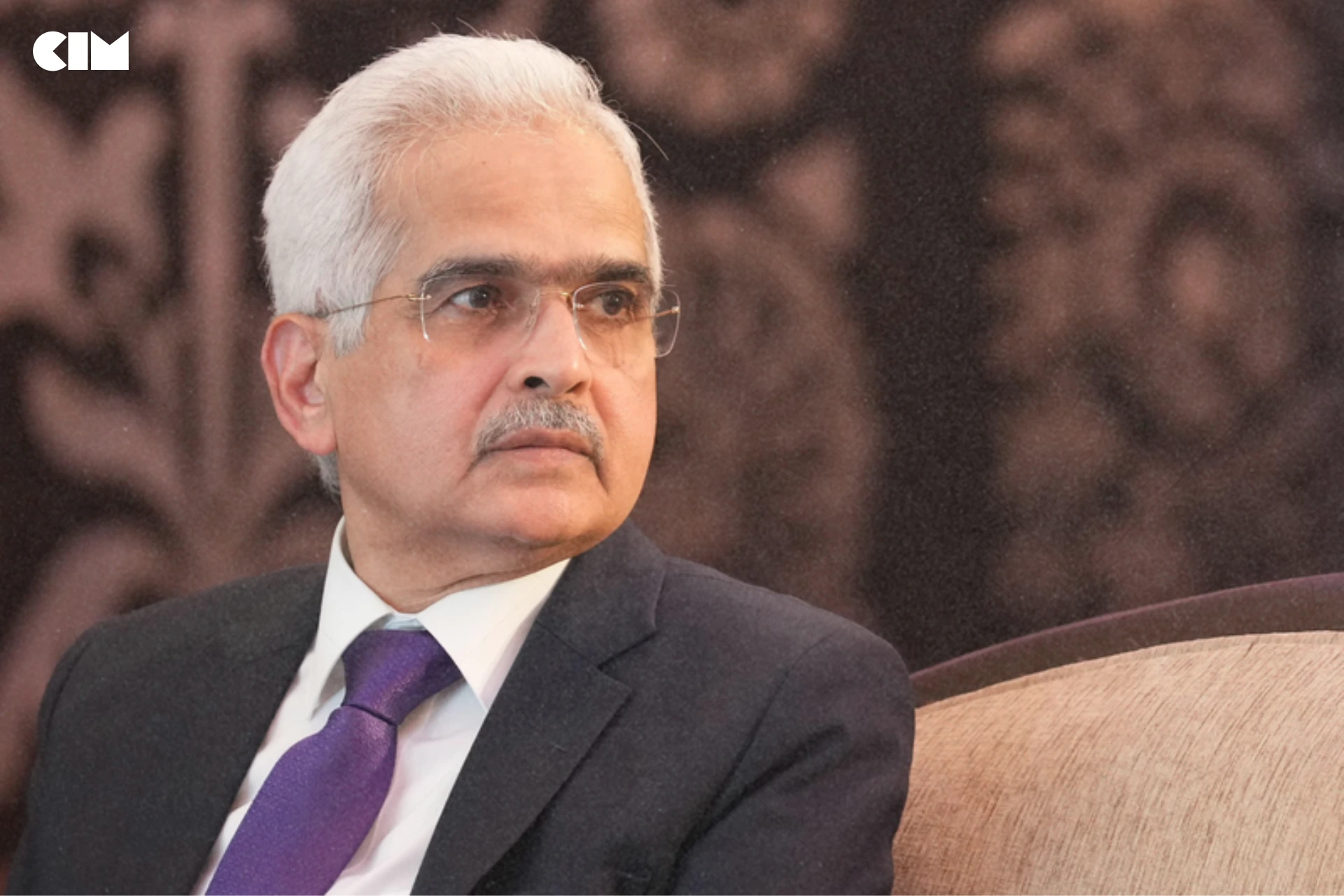

QUICK BYTE

- RBI Governor Shaktikanta Das warns that cryptocurrencies pose risks to financial stability, potentially undermining the central bank’s control over monetary policy.

- Addressing international policymakers, Das called for a unified global regulatory approach to manage the risks of cross-border cryptocurrency transactions.

Reserve Bank of India (RBI) Governor Shaktikanta Das has reiterated his strong concerns over cryptocurrencies, describing them as a significant threat to both financial and monetary stability. Speaking at the Peterson Institute for International Economics, Das warned that widespread adoption of cryptocurrencies could undermine the RBI’s control over the economy, particularly with regard to money supply and inflation control.

Das emphasized that cryptocurrencies possess the characteristics of currency issuance, a function traditionally held by sovereign governments. This, he argued, could challenge the central bank’s authority in managing the nation’s money supply. “If the central bank loses control of the money supply, it loses the ability to manage liquidity and address inflation,” he stated. He added that cryptocurrencies’ cross-border nature calls for a unified international approach to regulation, noting that transactions in digital assets transcend national boundaries.

The Indian government has been vocal on the risks of cryptocurrencies, with India being among the first nations to express these concerns in global forums. Das highlighted India’s role in bringing crypto-related issues to the forefront during its G20 presidency, leading to a broad consensus on the need for international regulatory measures. While some progress has been made, he emphasized that more work remains to be done.

Das also addressed the origins of cryptocurrencies, which he noted were initially designed to bypass the conventional financial system. He questioned the viability of privately issued digital assets coexisting alongside fiat currency, cautioning that if crypto-assets dominate a portion of the economy, central banks may lose control over monetary policy. This scenario, he warned, could destabilize both financial and monetary systems.

Reflecting on India’s regulatory stance, Das underscored that the RBI has consistently advocated caution. He expressed hope that countries worldwide will approach cryptocurrency regulation with a balanced perspective, stressing the importance of managing the risks carefully.

In related news, the Indian government is intensifying discussions around banning privately operated cryptocurrencies, such as Bitcoin and Ethereum, in favor of a Central Bank Digital Currency (CBDC). A series of consultations with experts and regulatory bodies like the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) have explored the potential for CBDCs to replicate the benefits of cryptocurrencies without the associated risks.

This position aligns with guidance from international organizations like the IMF and the Financial Stability Board (FSB), which recommend strict crypto regulations for member countries. An Indian official recently noted, “CBDCs can achieve what cryptocurrencies offer but with fewer risks,” signaling a government preference for regulated digital finance options.