NCPPR), a Washington-based pro-free-market think tank, argued that Bitcoin adoption could diversify profits and enhance shareholder value.

During the meeting, the NCPPR presented its case through a pre-recorded video, emphasizing Bitcoin’s potential as a transformative asset. The presentation highlighted institutional adoption trends, including BlackRock’s Bitcoin ETF offerings, and framed Bitcoin as the next major technological wave. It proposed allocating 1% to 5% of Microsoft’s profits to Bitcoin investments, asserting that such a move could create substantial value while managing risks through limited exposure.

However, the proposal acknowledged Bitcoin’s volatility compared to traditional corporate bonds and advised against overexposure. It urged Microsoft to assess whether diversifying its balance sheet with Bitcoin would align with shareholders’ long-term interests.

ALSO READ: Amazon Shareholders Push for Bitcoin Treasury Strategy to Combat Inflation

Despite these arguments, Microsoft’s board recommended against the resolution in a filing with the U.S. Securities and Exchange Commission (SEC). The board deemed the proposal “unnecessary,” emphasizing the company’s existing processes to manage and diversify its corporate treasury.

“As the proposal itself notes, volatility is a factor to consider in evaluating cryptocurrency investments for corporate treasury applications that require stable and predictable investments to ensure liquidity and operational funding,” the board stated.

Critics of the proposal also pointed to its reliance on a “fear of missing out” (FOMO) narrative, as it cited the Bitcoin adoption strategies of companies like MicroStrategy and BlackRock. Microsoft’s board dismissed such comparisons, noting that while MicroStrategy has embraced Bitcoin as a core part of its operations, Microsoft’s approach to treasury management remains distinct.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by Harshajit Sarmah.