- MicroStrategy bought 15,400 Bitcoin for $1.5 billion in a month, pushing its total holdings to 402,100 BTC, worth $39 billion.

- Michael Saylor’s Bitcoin-focused strategy has driven MicroStrategy’s stock from $15 in 2020 to $389 today, outperforming most S&P 500 firms.

MicroStrategy has made another significant Bitcoin acquisition, its fourth in as many weeks, further cementing its status as a key corporate player in the cryptocurrency space. The company announced on Monday that it purchased approximately 15,400 Bitcoin between November 25 and December 1 for $1.5 billion, paying an average price of $95,976 per Bitcoin.

This latest acquisition brings MicroStrategy’s total Bitcoin holdings to 402,100, valued at approximately $39 billion at Bitcoin’s current price of $97,000, according to CoinGecko. Since its initial $250 million Bitcoin purchase in August 2020, the company has consistently increased its stake in the digital asset.

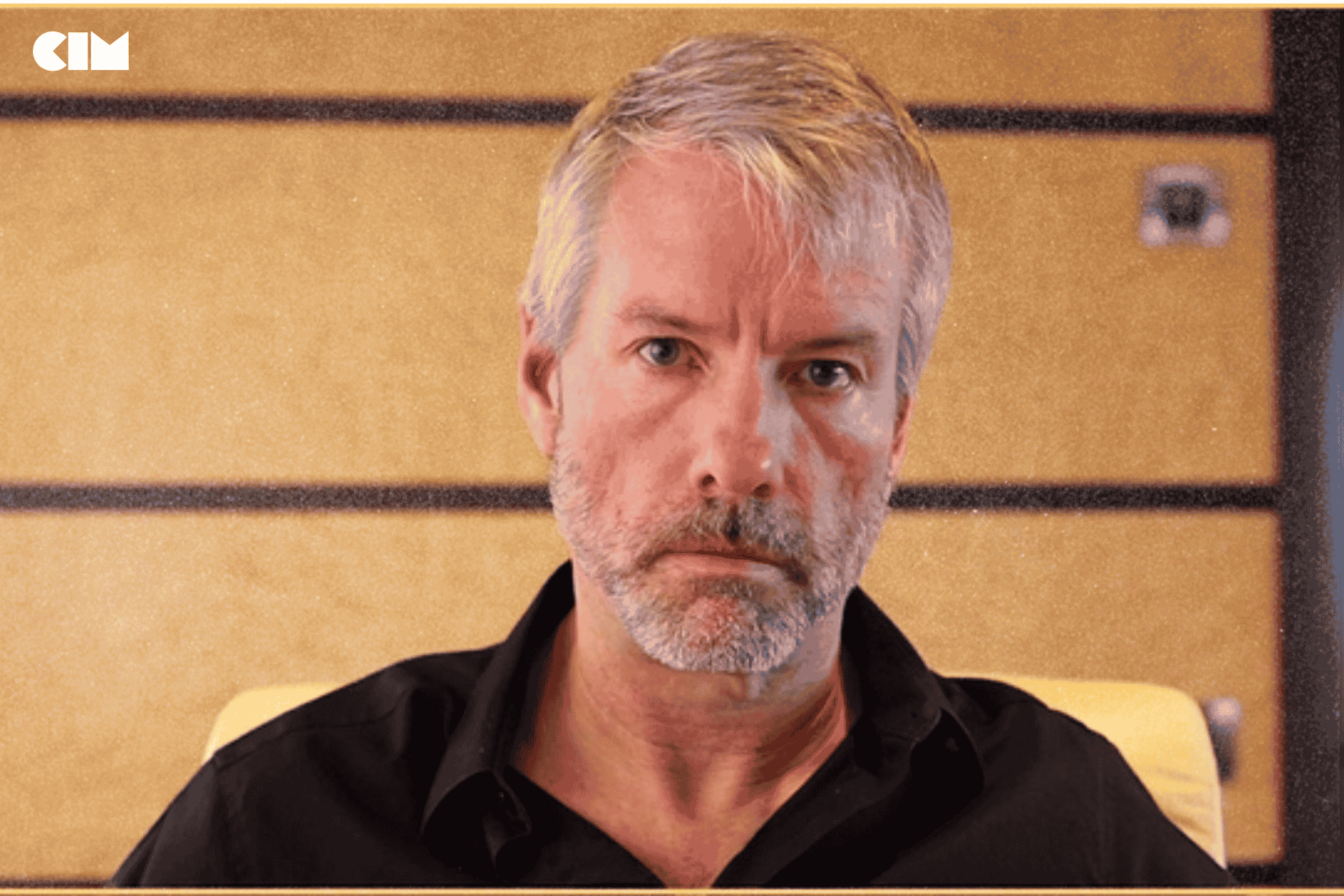

Under the leadership of co-founder and Executive Chairman Michael Saylor, MicroStrategy pivoted from a traditional software company to what is now often referred to as a “Bitcoin development company.” Saylor has championed Bitcoin as a superior store of value, arguing that its scarcity and consistent appreciation make it a reliable investment for generating shareholder returns. “Whoever gets the most Bitcoin wins,” Saylor stated in a March interview, summarizing his long-term vision for the cryptocurrency’s role in wealth preservation.

MicroStrategy’s Bitcoin-focused strategy has significantly impacted its stock performance. Before adopting Bitcoin in 2020, the company’s stock traded at under $15 per share. Today, it sits at $389, having reached an all-time high last month. The company has consistently outperformed many others on the S&P 500, a testament to the effectiveness of its unorthodox treasury strategy.

ALSO READ: Michael Saylor Proposes Bitcoin Strategy to Microsoft, Predicts $5T Growth

As Bitcoin prices continue to rise, MicroStrategy has accelerated its purchasing activity in 2024. The company also recently announced plans to raise an additional $42 billion in funding to continue its Bitcoin acquisitions. This aggressive approach reflects a belief in Bitcoin’s long-term value proposition, particularly as an alternative to traditional investments.

While critics have raised concerns about the risks of tying a company’s financial future to the volatile cryptocurrency market, MicroStrategy’s stock performance and increasing Bitcoin holdings suggest that, for now, Saylor’s gamble on Bitcoin is paying off.

Editorial Note: This news article has been written with assistance from AI. Edited & fact-checked by Harshajit Sarmah.